Phenom 100 (100, 100E, 100EV), Phenom 300 (300, 300E), Citation CJ2 (CJ2, CJ2+), Citation CJ3 (CJ3, CJ3+), Citation CJ4, Citation M2

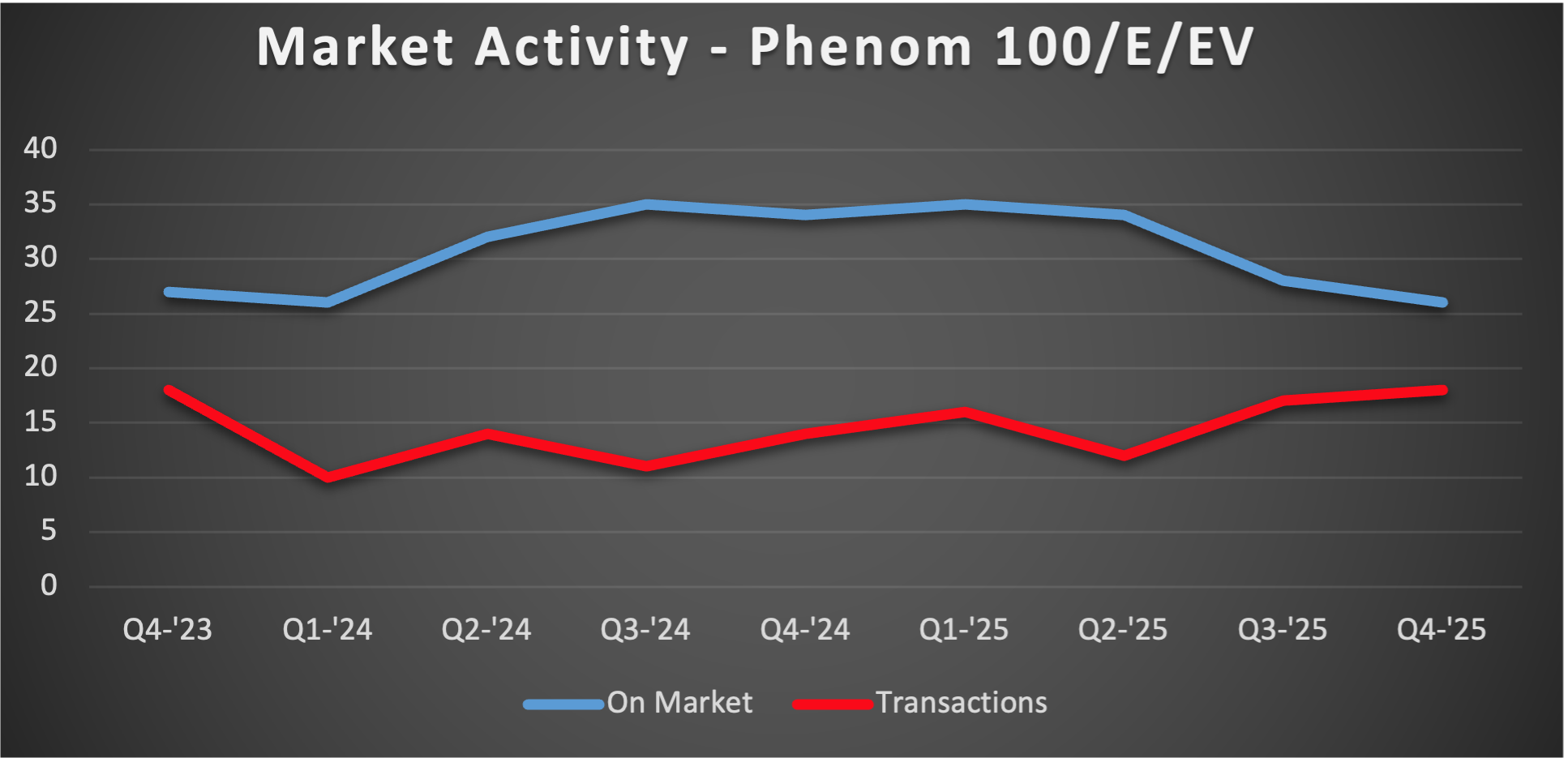

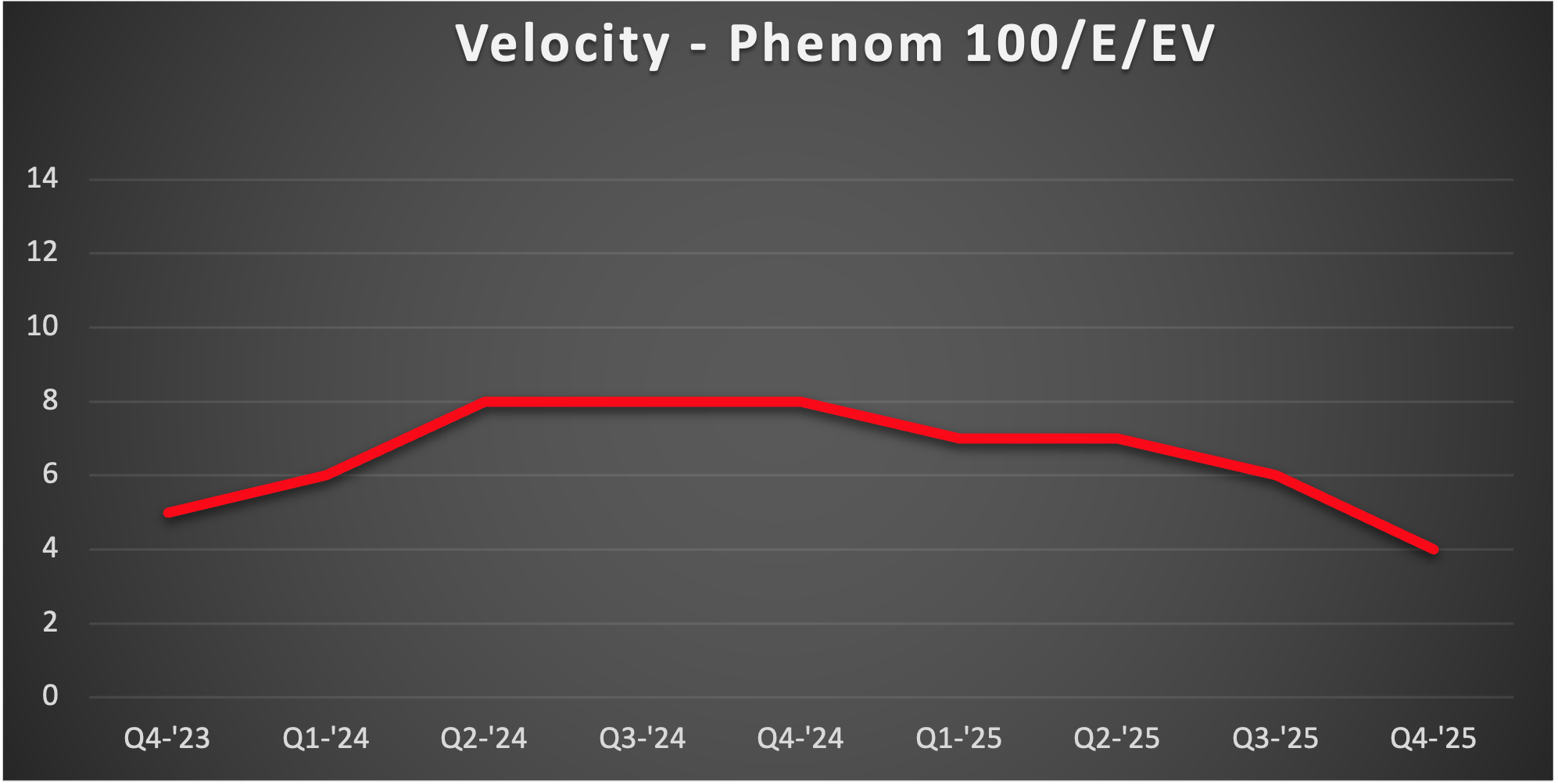

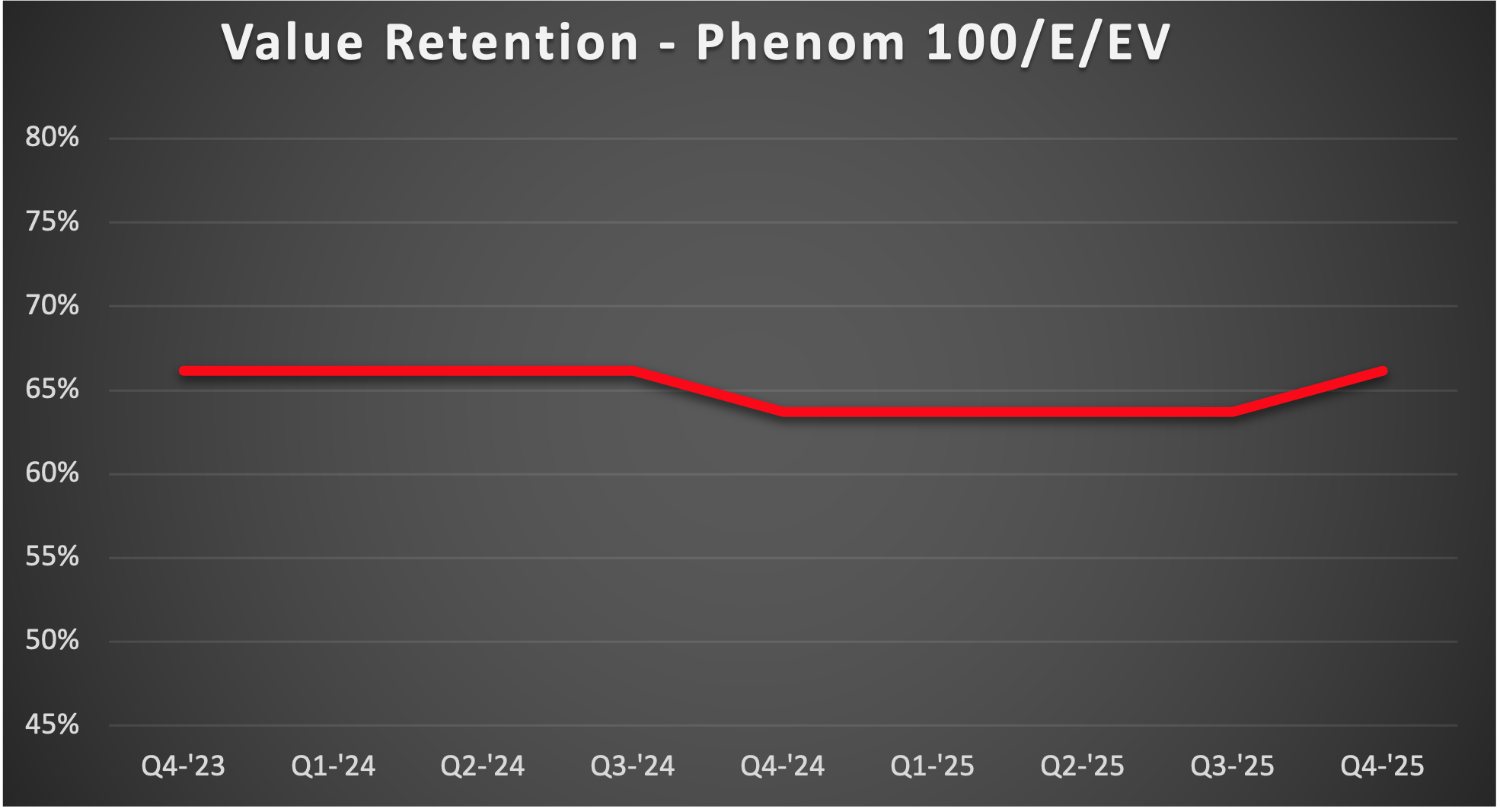

Beginning in Q2 2025, the availability of Phenom 100 aircraft on the market has declined each quarter, while transaction volume has steadily increased. This tightening of supply alongside stronger demand contributed to a roughly 3% increase in aircraft values during Q4. In that quarter alone, average inventory fell by two aircraft, while transactions slightly increased by one following a notable 41% quarter-over-quarter increase in transactions from Q3. As a result, the Phenom 100 market has emerged as one of the most stable and consistent segments in the light jet category. This is a seller-leaning balanced market, with tightening inventory and rising transaction volume giving sellers a modest advantage.

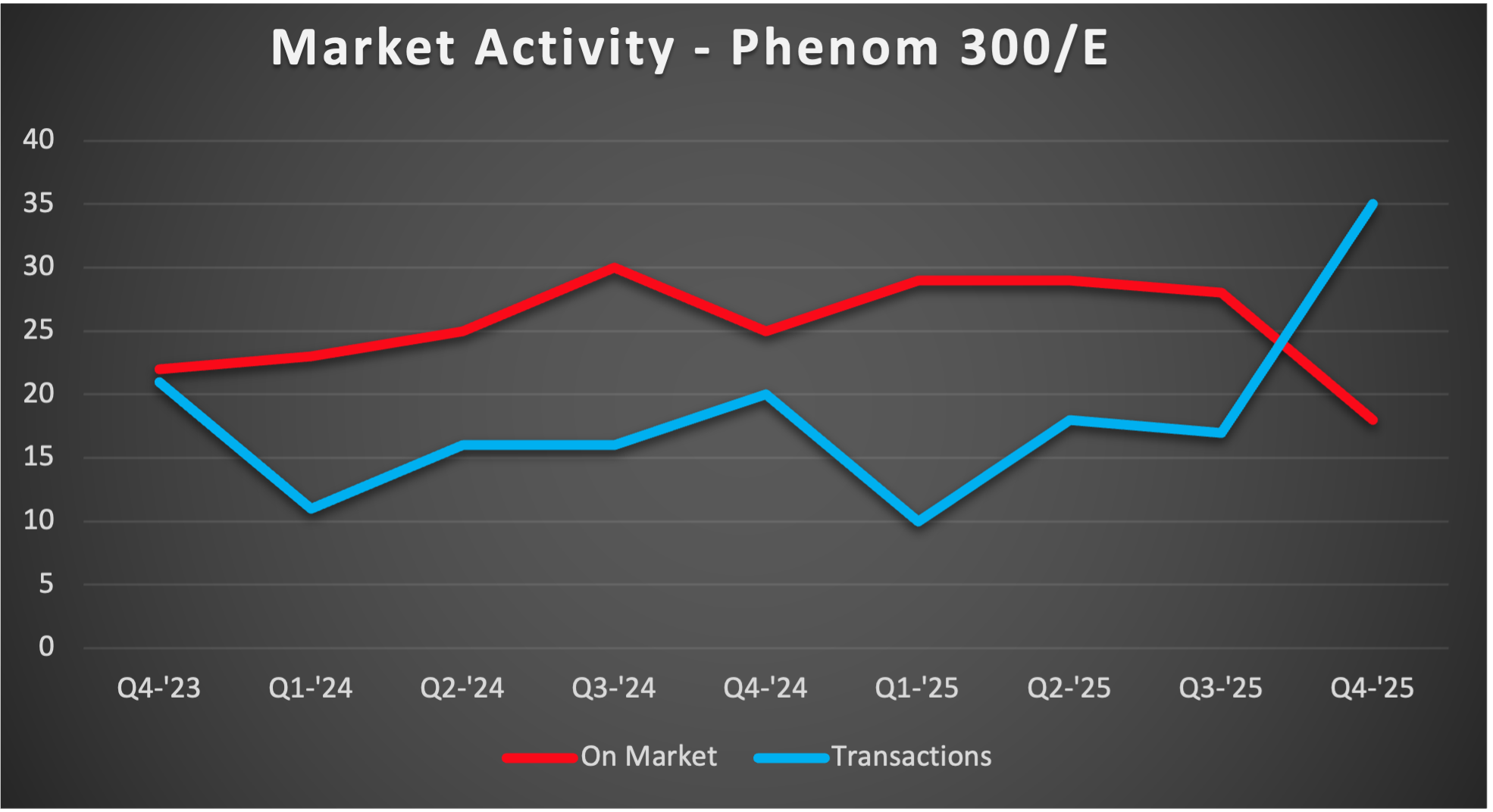

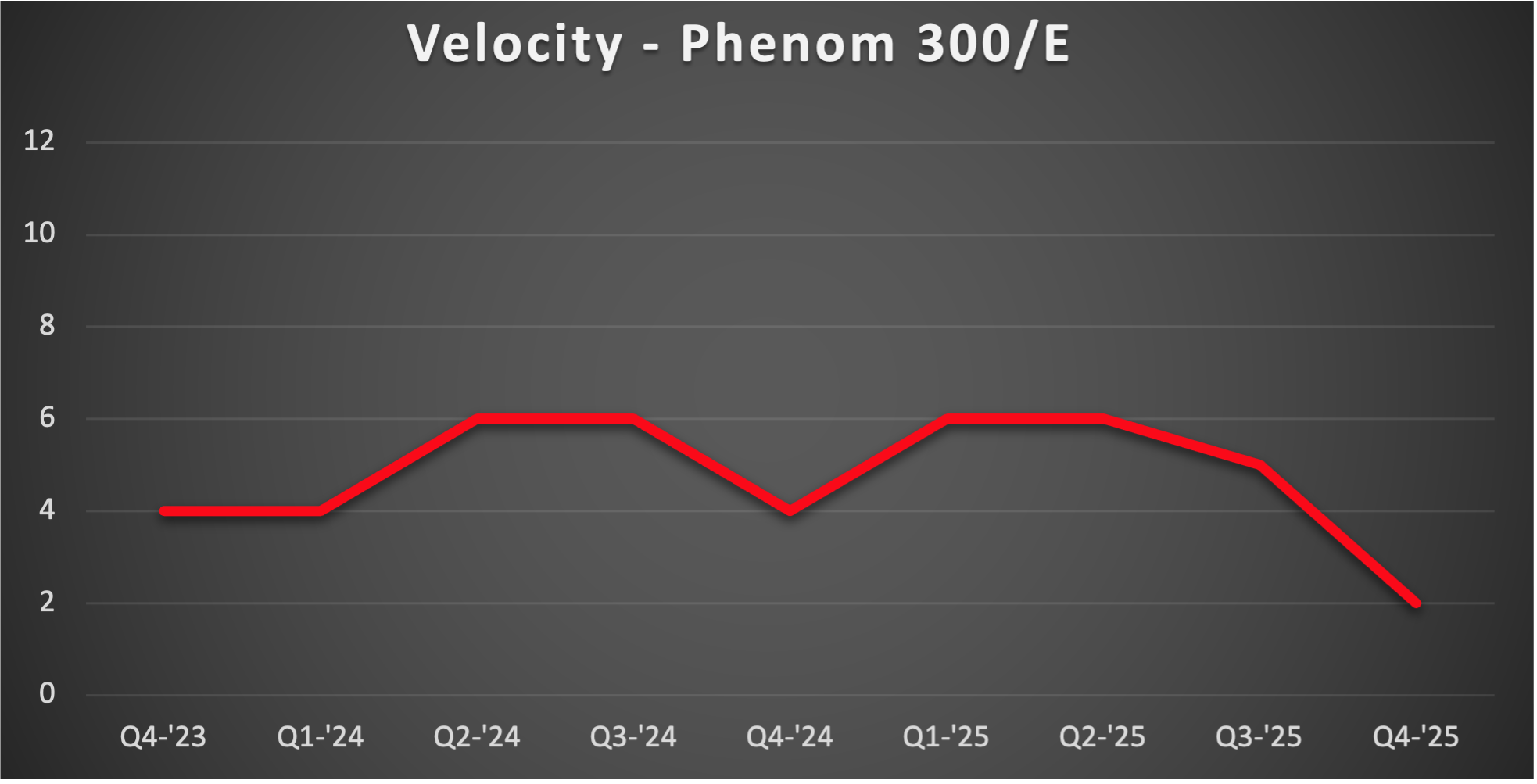

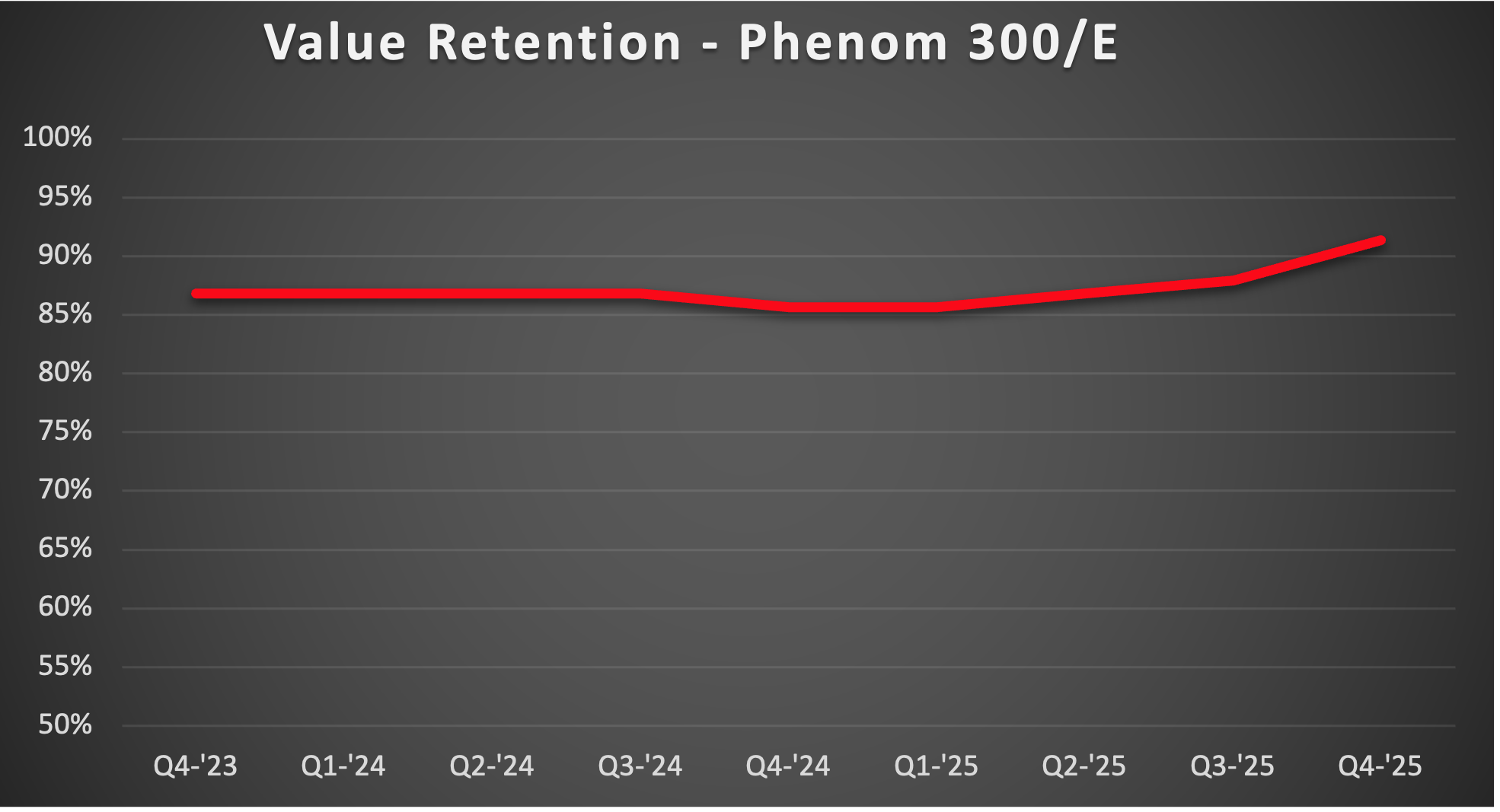

Thinking of selling your Phenom 300? There is undoubtedly a buyer for it. The Phenom 300 increased in value again for the 4th consecutive quarter. This time, by about 3%, recapturing almost 91% of its original value. Average inventory dropped by 35%, and transactions increased by 105% from Q3 to Q4. With sustained price appreciation, sharply reduced inventory, and a surge in transactions, the Phenom 300 market is decisively seller-driven. Demand is deep and liquid, making this an opportune window for owners considering a sale.

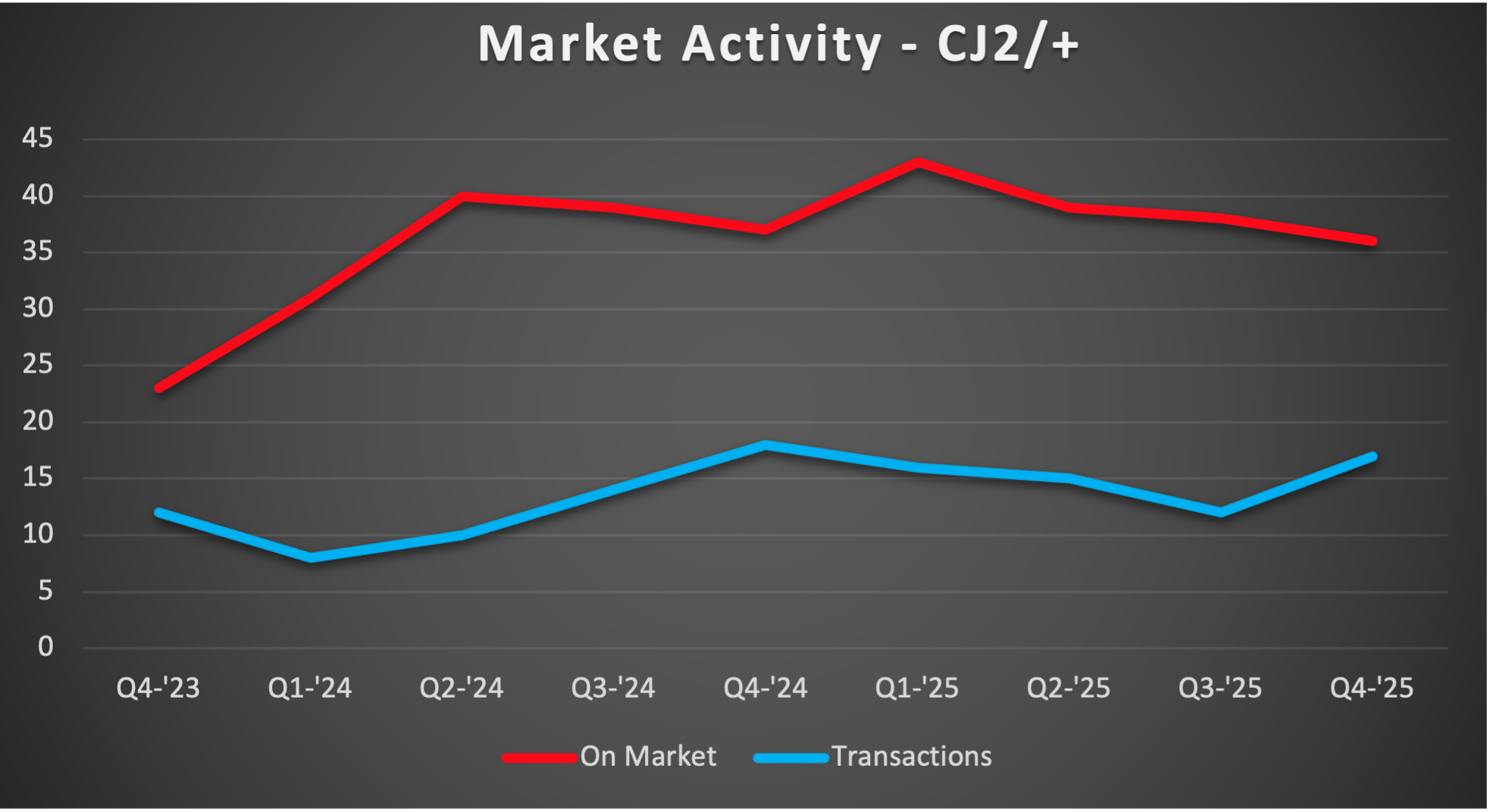

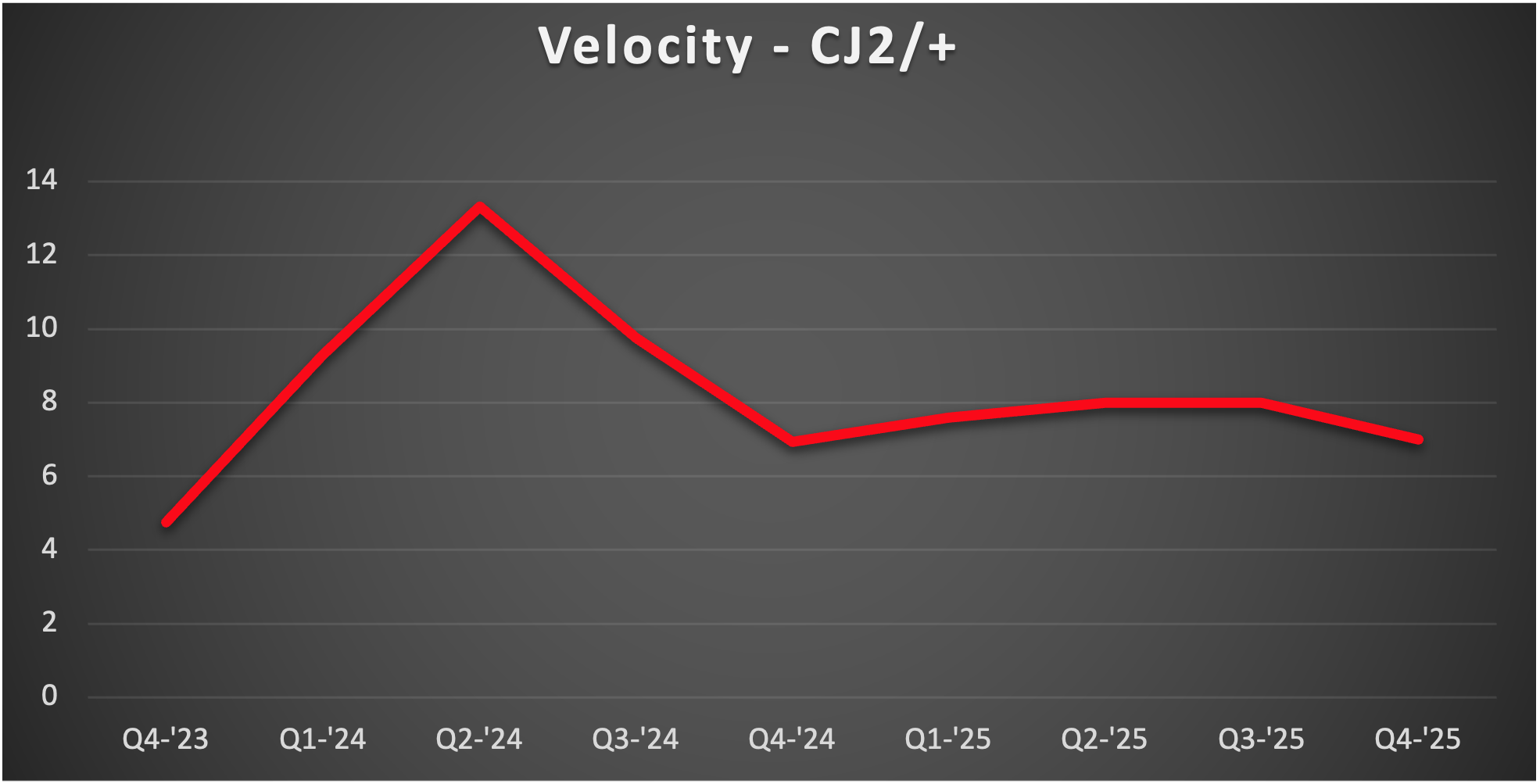

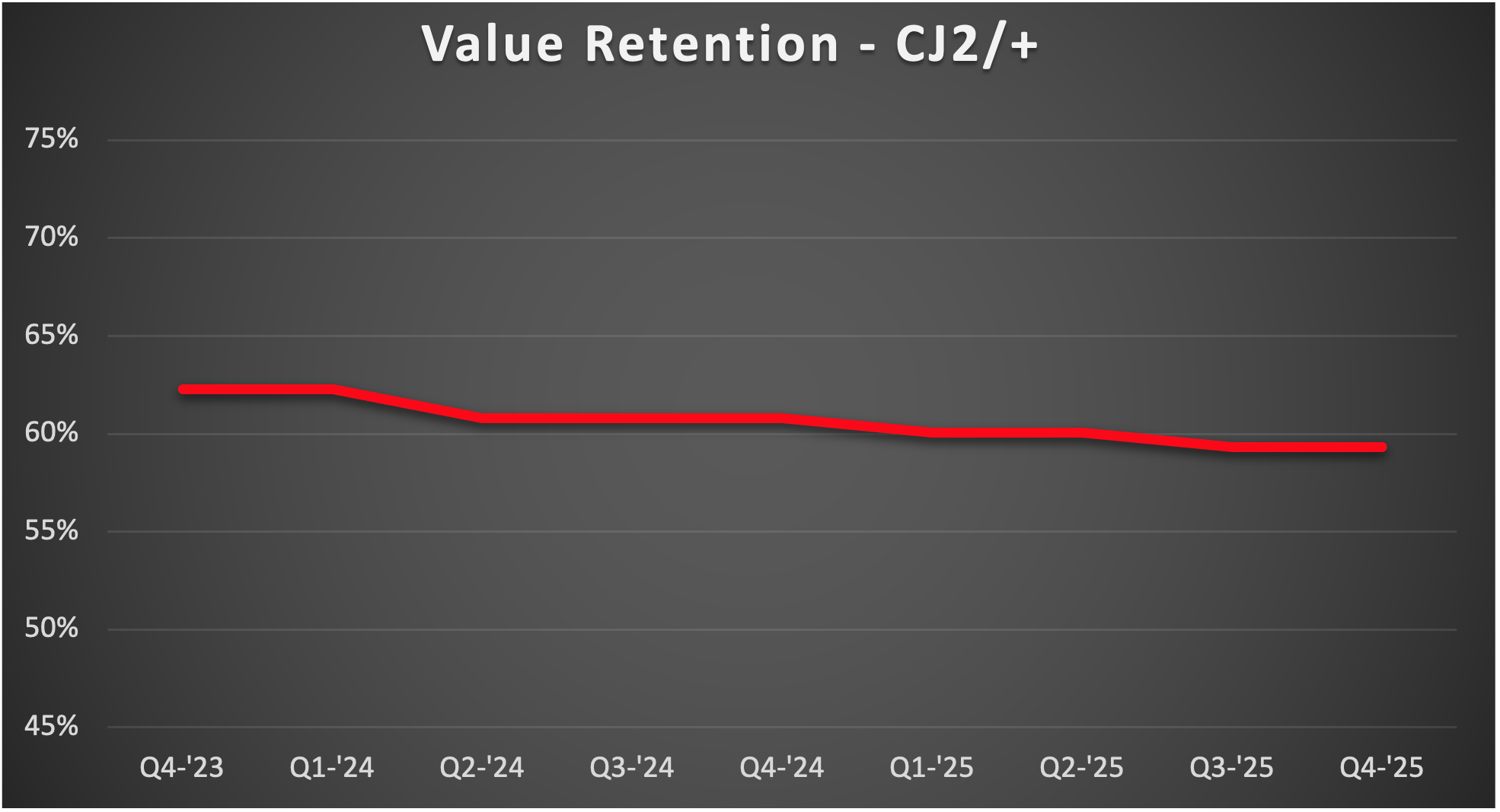

CJ2 values held steady from Q3 to Q4, supported by a modest reduction in average inventory from 38 to 36 aircraft. Transaction activity strengthened in the fourth quarter, reaching its highest level since Q4 2024. Historically, the CJ2 market follows a consistent annual pattern— transactions tend to start slowly in Q1, build progressively through the year, while values continue a gradual downward trend. Despite improved late-year liquidity, the ongoing softening of values points to a buyer’s market, where purchasers retain pricing leverage while sellers benefit mainly from predictable transaction velocity rather than upward price pressure.

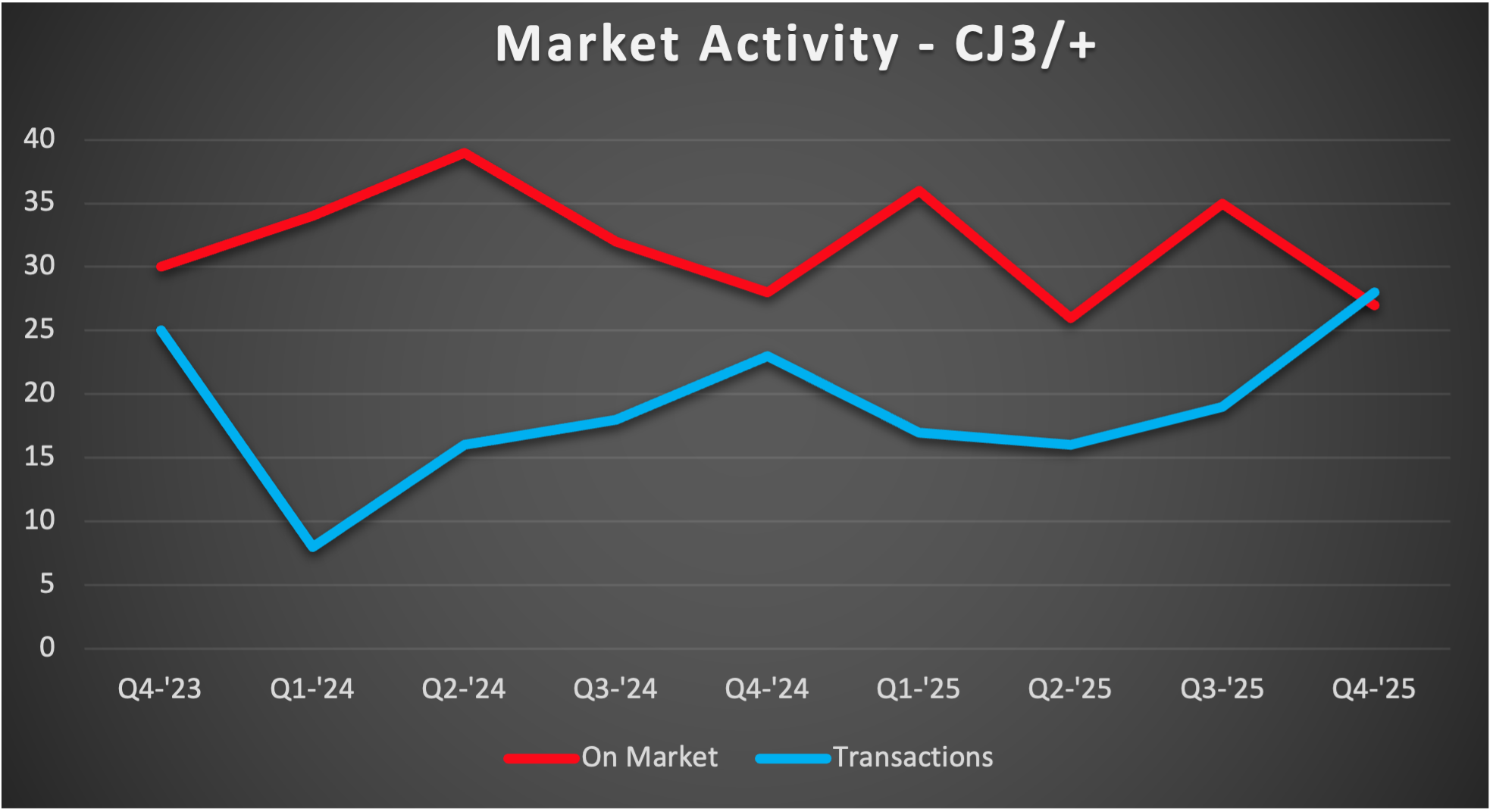

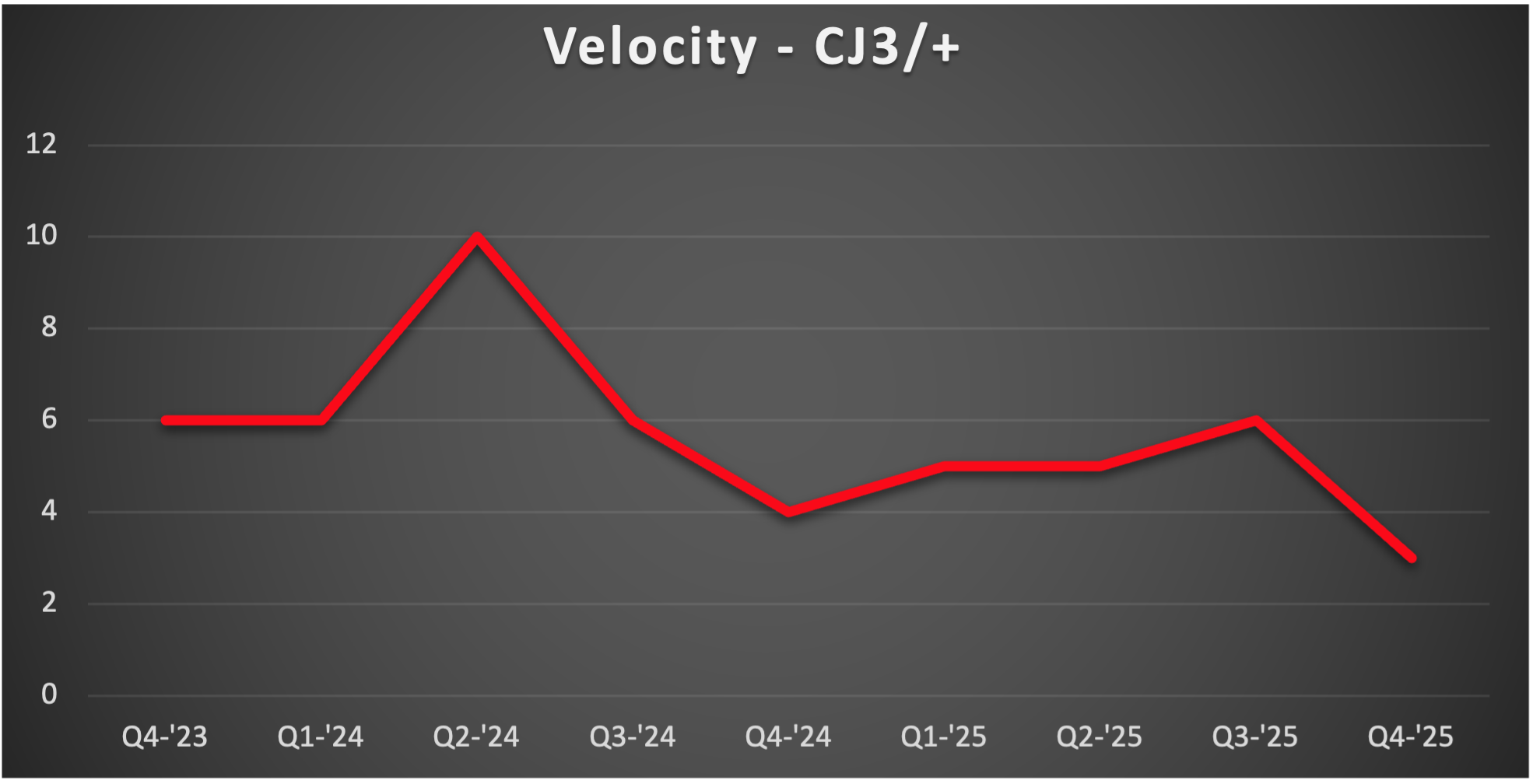

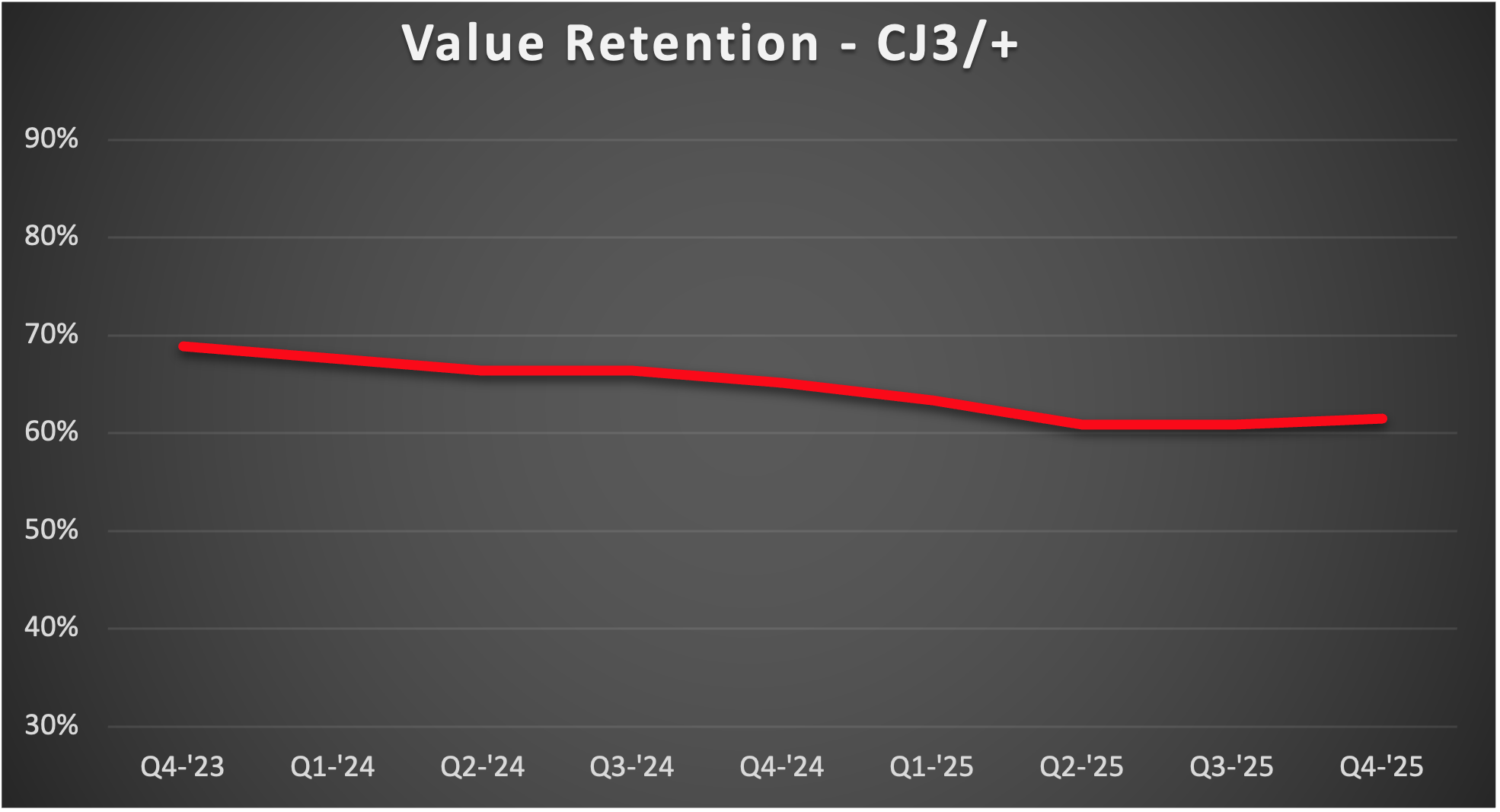

The CJ3 market saw a great number of transactions in Q4 2025. If you wanted to purchase a CJ3 in December of ‘25, options were limited as most decent aircraft were already under contract. This surge of interest helped increase value by 1.5%. Inventory is down by about 22%. These conditions point to a seller’s market, where constrained supply and elevated demand are driving value appreciation and faster deal flow. Though a pullback in transactions may occur in Q1 2026. Keep this information in mind if you decide to purchase a CJ3 this year, as buyers may have an easier time during the first 2 quarters.

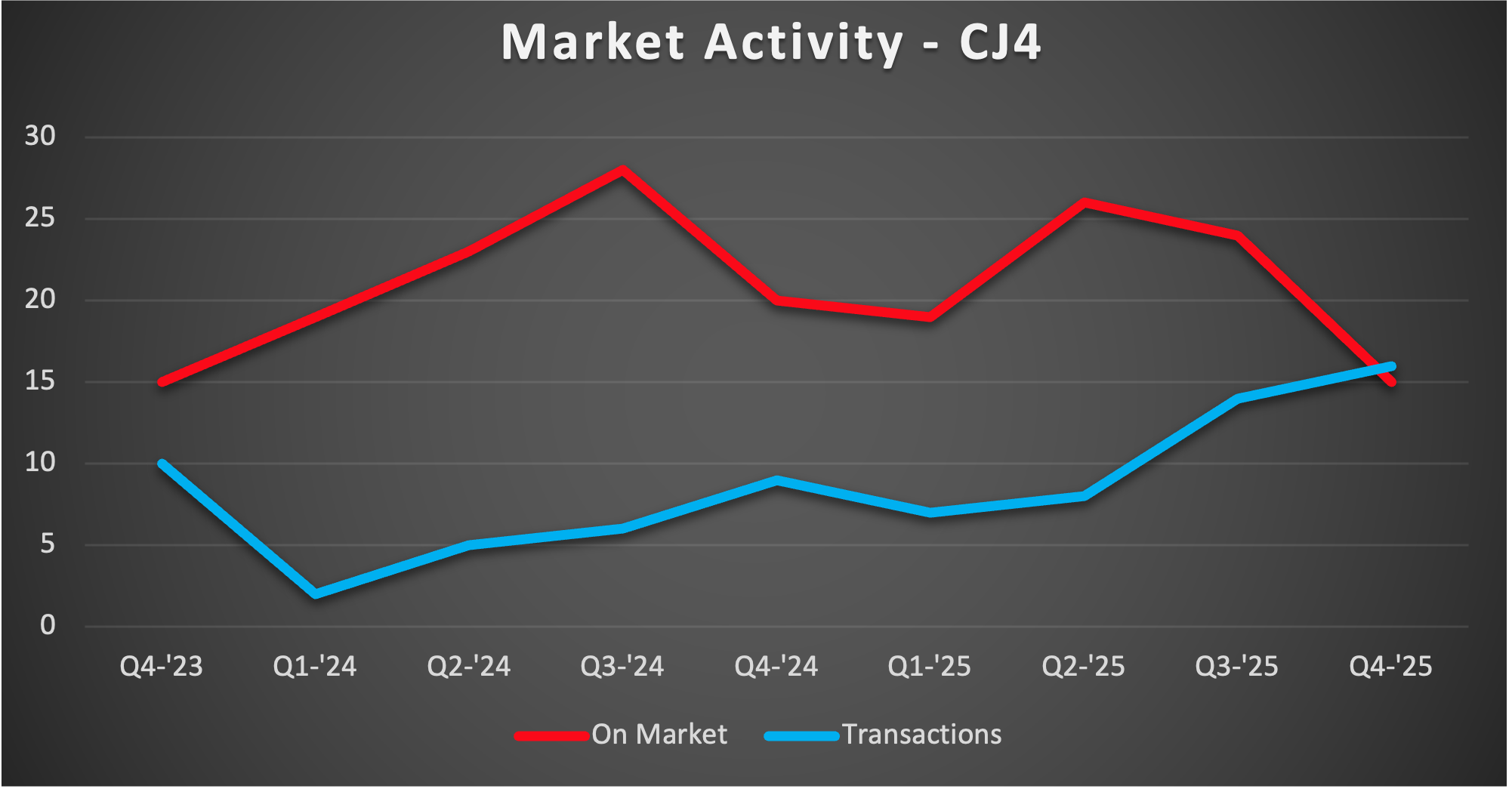

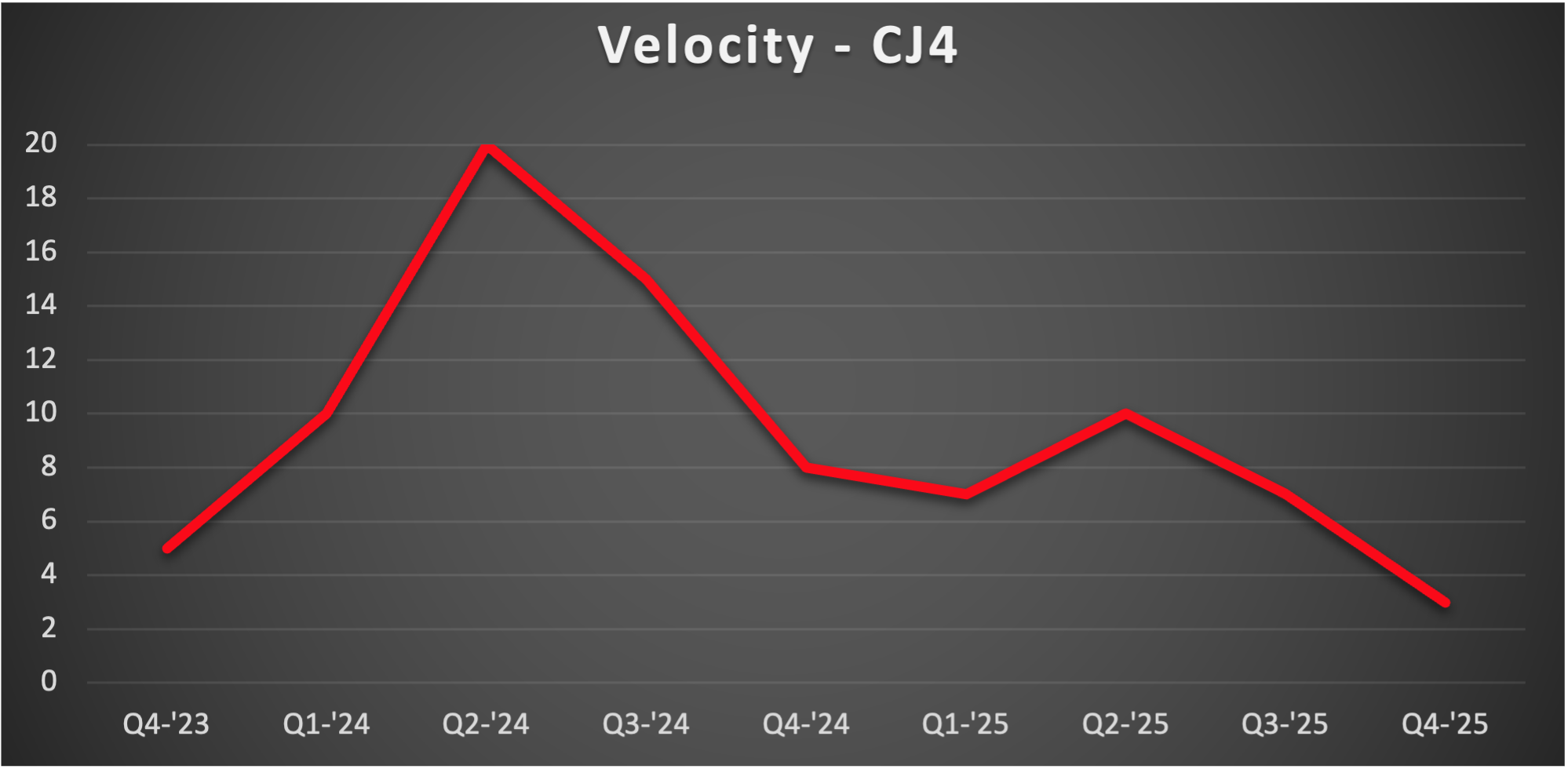

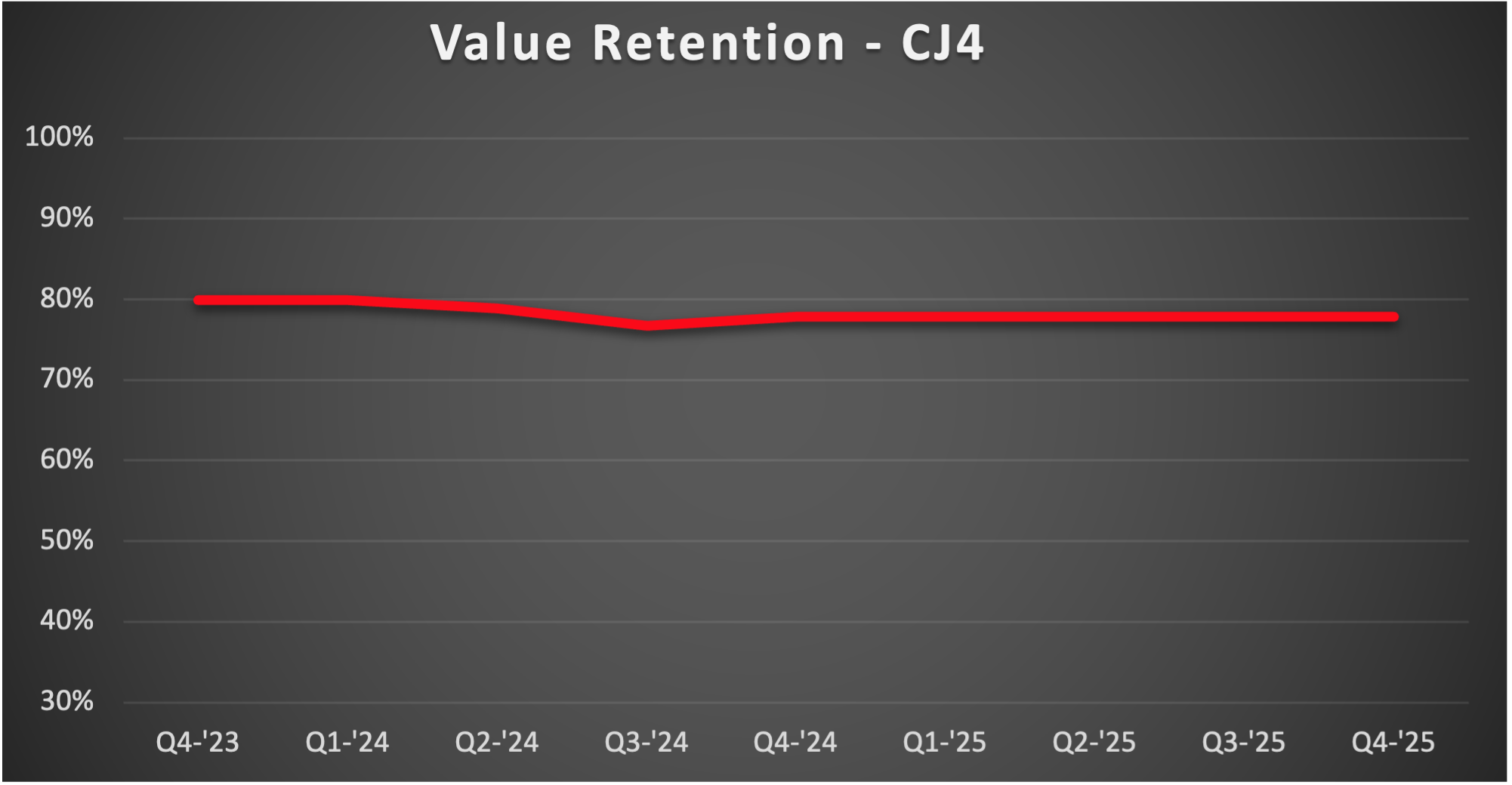

The CJ4 market has shown notable stability in values- holding steady over the past five quarters. Transaction activity continued to build momentum, increasing 14% from Q3 to Q4 after a substantial 75% jump in the prior quarter. At the same time, available inventory tightened meaningfully, declining from an average of 24 aircraft to just 15. With rising transaction volume and reduced supply supporting firm values, the CJ4 market is best described as a balanced market with a clear seller-leaning bias. Most CJ4s currently for sale have complied with the Window Service Bulletin, providing solid options for prospective buyers. For sellers, completing the Service Bulletin before bringing an aircraft to market is strongly recommended, as compliance remains a key differentiator and directly impacts marketability and pricing.

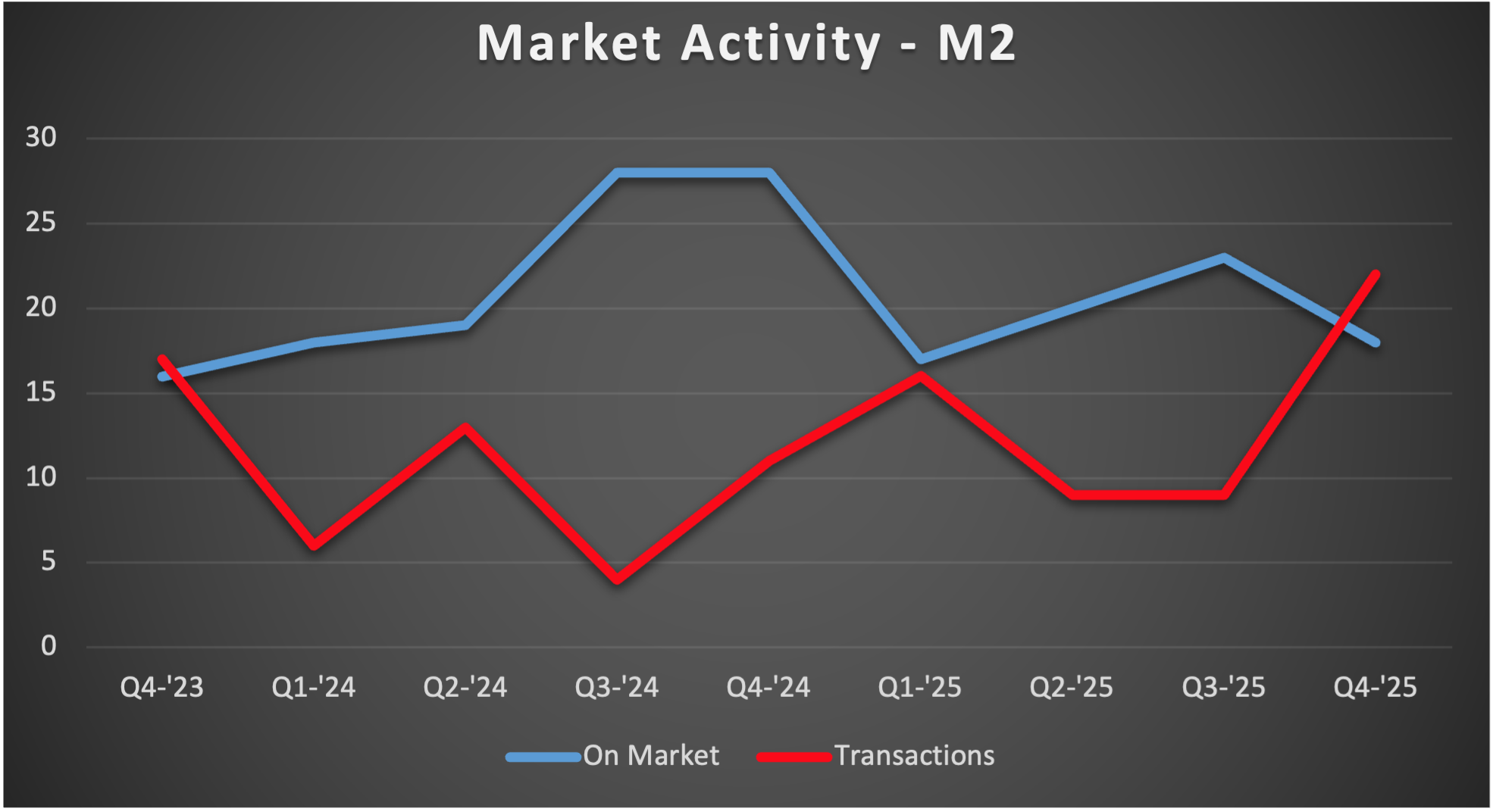

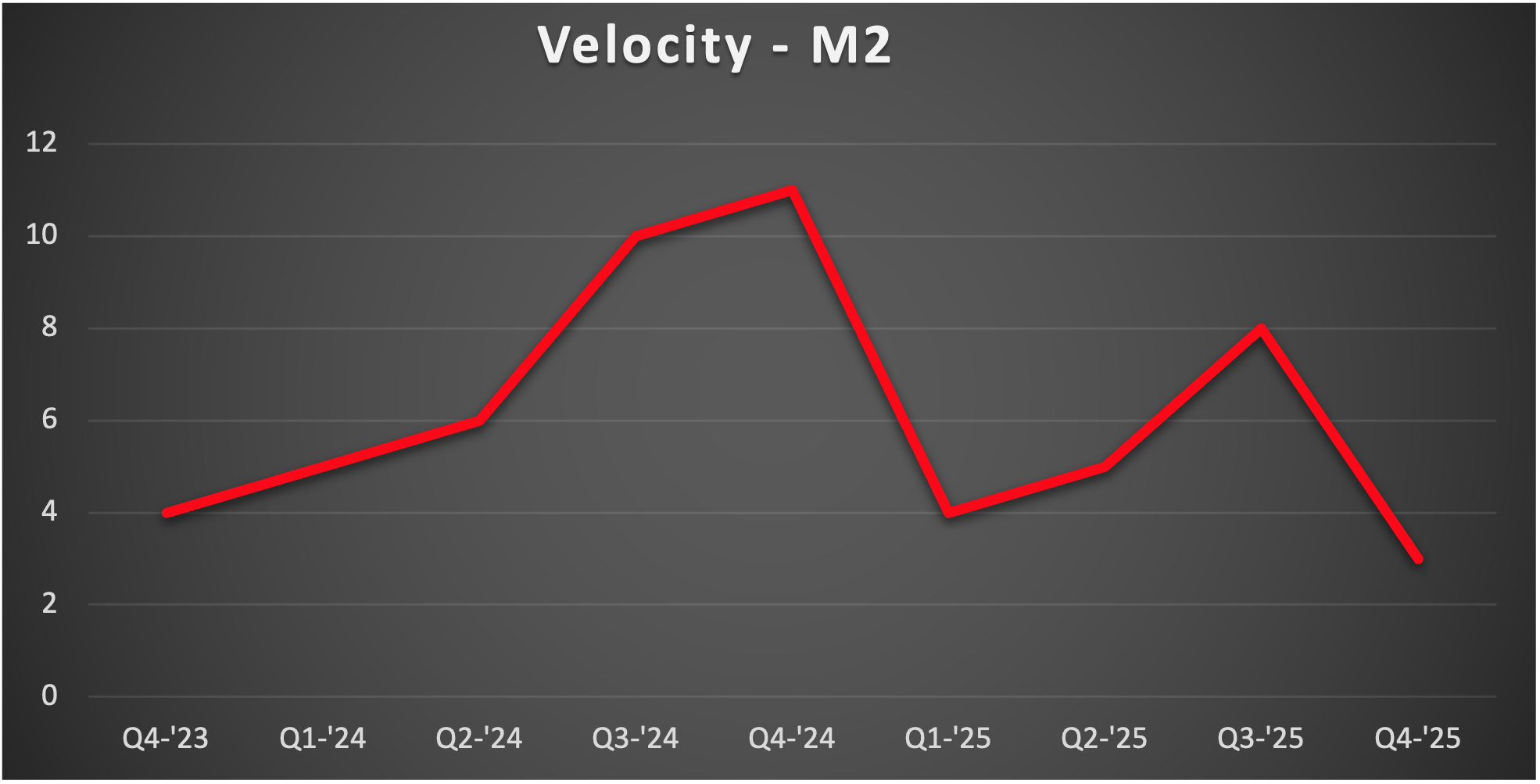

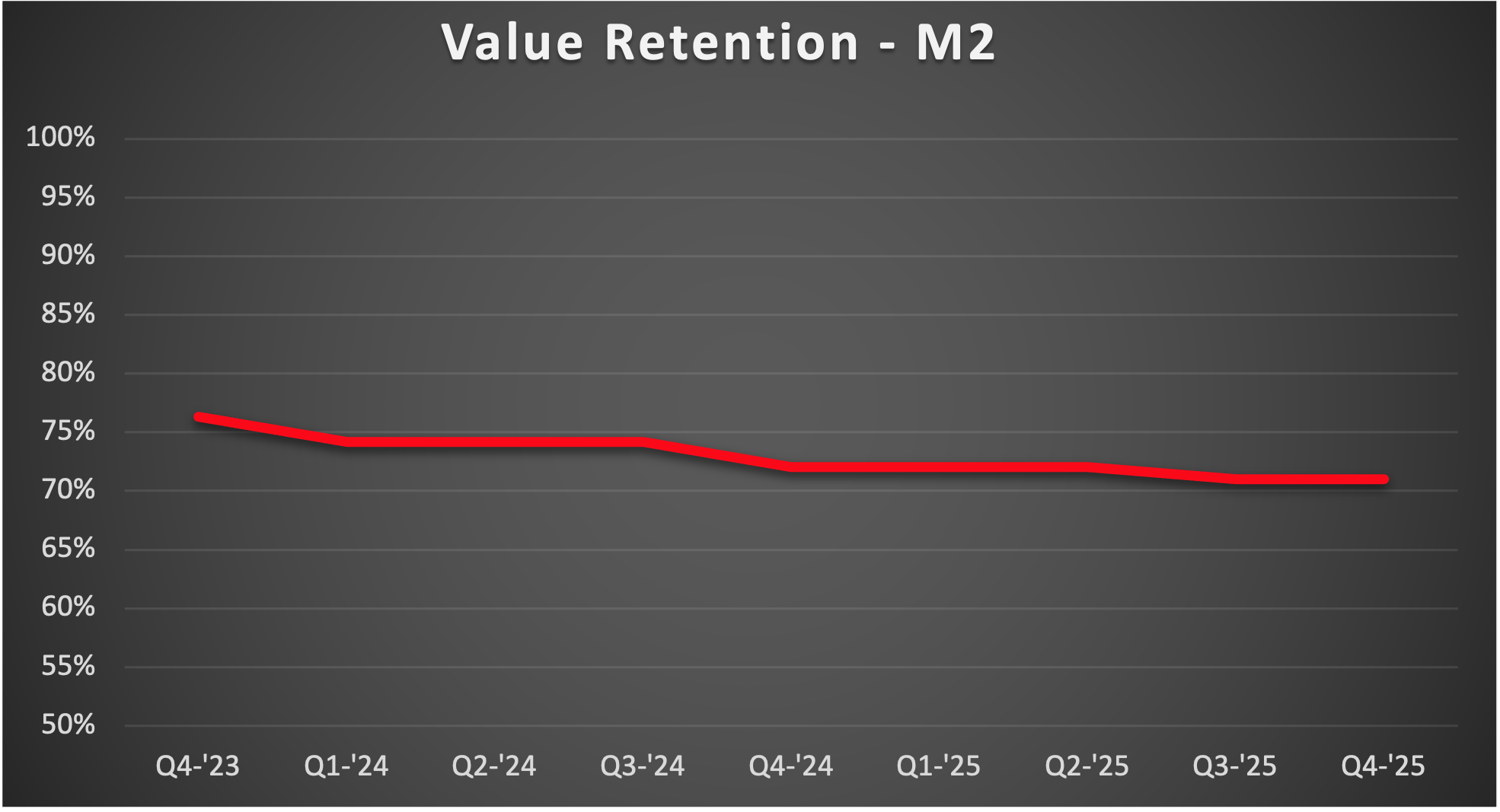

Transactions in the Citation M2 market increased by 144% from Q3 to Q4. Value retention remained stable thanks to this 4th quarter surge. Following 3 quarters of rising inventory, Inventory levels for the M2s have dropped to the lowest levels since Q1 2025. The dramatic increase in transactions and tightening inventory support value stability and give sellers improved leverage, while still maintaining enough activity to keep buyers engaged.