TBM 700 Series (700A, 700B, 700C2), TBM 850, TBM 900 Series (900, 910, 930, 940), TBM 960

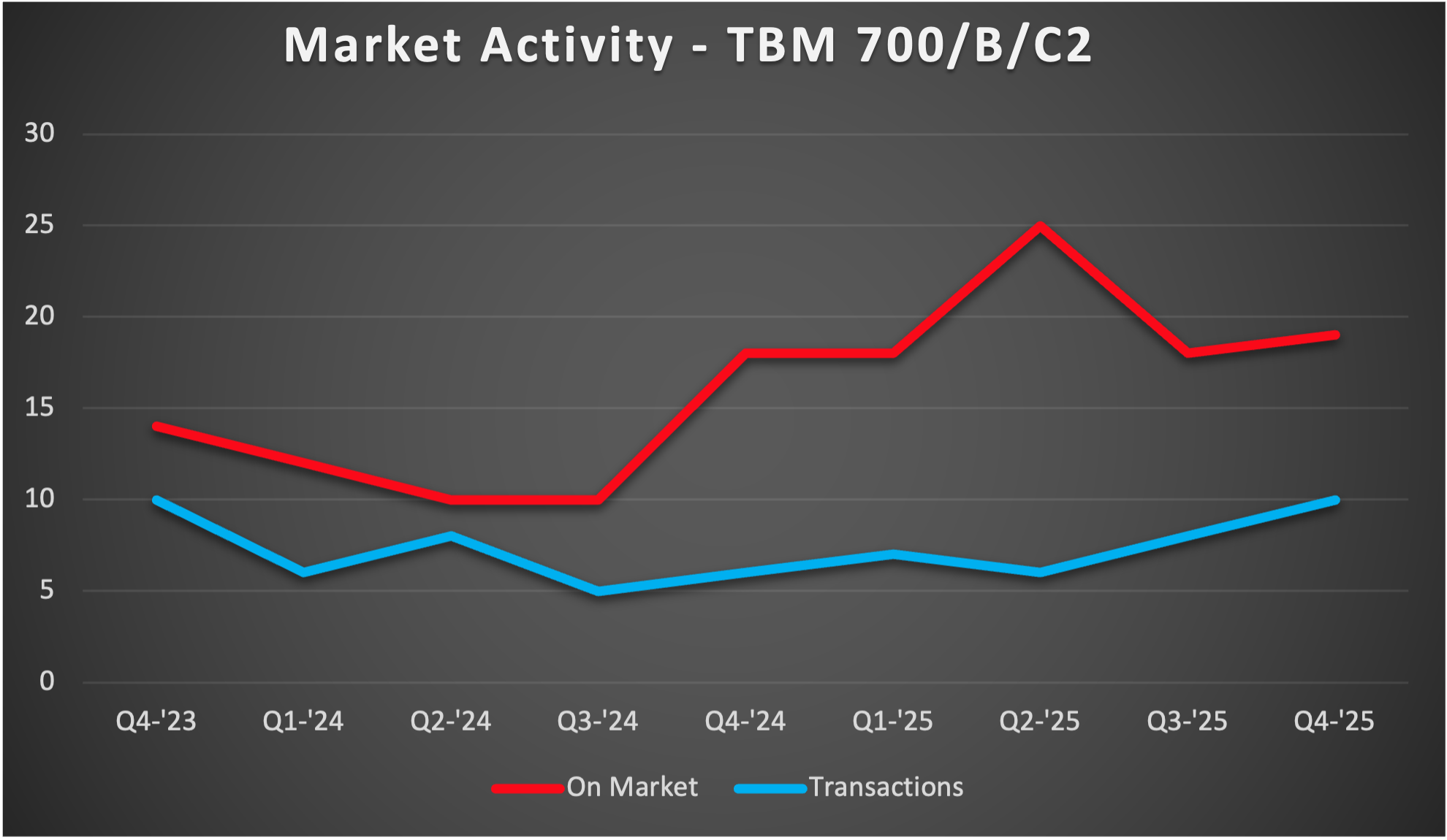

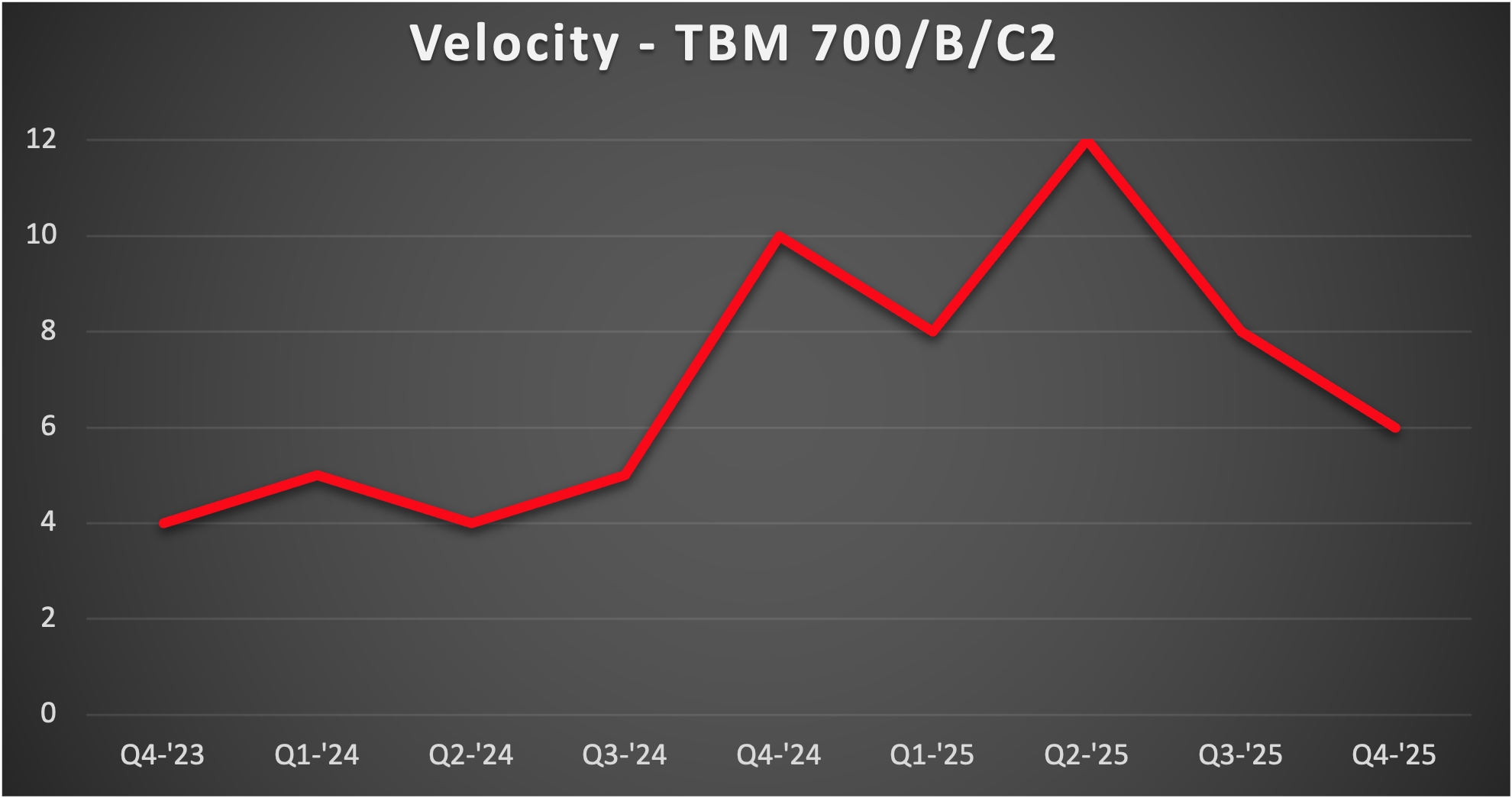

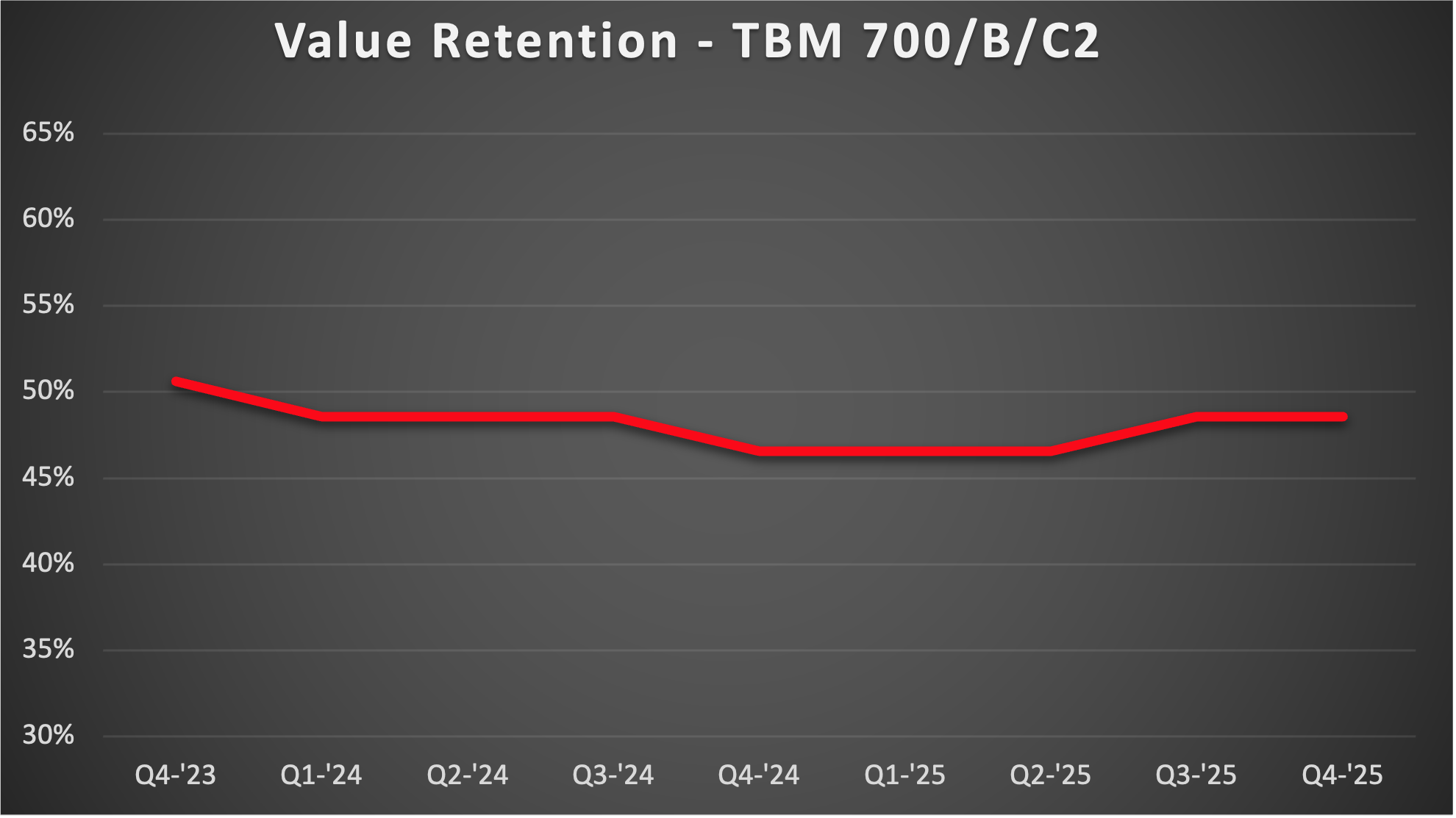

TBM 700 series inventory is holding steady and demand remains strong as we head into the first quarter of 2026. There are currently 19 listings in this market, just one more than last quarter. 7.1% of the active fleet is listed for sale, which has held stable for the past five quarters, with the exception of Q2 2025 where inventory temporarily surged. Decent activity is keeping listings in check, with another 10 transactions during the fourth quarter. 2025 ended up with 31 sales, up from 24 the year prior. With pricing, inventory and demand all holding stable, this market remains balanced for buyers and sellers.

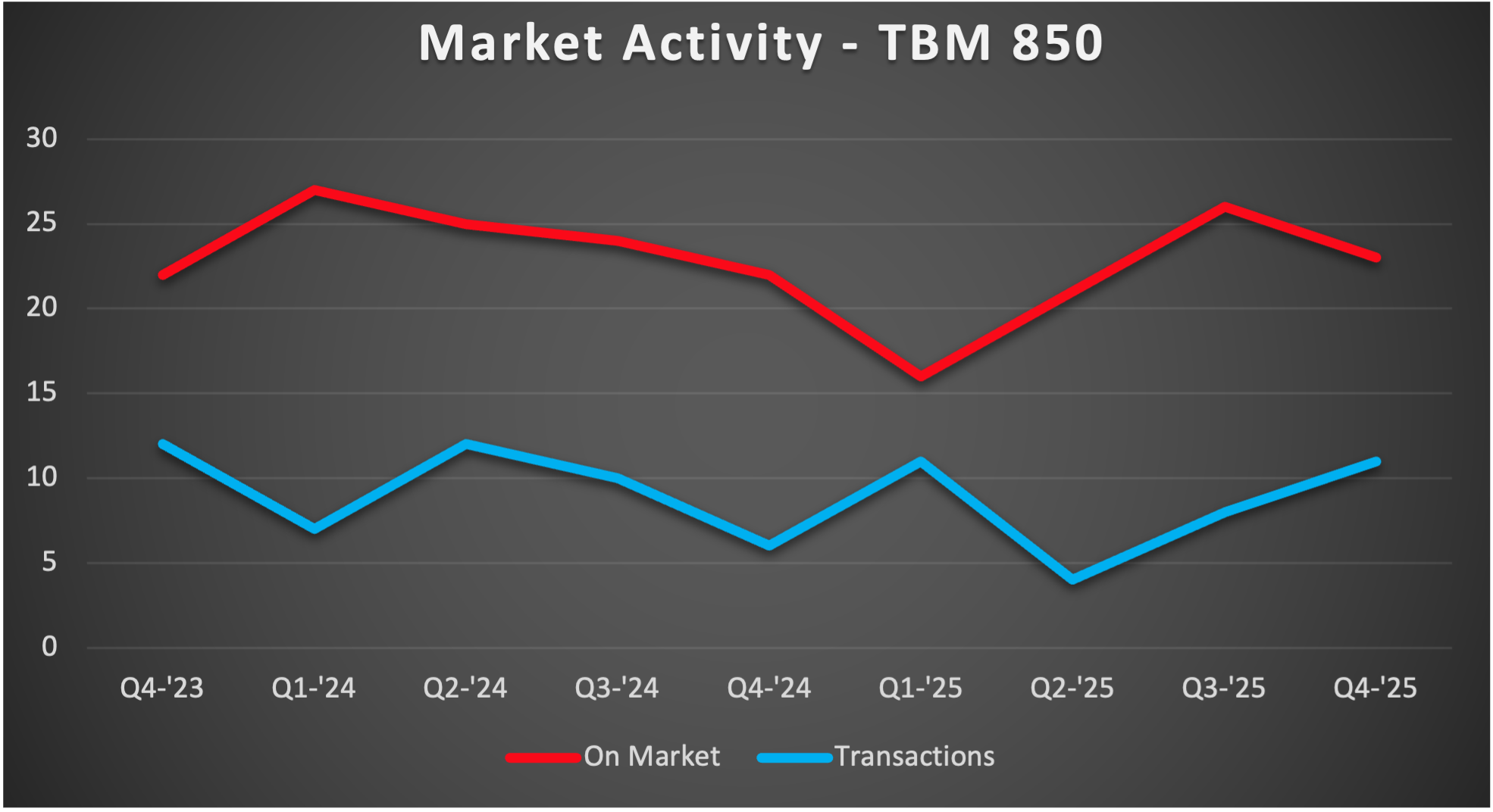

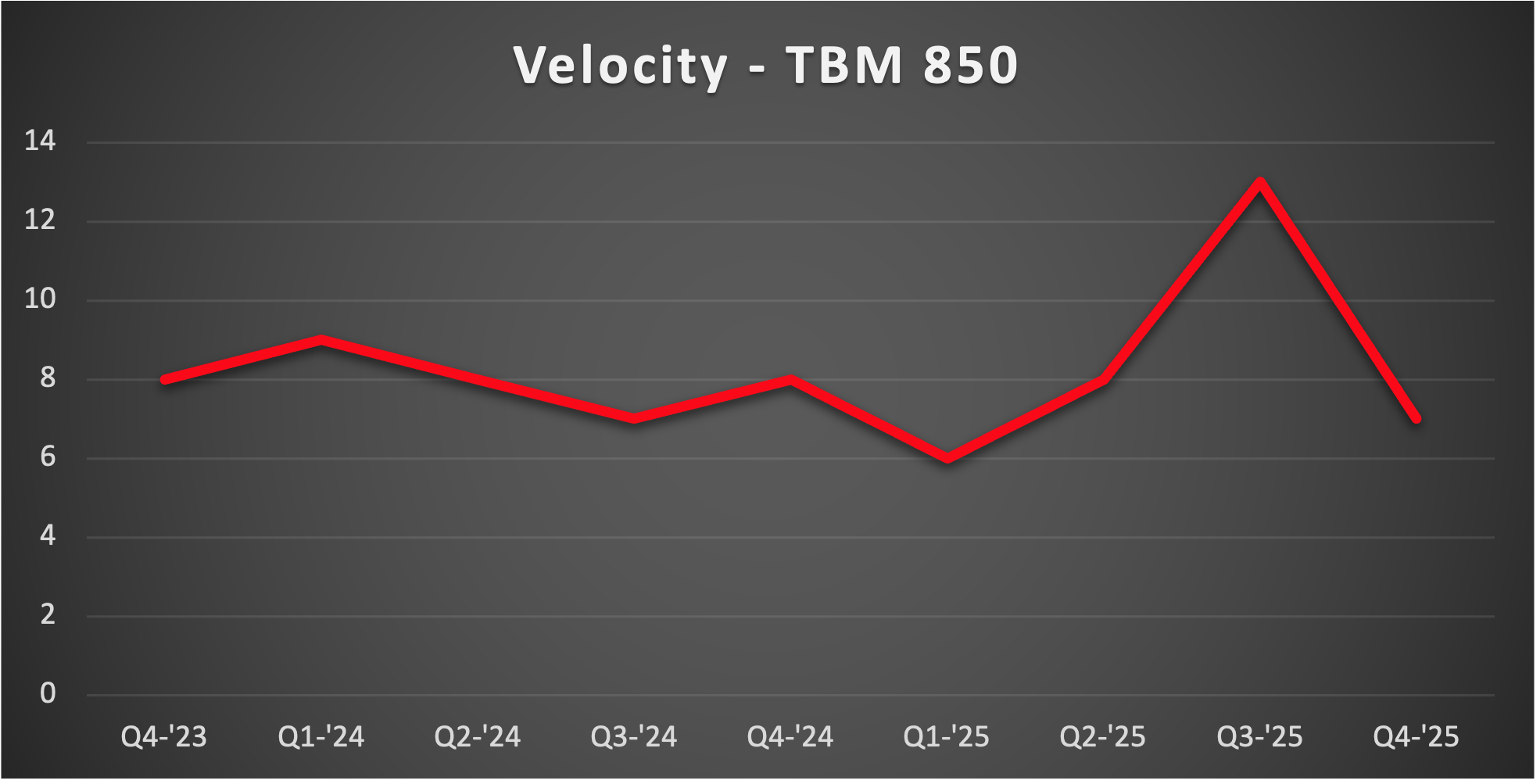

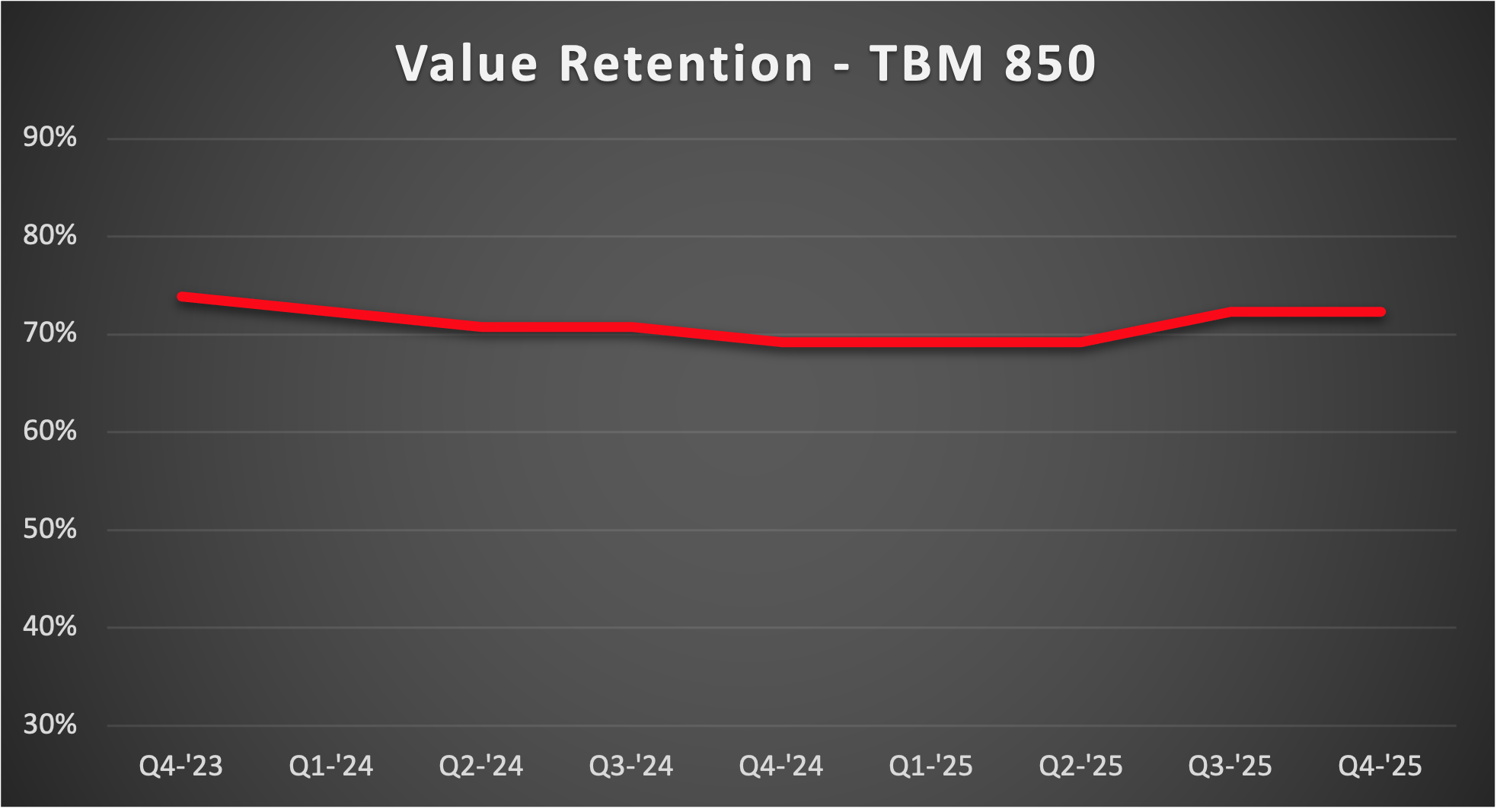

TBM 850 inventory has declined, and transactions have picked up. There are 23 listings in this market, which is down from 26 three months ago. 7.2% of the active fleet is listed, which is similar to a year ago. Activity has picked up, with Q4 producing 11 sales, well above the six that traded during the fourth quarter of 2024. Values have held steady for six months now, after a small increase halfway through the year. As usual with these TBM markets, stable pricing and supply are resulting in a consistent, balanced market for buyers and sellers.

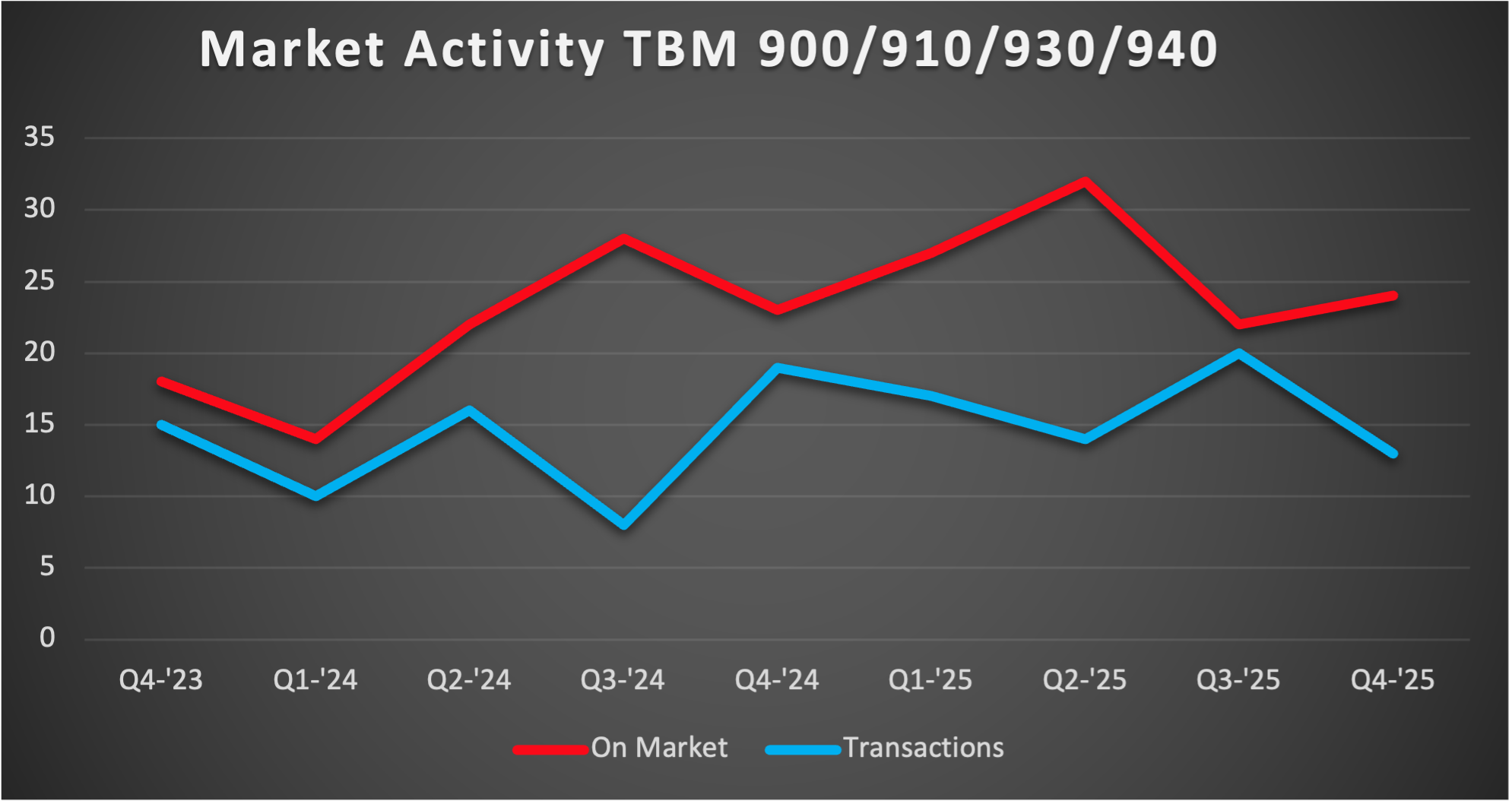

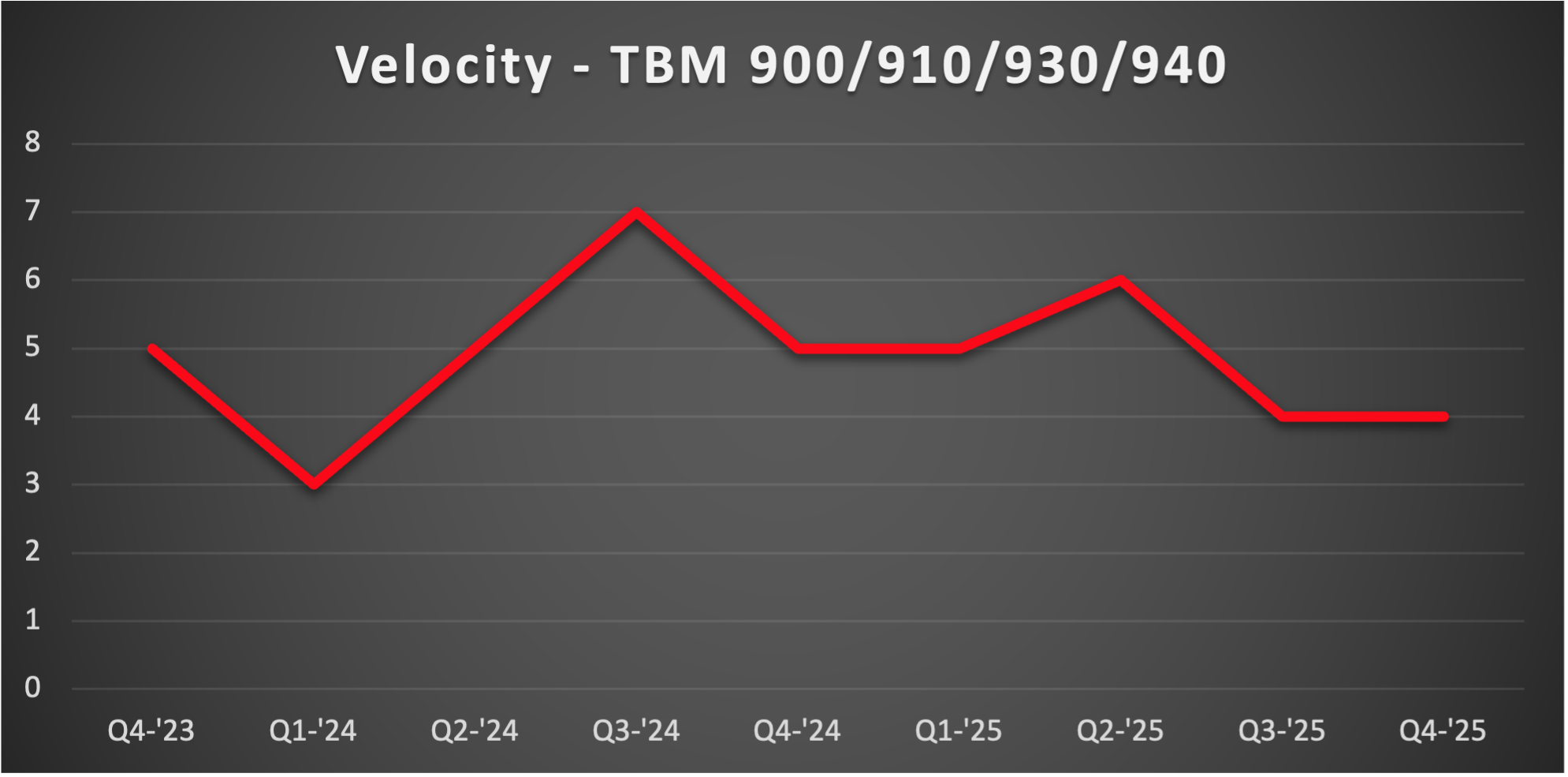

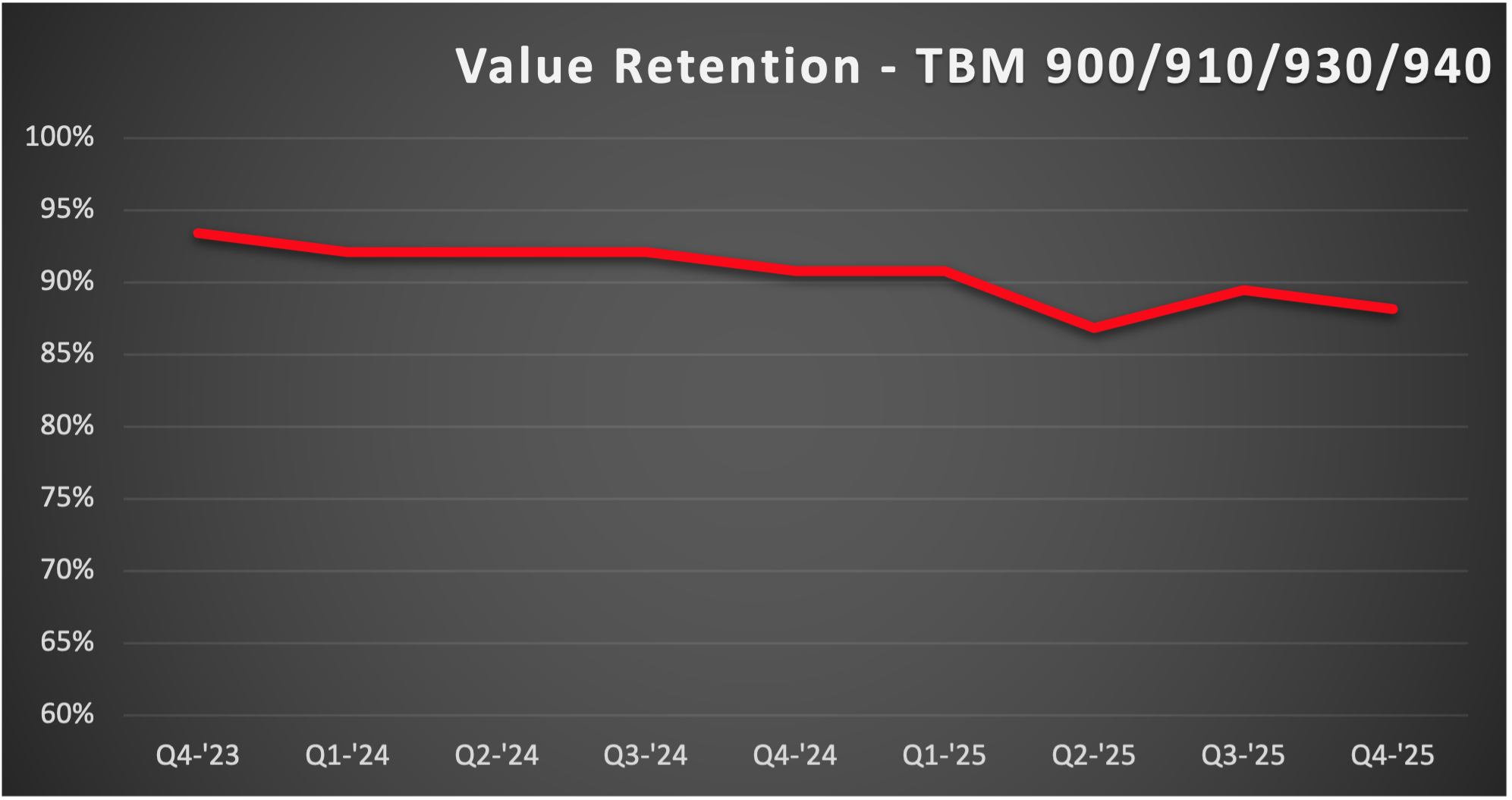

TBM 900 inventory has bounced back slightly, but a lack of options has cooled off transactions a bit. There are now 24 listings in this market, up from 22 last quarter, but still well below the 32 listings during Q2. 5.3% of the active fleet is listed for sale, which is nearly identical to levels a year ago. There were 13 sales during the fourth quarter, well below the 20 that traded during Q3, which contributed to the significant drop in inventory three months ago. Values saw an increase of roughly $100k in Q3, but Q4 gave back $50k of that as a few more options trickled into the market. With relatively stable inventory and demand, this market is considered balanced for buyers and sellers.

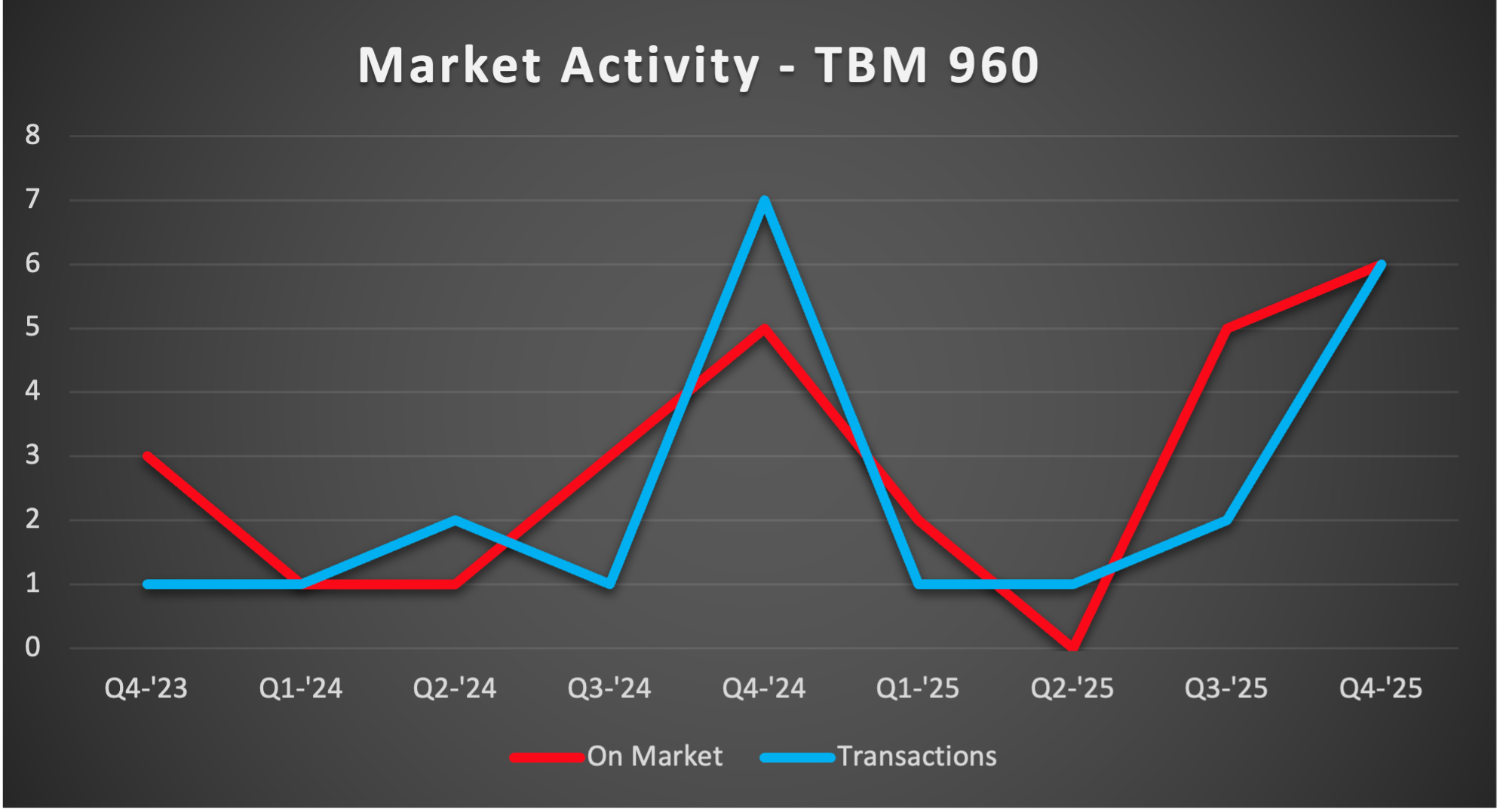

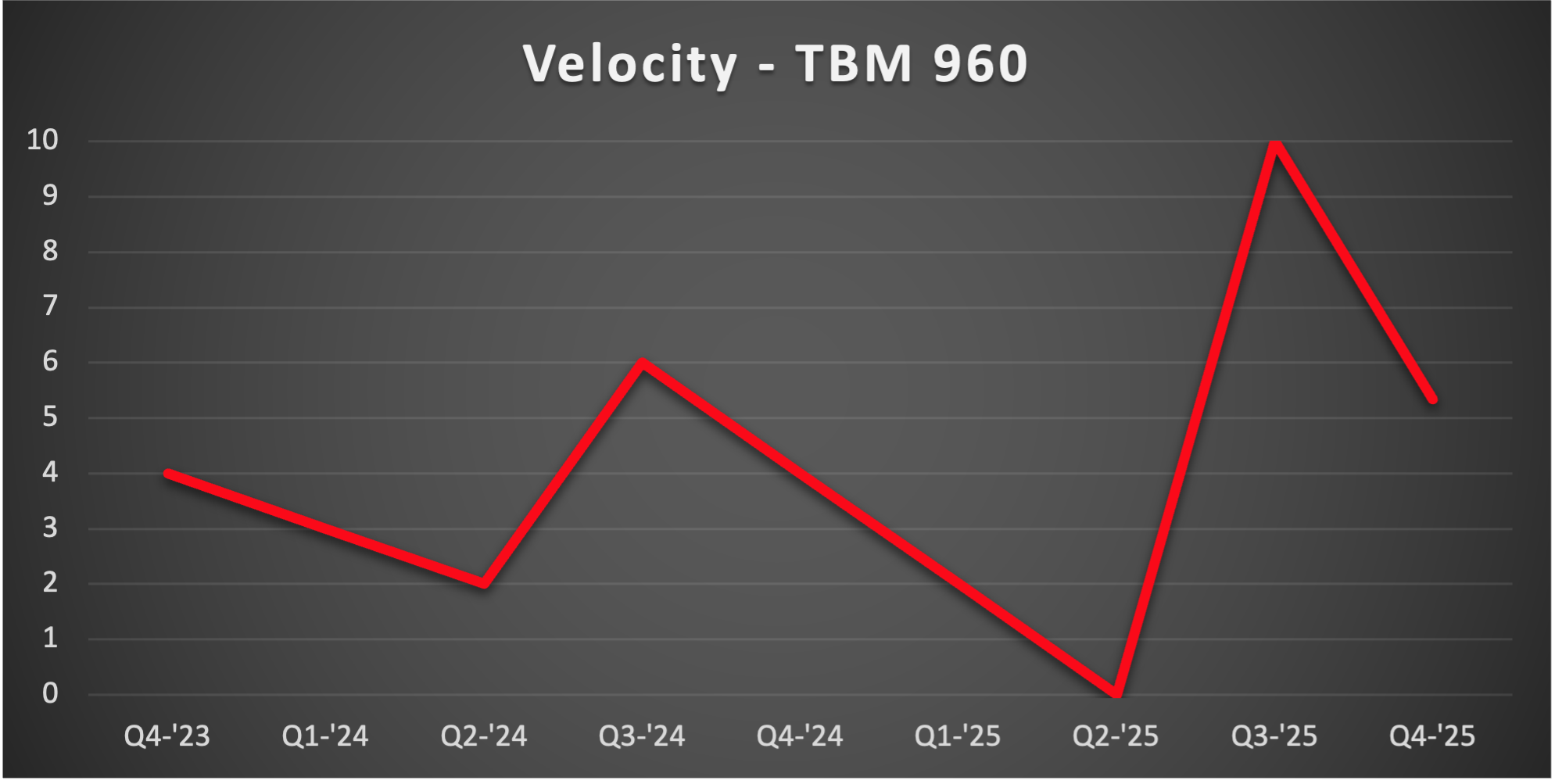

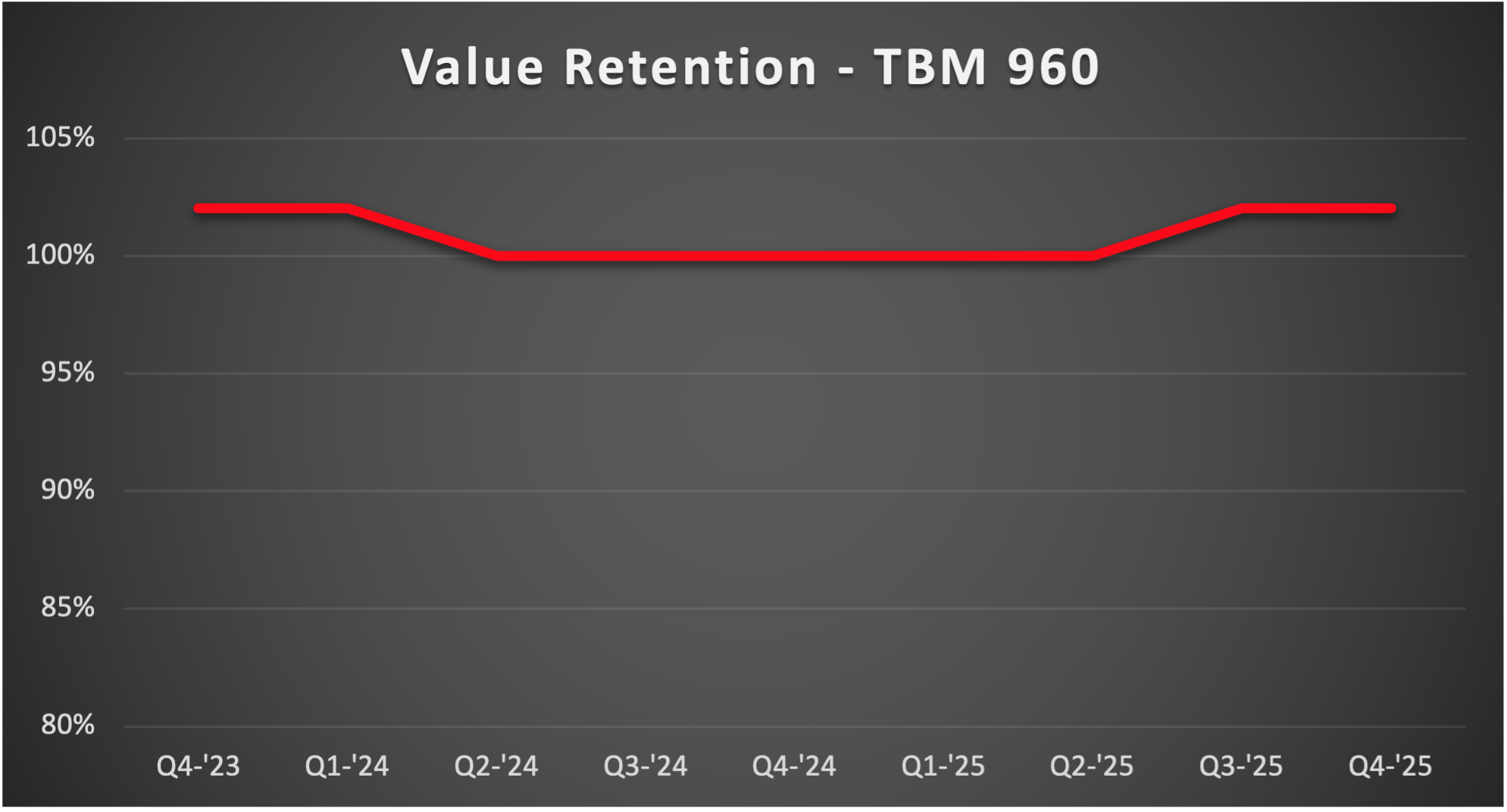

The pre-owned TBM 960 market has found its footing, with ample supply yet strong demand. There are now six listings in this market, showing stability from the five last quarter. 3.6% of the active fleet is listed, the most we’ve seen in this market, but still well below any of the other TBM markets. Six aircraft traded during Q4, making 11 total sales for the second half of 2025. This is more than any six-month stretch since the 960’s were introduced. Values are holding steady, being held up by strong demand for new aircraft. With decent availability and stable pricing, this market is balanced for buyers and sellers.