Lear 45XR, Lear 60XR, Lear 75, Hawker 800XP, Hawker 850XP, Hawker 900XP, Citation Excel, Citation XLS, Citation XLS+, Citation Sovereign, Citation X

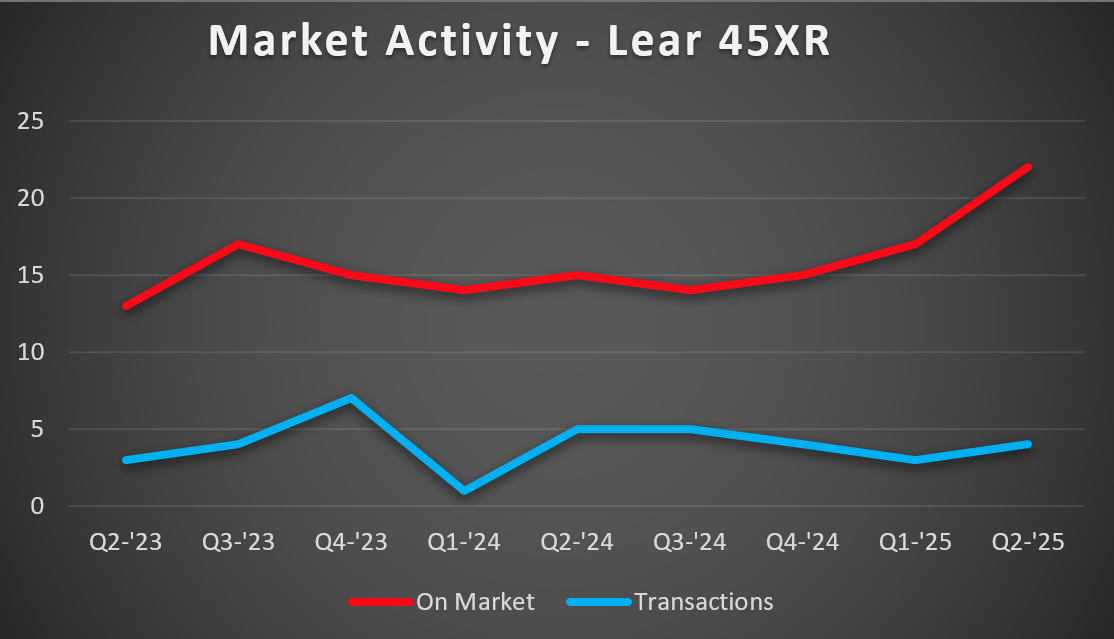

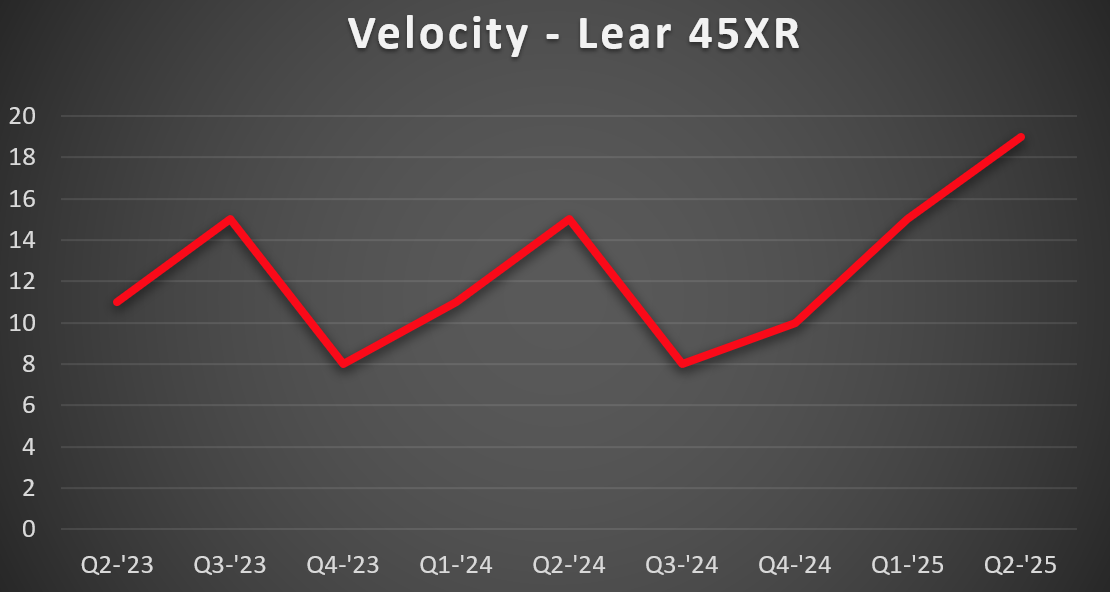

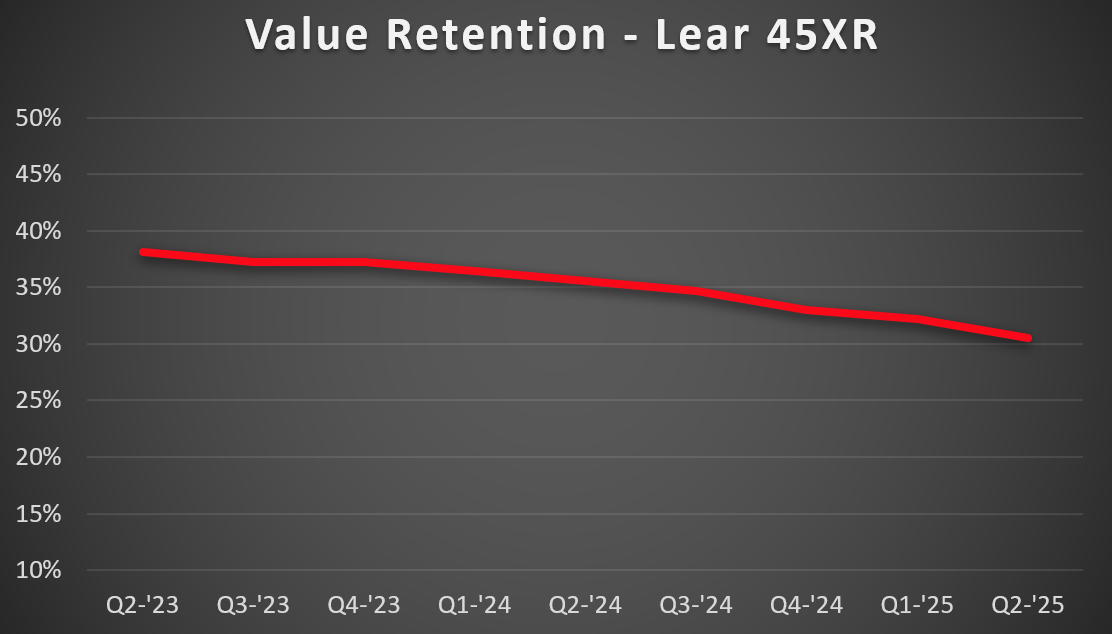

Lear 45XR inventory has increased significantly and prices have softened as we make our way into the third quarter of 2025. There are now 22 listings in this market, representing more than 10% of the active fleet, the highest level we’ve seen in many years. Transactions have held stable with four sales taking place in Q2. This is up from three sales during Q1, but slightly behind the five sales that occurred during Q2 of 2024. Prices continue to decline, with values dropping roughly $200k on average over the past three months. With inventory rising and values dropping, this is the best time to purchase a 45XR in many years.

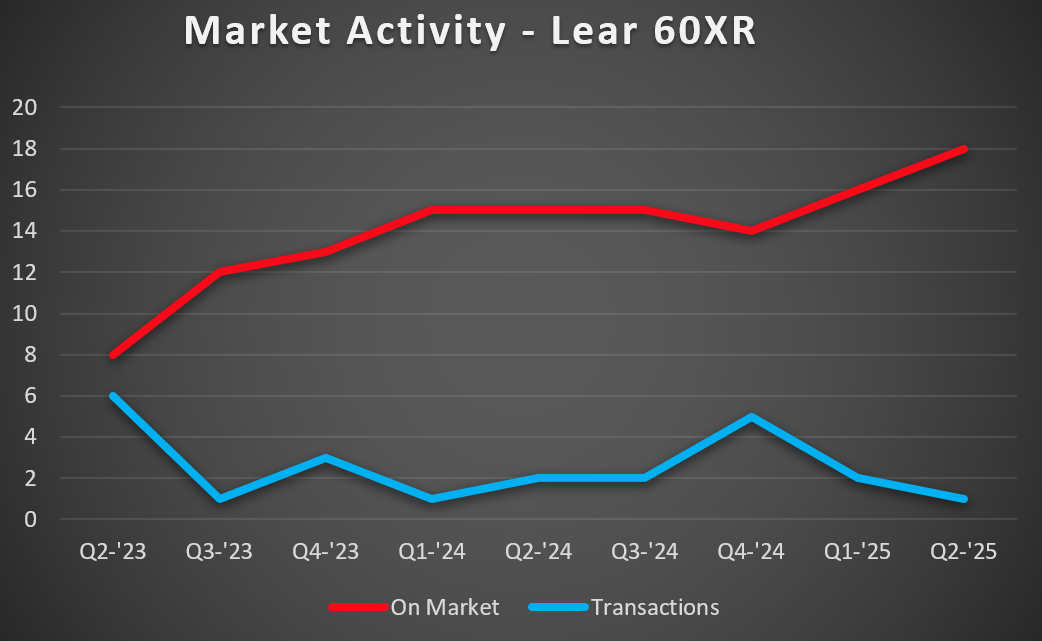

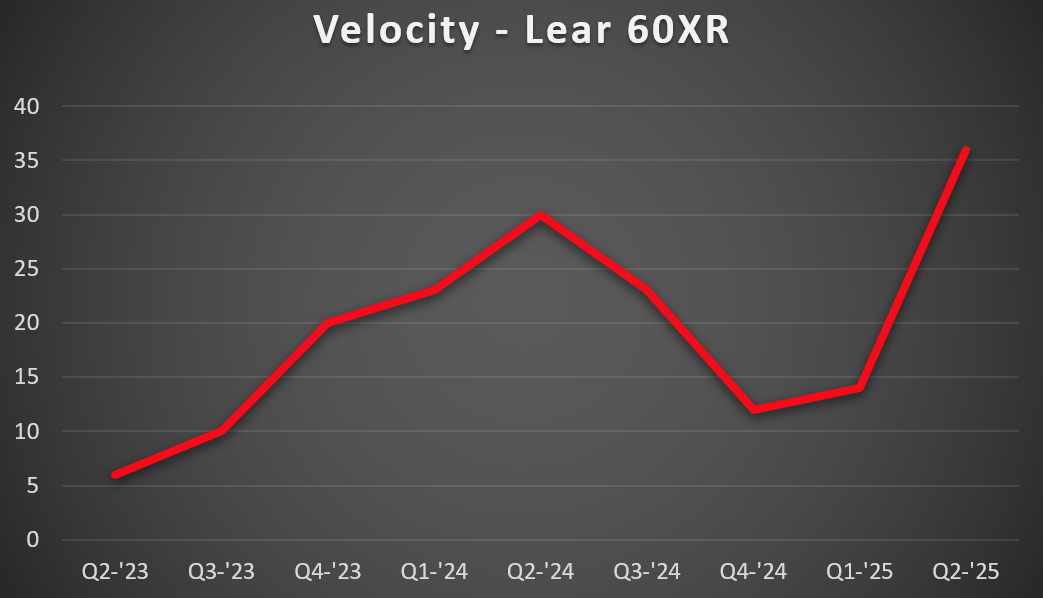

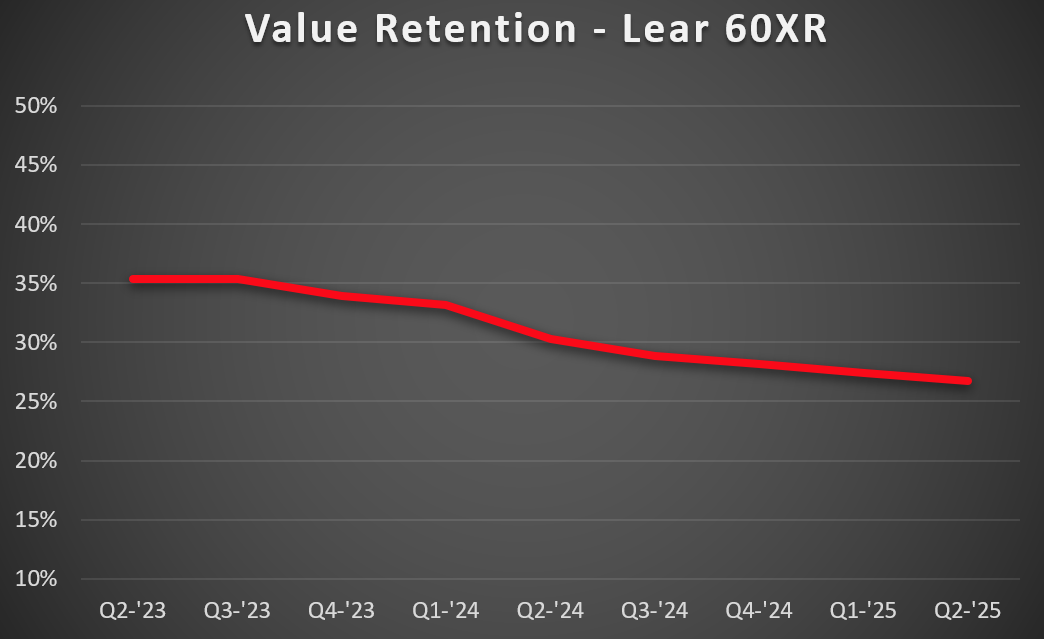

Lear 60XR inventory continues to climb, and transactions remain few and far between. There are currently 18 listings in this market, up from 16 last quarter. Current inventory levels now represent more than 16% of the active fleet , the highest of any other midsize jet in our report. Sales are hard to come by in this market…only one sale during Q2, making just three total in the first six months of 20 25. As you can imagine, pricing has continued to decline, with values down roughly $500k over the past year. With elevated inventory and prices that continue to decline, the 60XR market remains favorable for buyers.

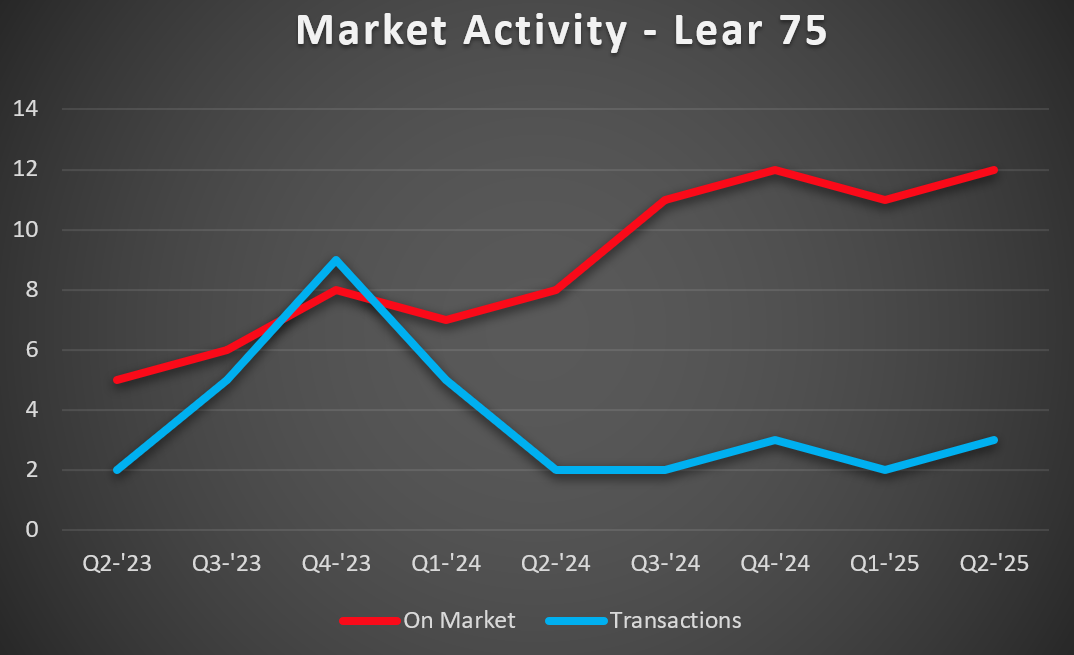

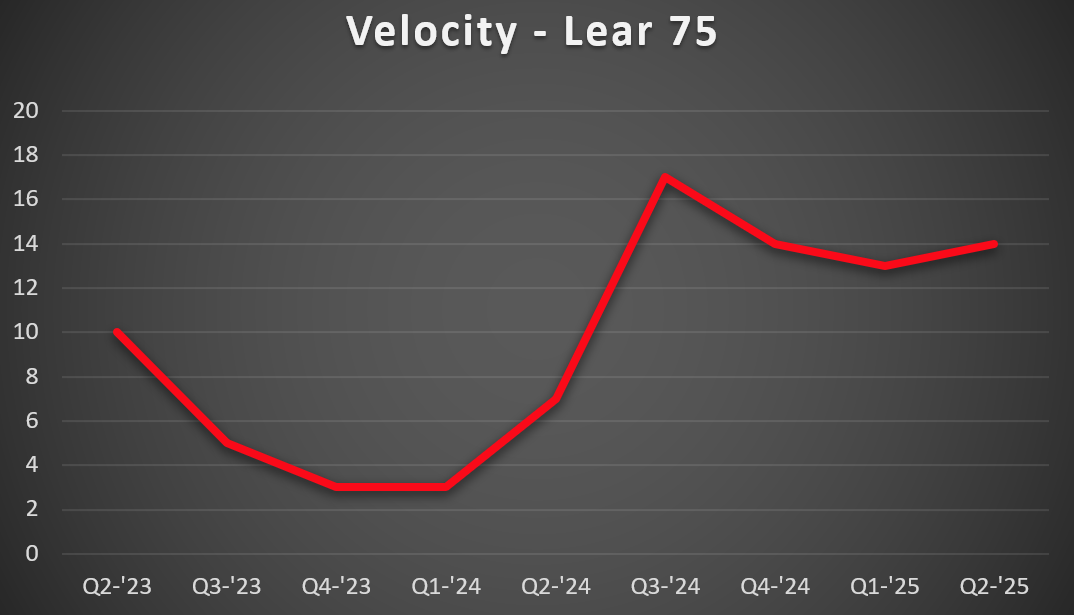

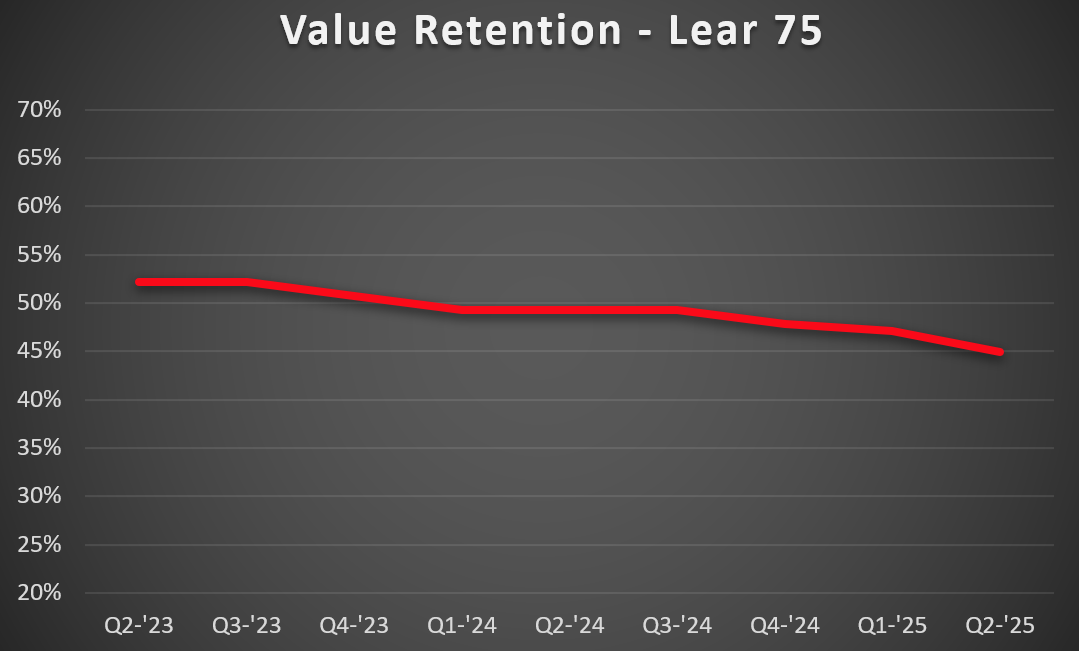

Lear 75 inventory remains near an all-time high, yet transactions remain stable. There are now 12 Lear 75’s for sale, representing nearly 9% of the active fleet. This is the highest level we’ve seen in this market, and nearly double from two years ago. Transactions have held slow but steady, with Q2 producing three sales. There have been 2-3 sales in each of the past five quarters now. Values have taken a pretty good hit, with Q2 showing one of the biggest percentage drops in many years. With lots of options and attractive pricing, now is a great time to buy a Lear 75.

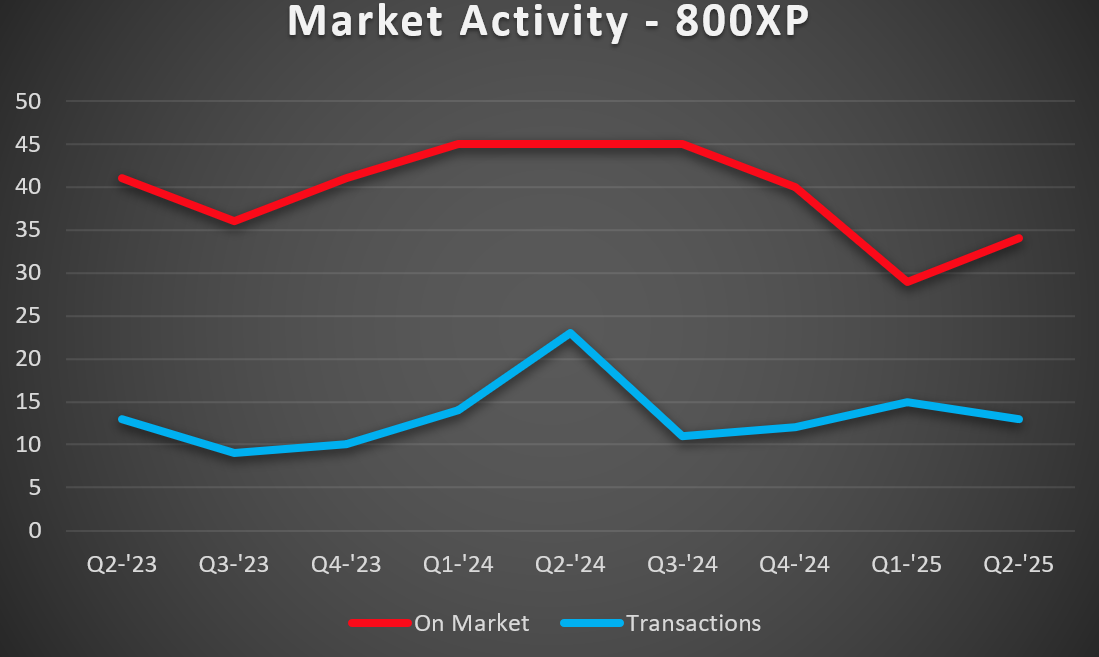

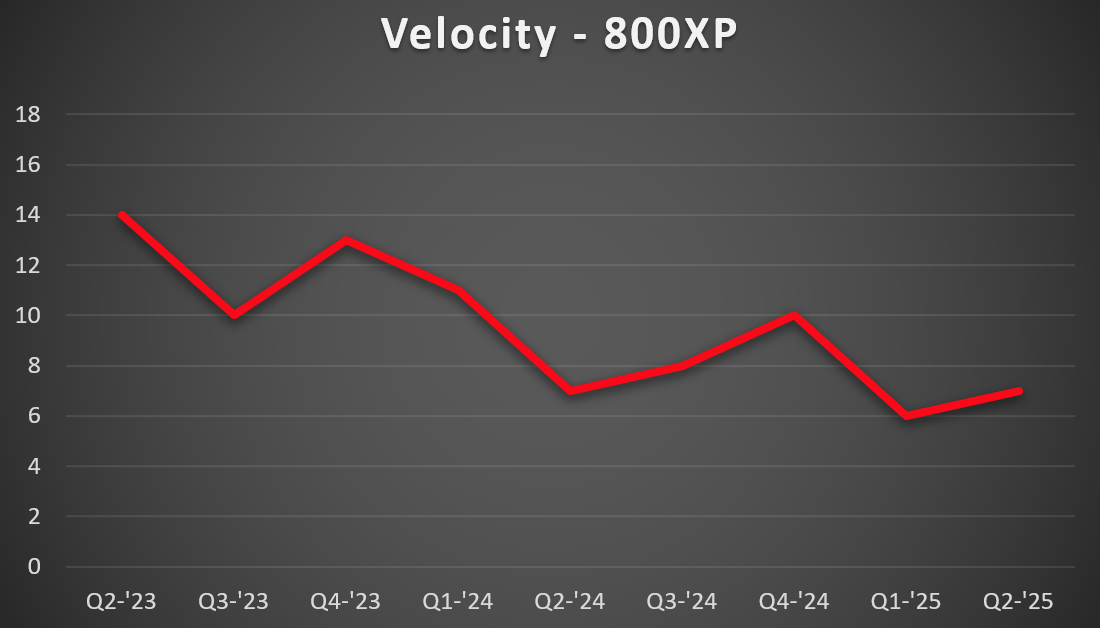

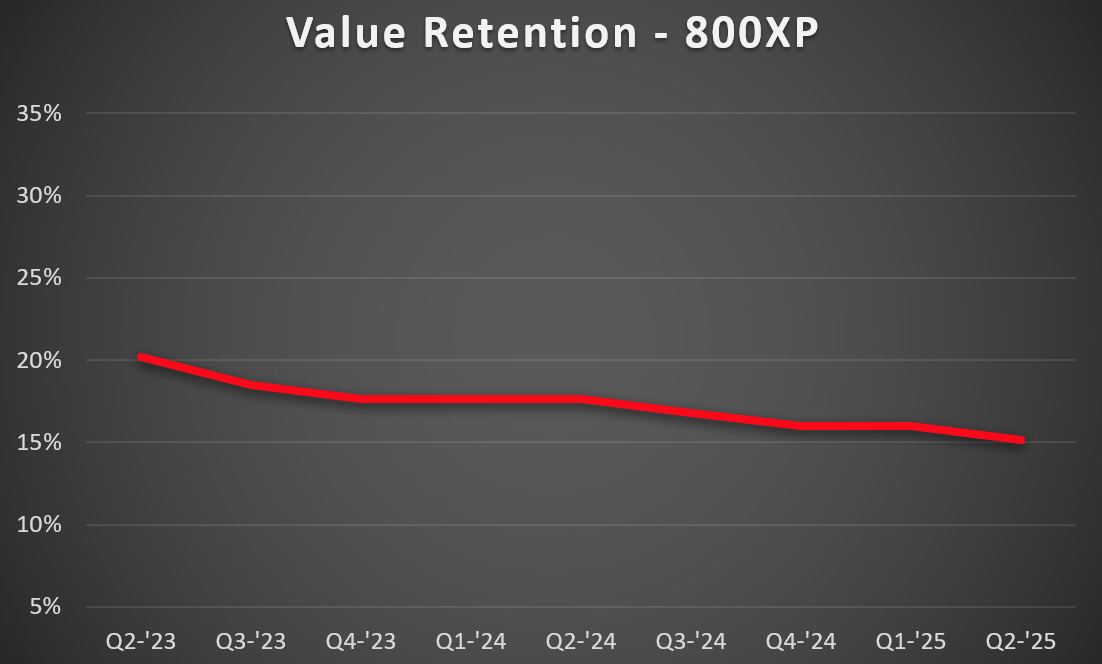

Hawker 800XP inventory has increased but is still well below the two-year average as we head into the third quarter of 2025. There are now 34 listings in this market, up from 29 last quarter but still roughly 10% below the two-year average. Current inventory levels represent just over 9% of the active fleet, compared to more than 12% a year ago. Transactions have cooled off a bit, but deals are still happening. There were 13 sales during Q2, down from 15 last quarter but slightly more active than Q3 and Q4 of 2024. Pricing has taken a small decrease, after remaining stable for six months. With ample supply yet limited quality options, this market remains balanced for buyers and sellers.

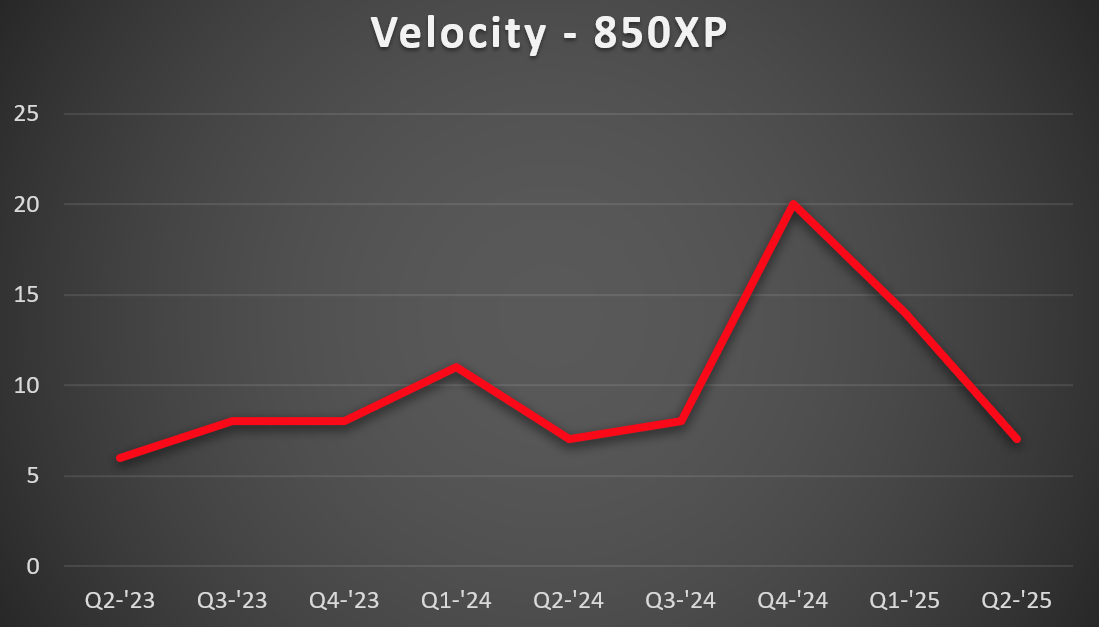

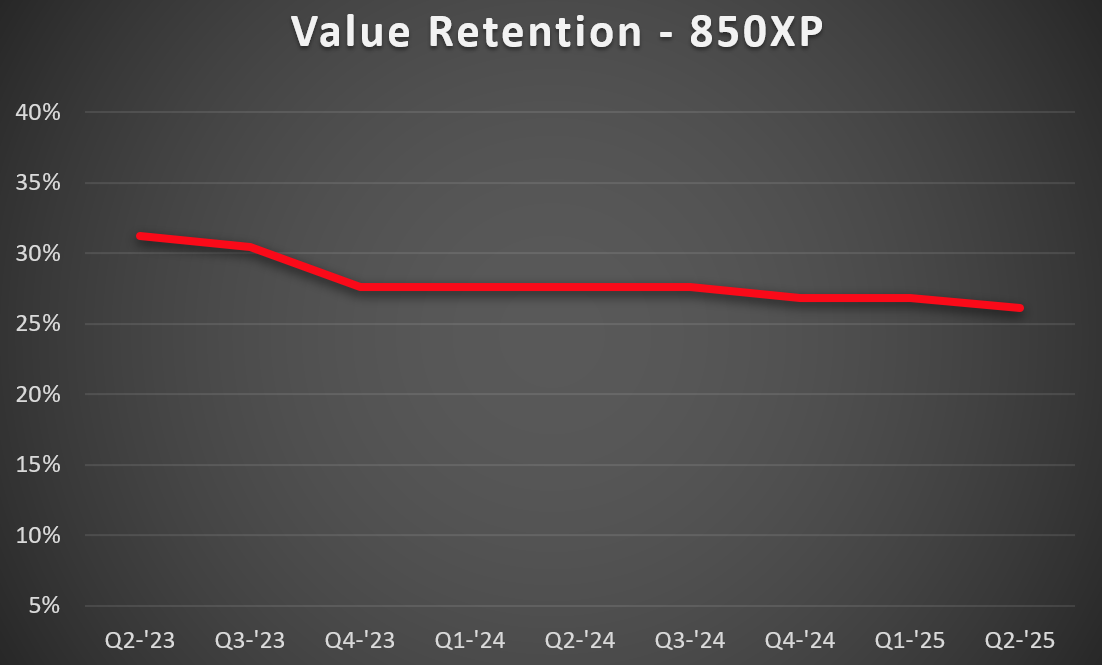

Hawker 850XP inventory has decreased and transactions remain stable. There are now 12 850XP’s listed for sale, down significantly from 16 in Q1. Current levels represent 12% of the active fleet, the lowest level in a year. Five sales took place last quarter, which is right in line with Q1 and much more active than Q2 and Q3 of 24 where four sales took place the entire six-month period. Pricing has dropped some, but this market continues to be resilient to the 900XP pressure. With plenty of options but steady demand, this market remains balanced for buyers and sellers.

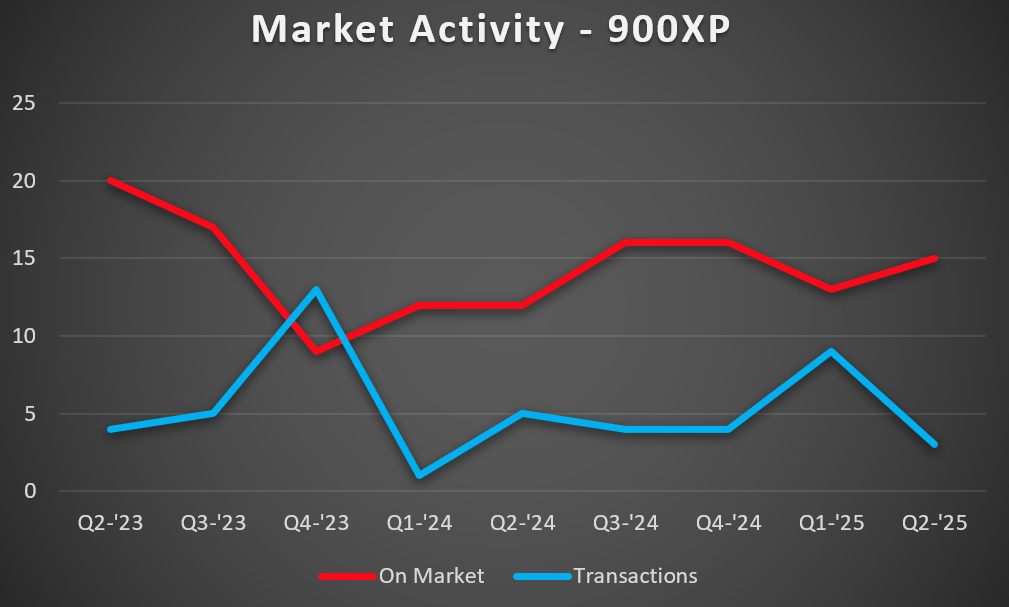

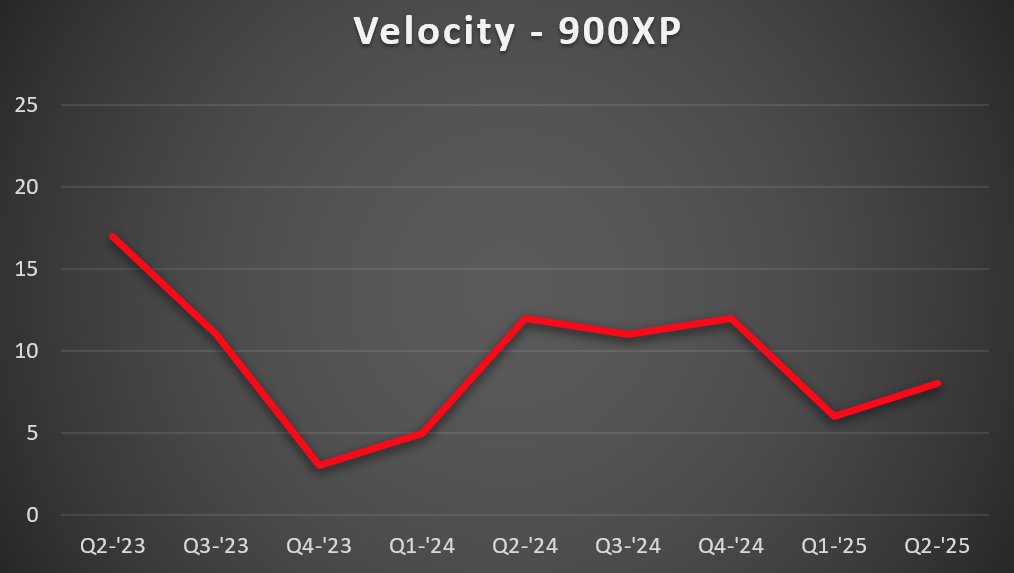

Hawker 900XP inventory has increased and transactions have cooled off. There are currently 15 listings in this market, up from 13 last quarter and an increase of 25% from a year ago. After one of the busiest Q1’s we’ve ever seen in this market, transactions slowed and only three took place during Q2. Pricing continues to fall, as buyers don’t seem to be valuing the performance bump over the 800/850XP’s as much as they used to. Values are down roughly $2mm from 2022 high’s, which makes the 900XP’s one of hardest hit mid-size jets in the past few years. With plenty of selection and what we think are incredibly undervalued aircraft, the 900XP is a great aircraft to buy right now.

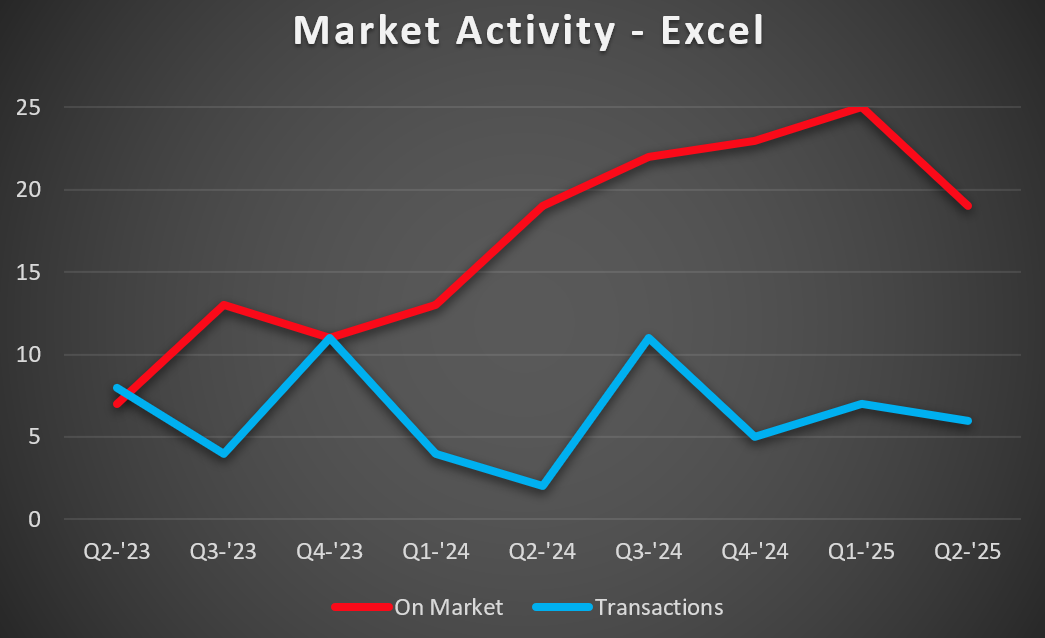

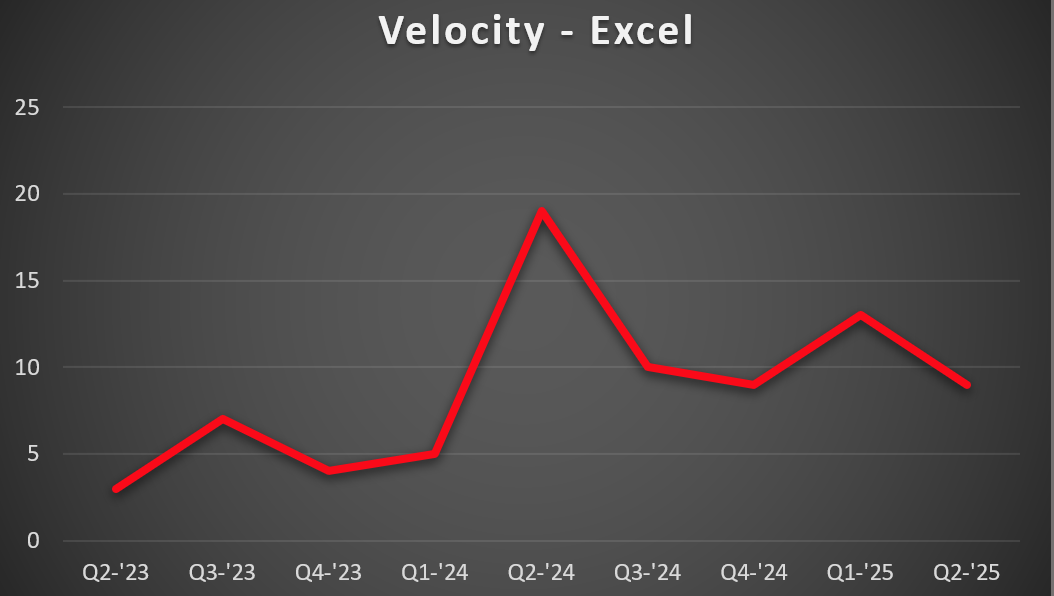

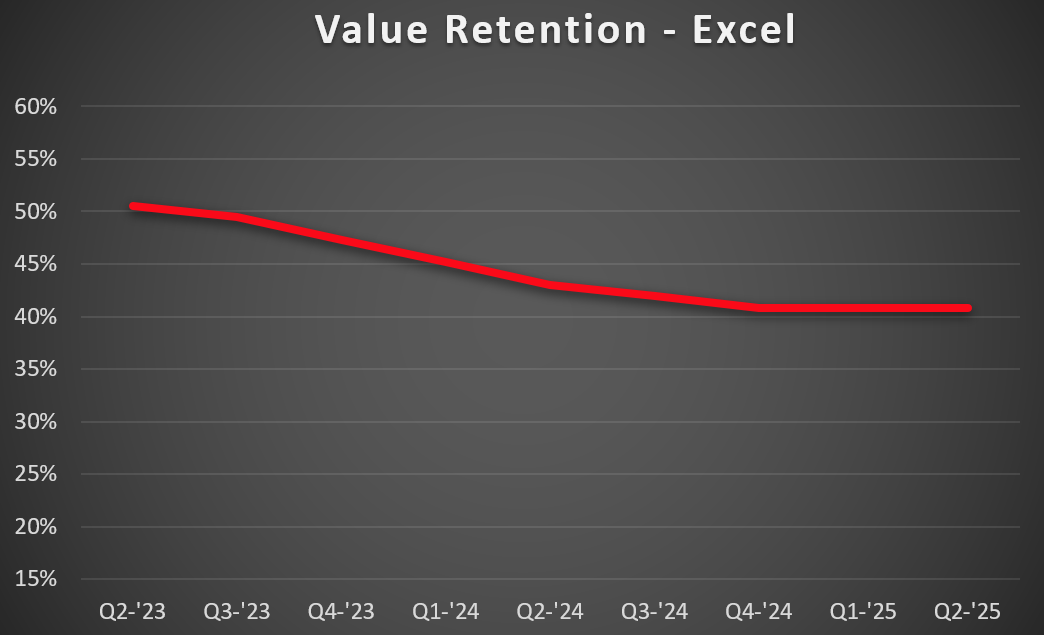

Citation Excel inventory levels have decreased significantly, with the lowest level in a year. The second quarter saw 19 units available for sale, which is six fewer than the previous quarter. Just under 5.5% of the fleet is available for sale. The second quarter saw six sales, which is one fewer than the previous quarter. Pricing is holding steady after dropping throughout 2024. This presents an excellent opportunity for both a buyer and seller, as there is ample inventory with steady pricing.

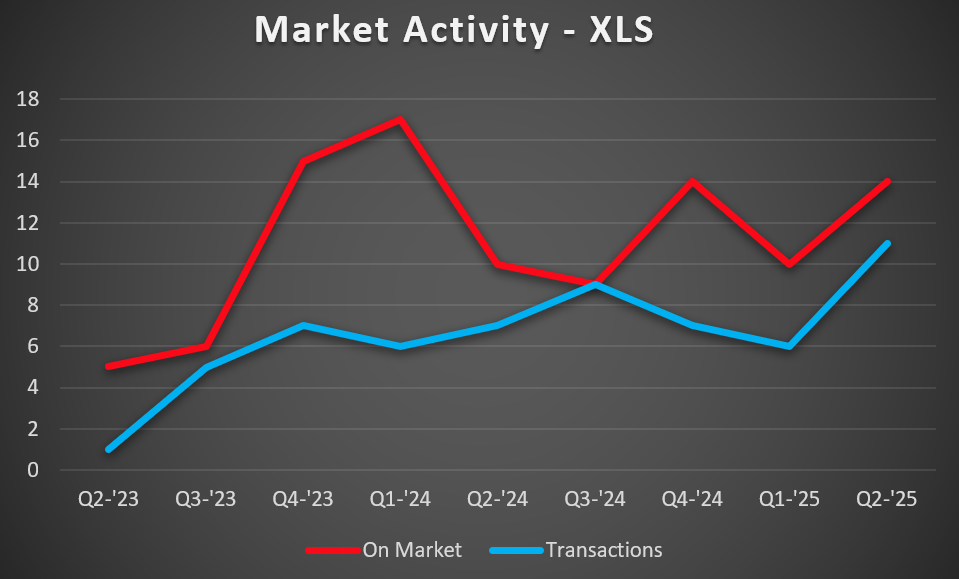

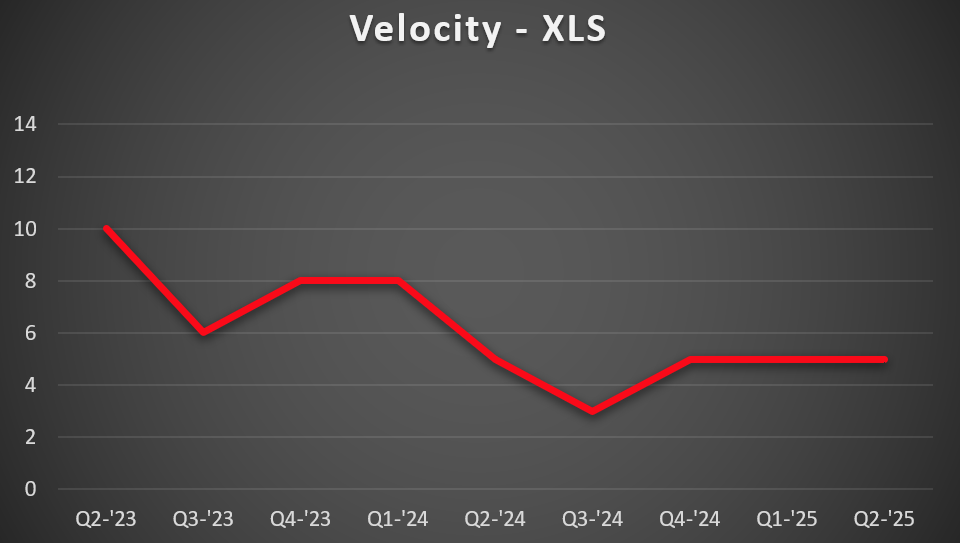

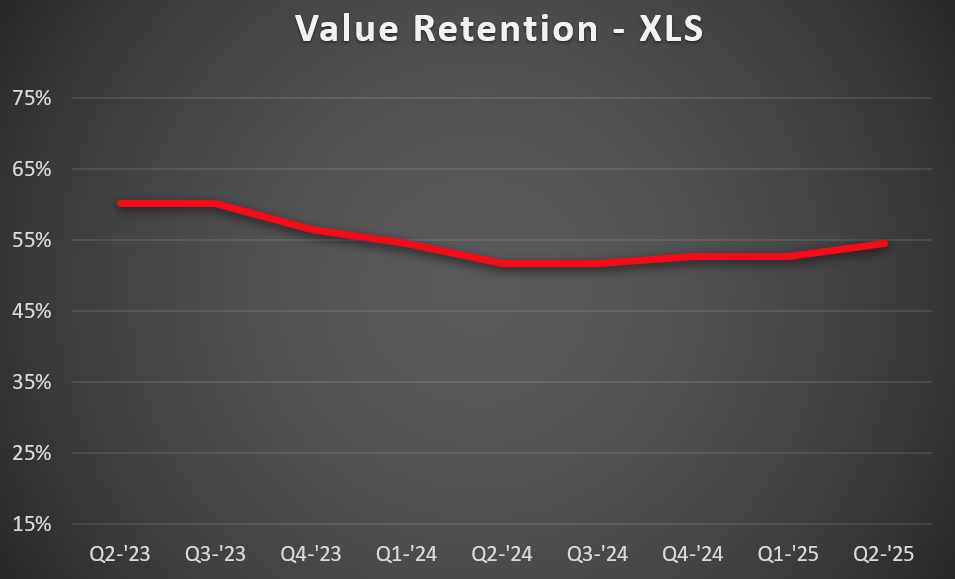

The Citation XLS market continues to be strong. After a significant decrease, inventory jumped to 14 units, which is four more than the previous quarter, and represents just under 4.5% of the active fleet. The second quarter saw 11 sales, which is five more than the previous quarter. Pricing in this market continues to moderately increase. This presents an excellent time for a seller as inventory is decreasing with firmer pricing.

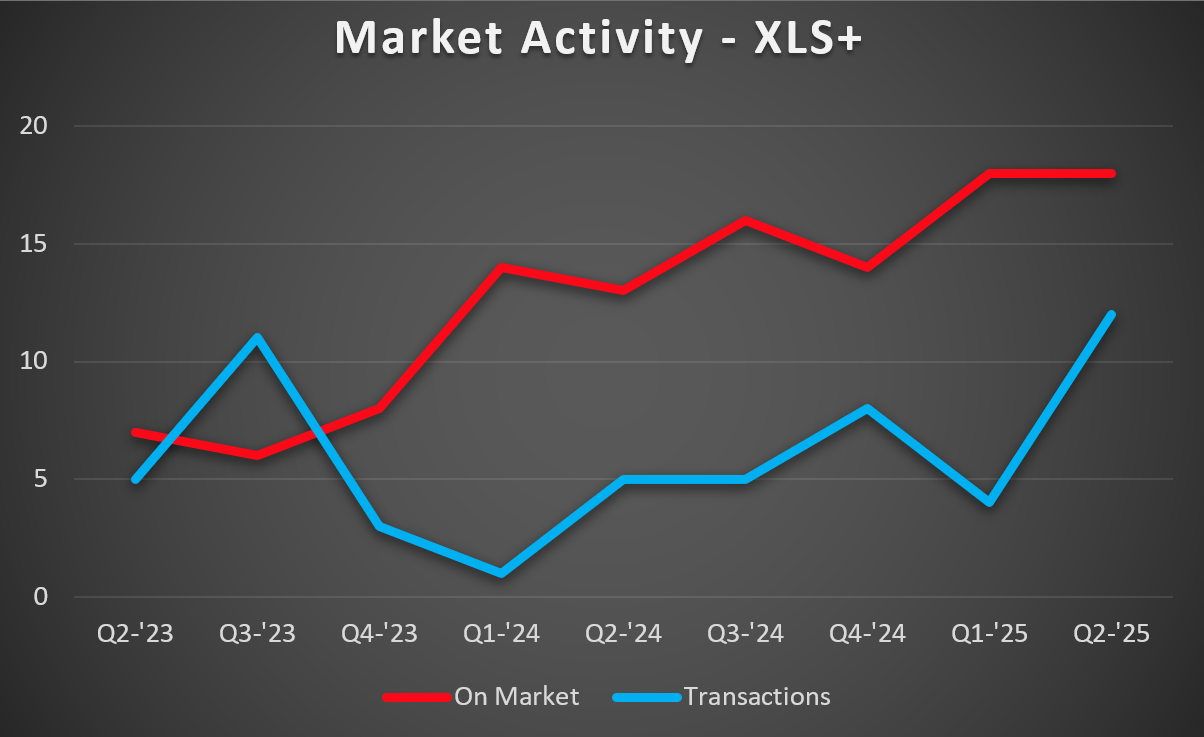

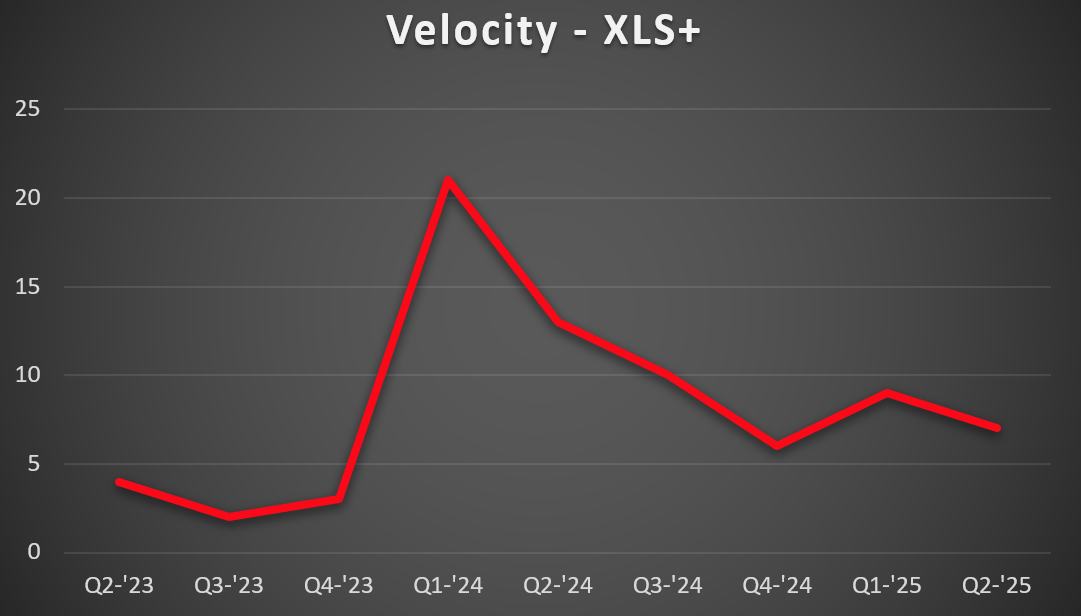

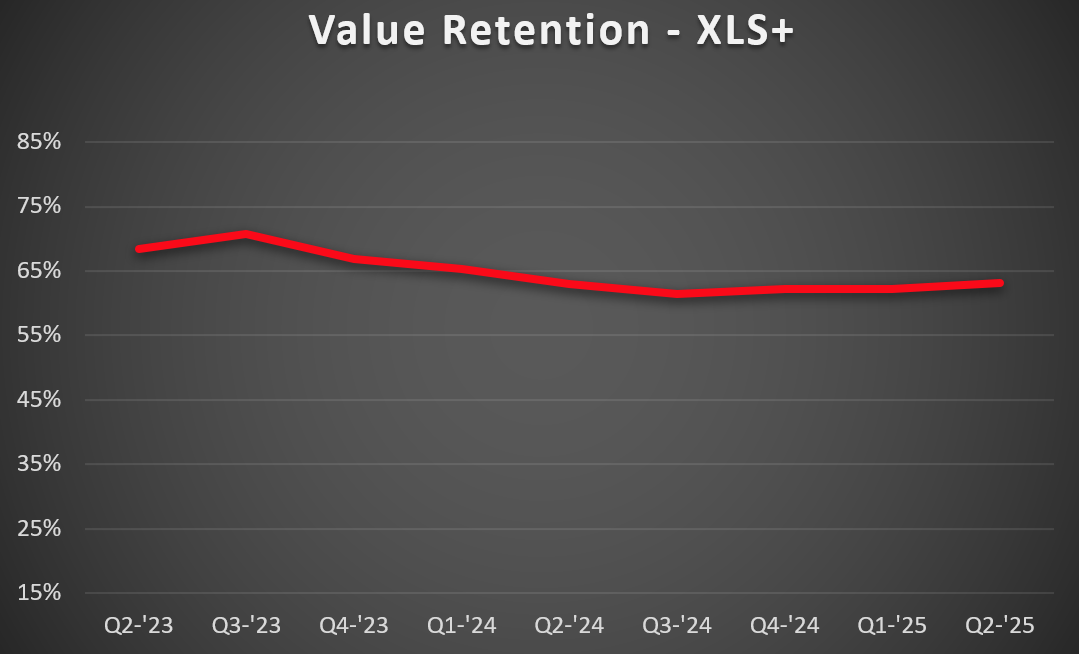

The Citation XLS+ market continues to be active. The second quarter averaged 18 of the Citation XLS+ aircraft for sale, which was the same as the previous quarter, and the most available for sale in five years. Just under 6% of the fleet was on the market in Q2. The second quarter saw 12 sales, which was three times that of the previous quarter, and the most in over three years. Pricing in this market has increased moderately over the previous quarter. This presents a good opportunity for both a buyer and seller, as inventory is plentiful and activity strong.

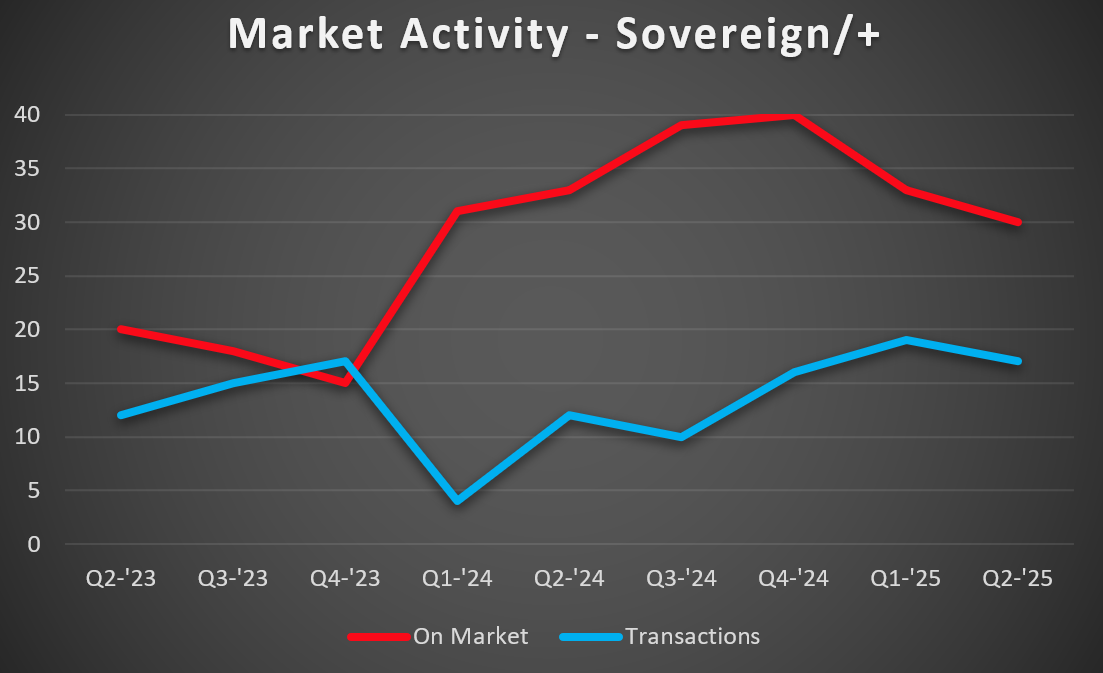

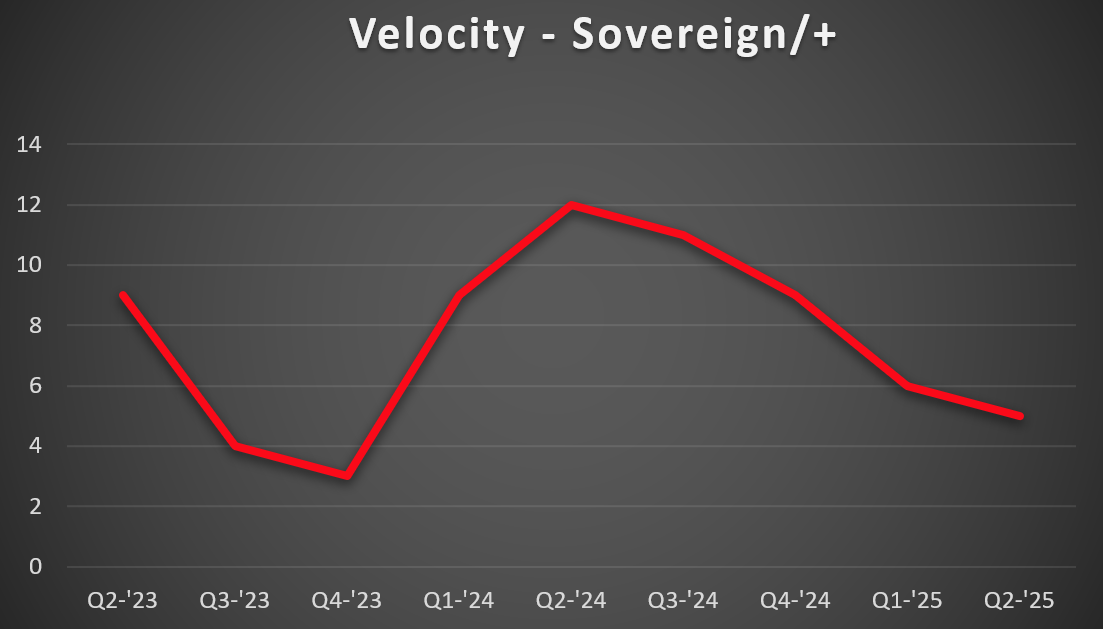

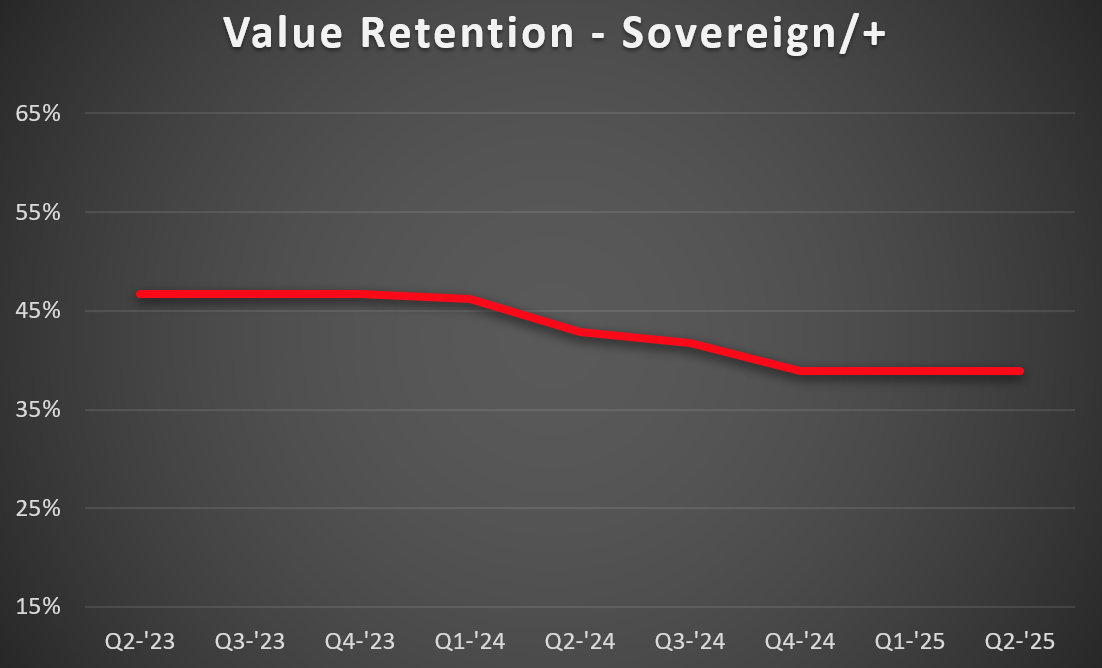

The Citation Sovereign series market continues to be strong. The second quarter averaged 30 Citation Sovereign series aircraft for sale, which is three fewer than the previous quarter. Just under 7% of the fleet was on the market in Q2. The second quarter saw 17 transactions, which was two fewer than the previous quarter, but still a respectable number when compared to other quarters. Pricing has leveled off, after drops throughout 2024. This presents a good opportunity for a seller, as inventory is dropping and activity is still brisk.

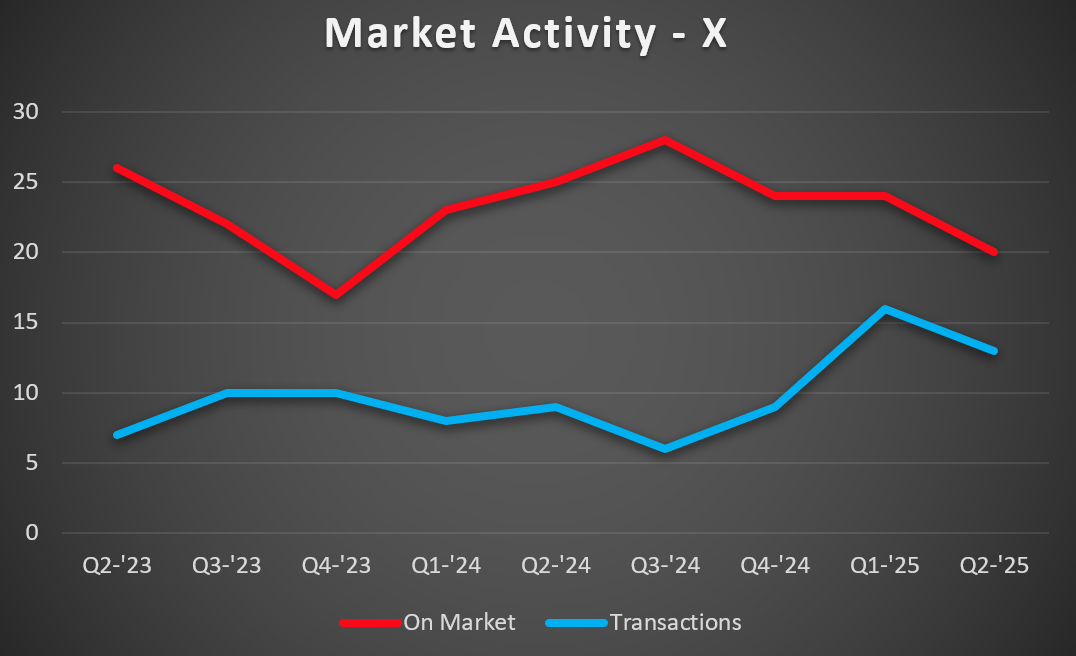

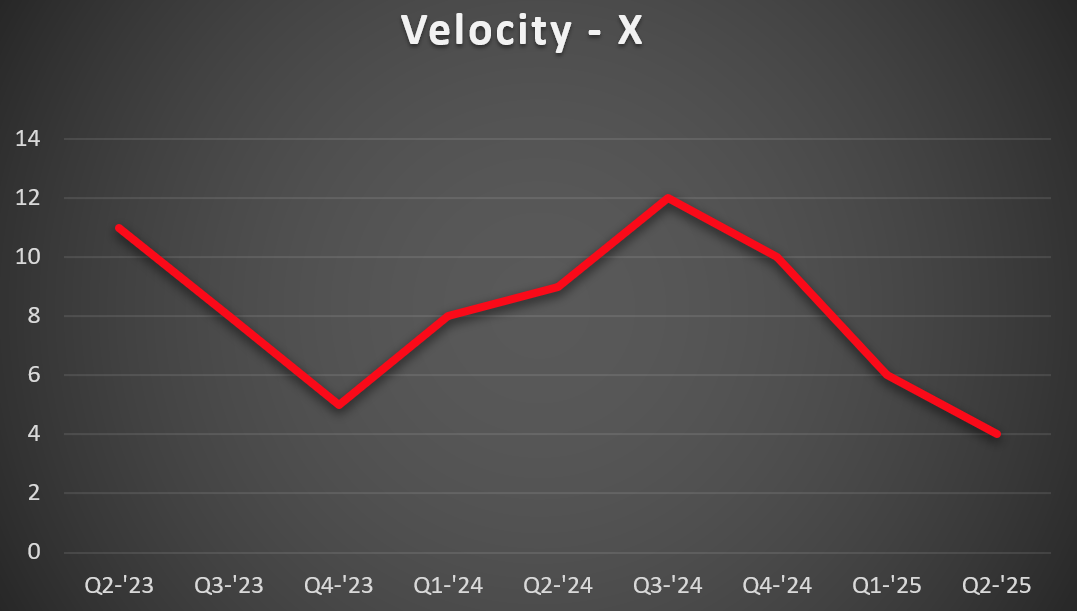

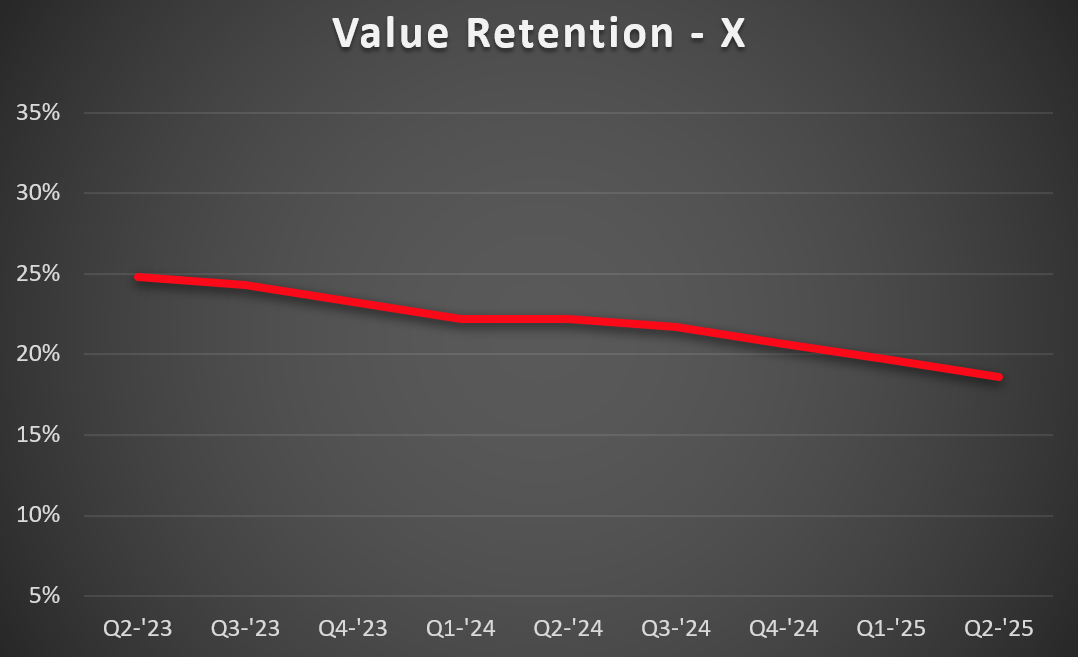

After a busy start to 2025, the Citation X market continues to be very busy. The second quarter saw 13 sales, which was three fewer than the previous quarter, but still the second most quarterly sales in more than three years. There are 20 Citation X aircraft listed for sale, which is four fewer than the previous quarter, and the lowest level in over a year. The second quarter saw just under 7% of the active fleet available for sale. Pricing in this market continues to soften after peaking in 2022. This presents an excellent time for a buyer, as pricing is still trending downward, and there is ample inventory.