Phenom 100, Phenom 300, Citation CJ2, Citation CJ3, Citation CJ4, Citation M2

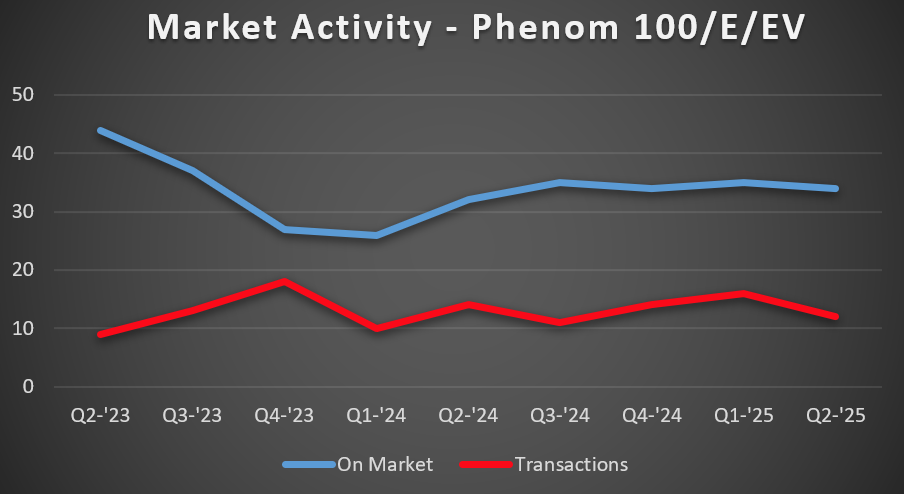

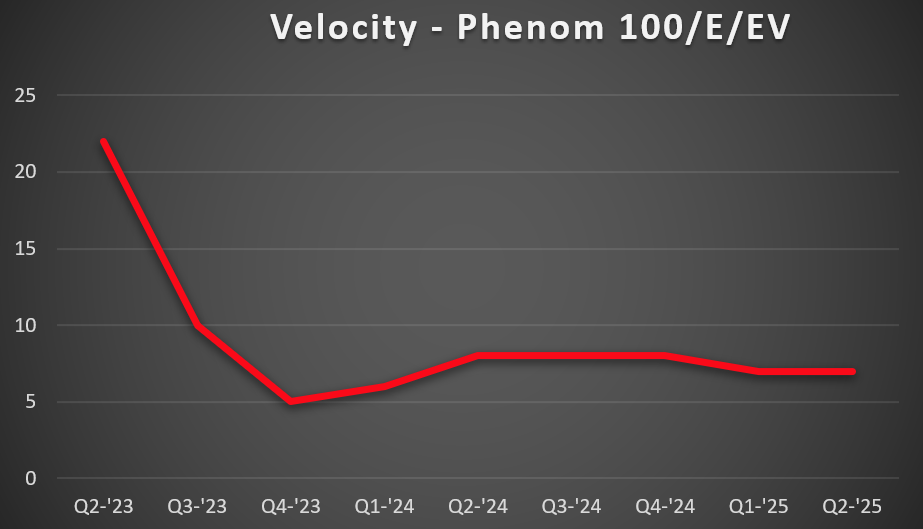

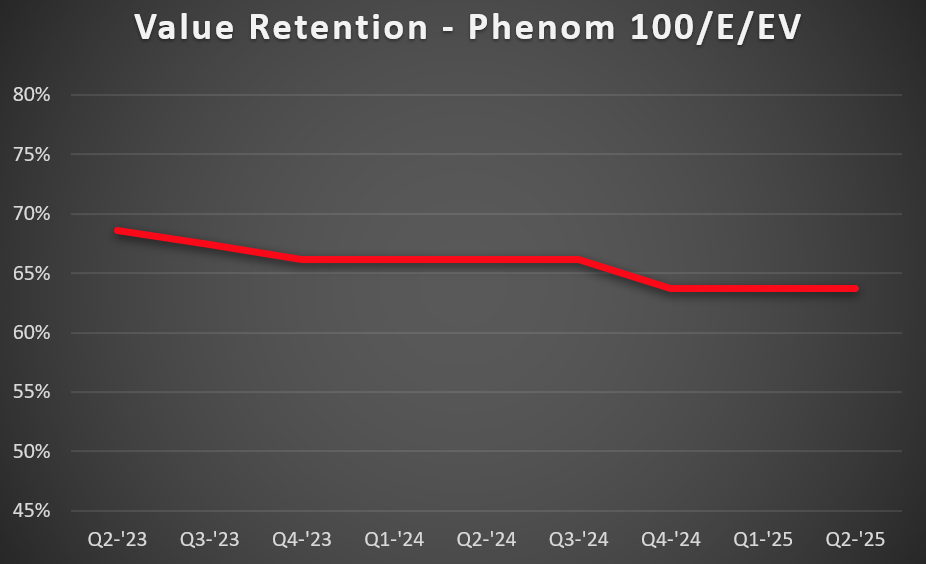

For the third consecutive quarter, pricing in the Phenom 100 market remained steady. The average number of available aircraft decreased by one, while the number of transactions declined slightly from 16 in Q1 2025 to 12 in Q2 2025. Overall, these trends suggest a stable and balanced market with consistent demand and limited fluctuations in supply.

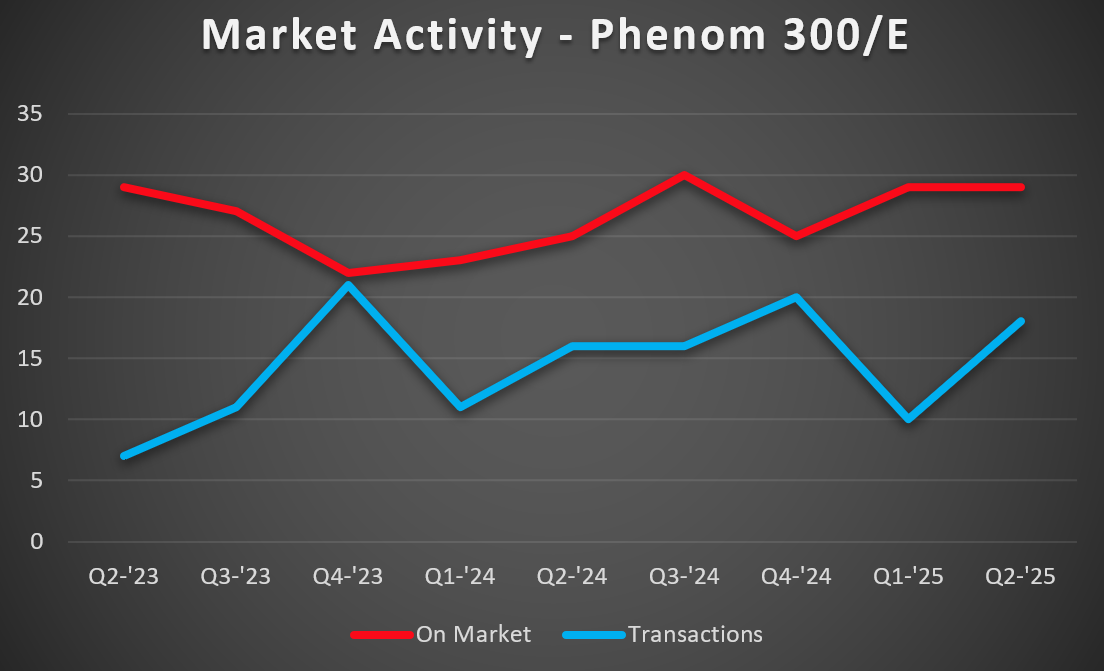

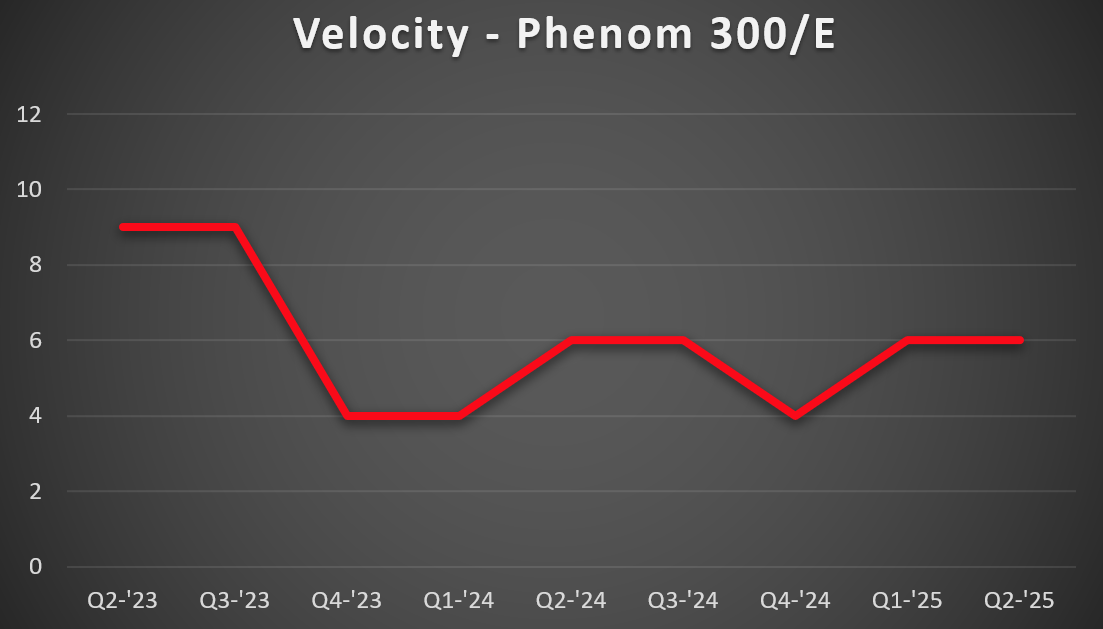

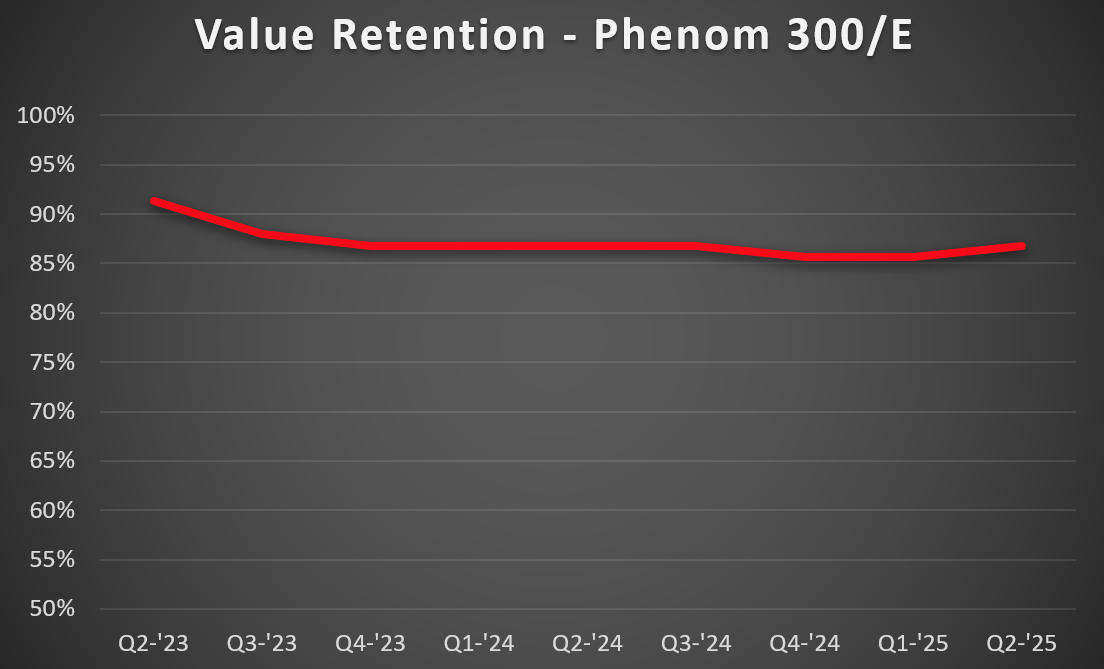

The Phenom 300 retained its value throughout the previous quarter. In fact, the average selling price raised the value by 1%. Average inventory remained the same from Q1 to Q2 while transactions increased by 80%. The uptick in transactions coupled with the slight increase in transaction pricing tilts the scale of this market in favor of the seller at the moment. Now is a great time to sell your Phenom 300/E if you have been on the fence about it.

Values for CJ2s were consistent from Q1 to Q2. Average inventory decreased from 43 to 39. Transactions continue to slide from their recent peak in Q4 2024. However, consistent buying pressure has kept market velocity steady at around eight months. The CJ2 market is still a balanced market for both buyers and sellers. There are plenty of options if you are looking as well as plenty of buyers if you are selling.

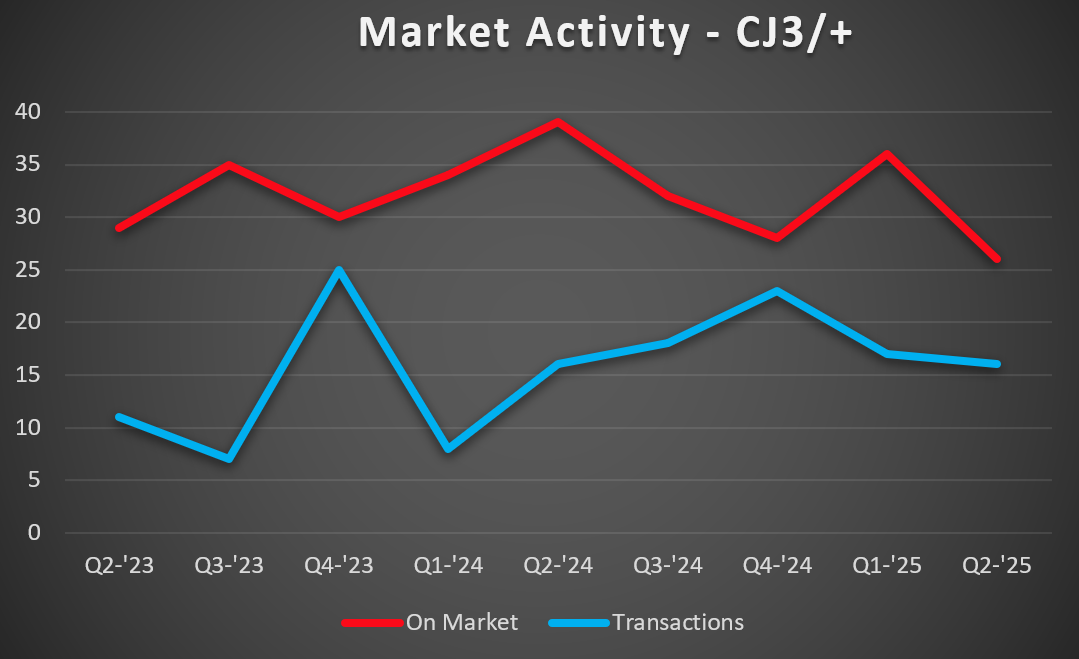

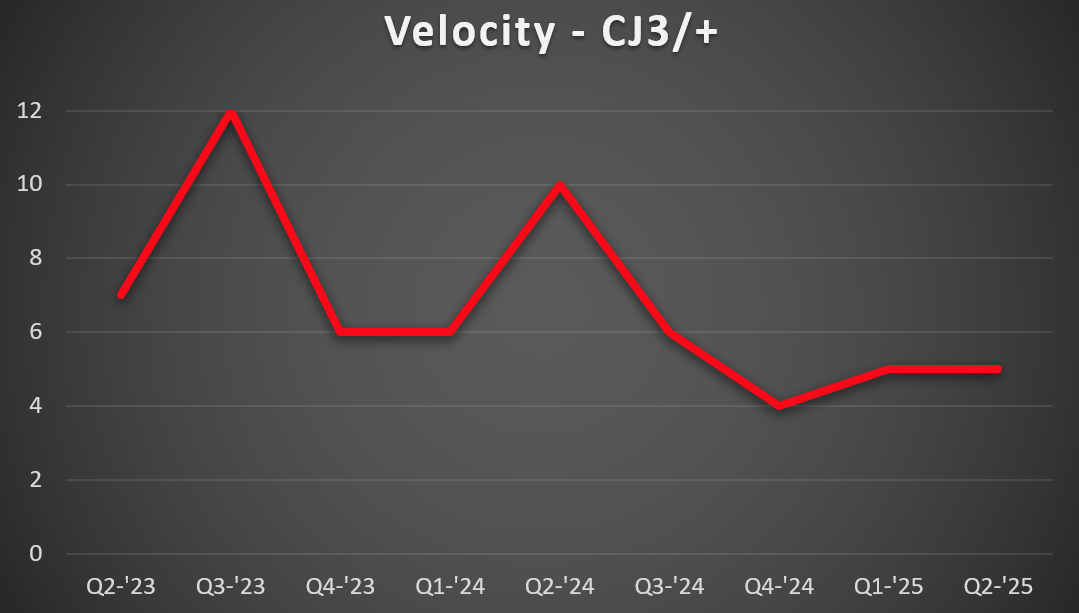

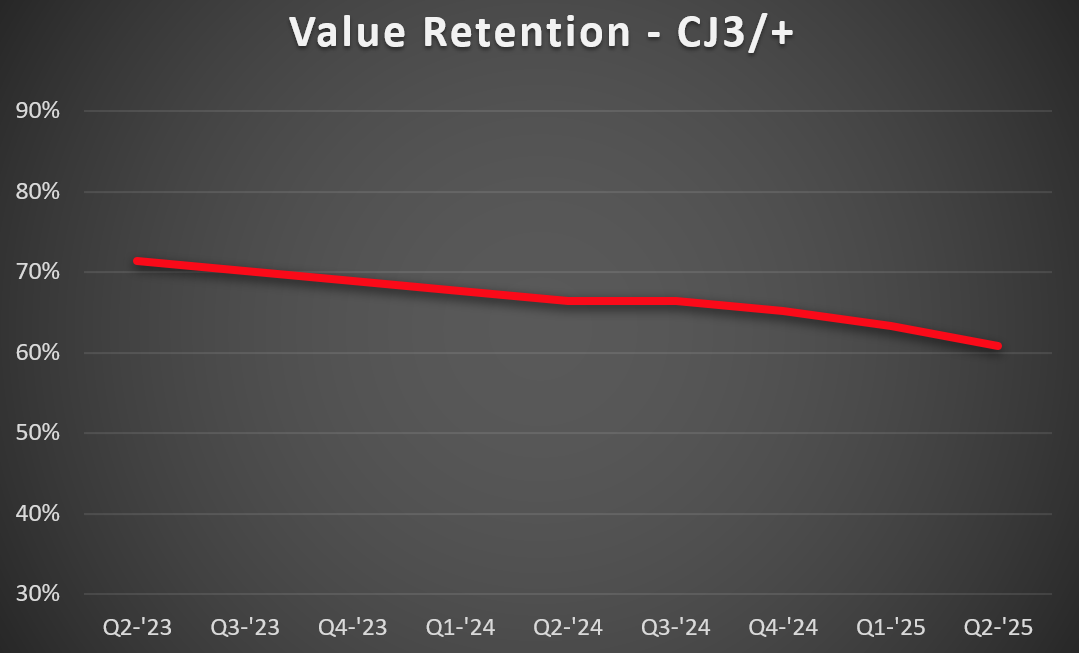

The CJ3s had a substantial bump in inventory for Q1 2025 and the market quickly absorbed those aircraft. Q2’s average amount for sale was lower than in recent quarters at an average of 26 aircraft for sale. The value continued to soften from Q1 to Q2, as did transaction volume. Although numbers across the board are decreasing, there is still consistent buying pressure for the CJ3 market. Demand sustained throughout Q2 but value and inventory slid. This environment continues to support a balanced market, with only a slight lean toward buyers.

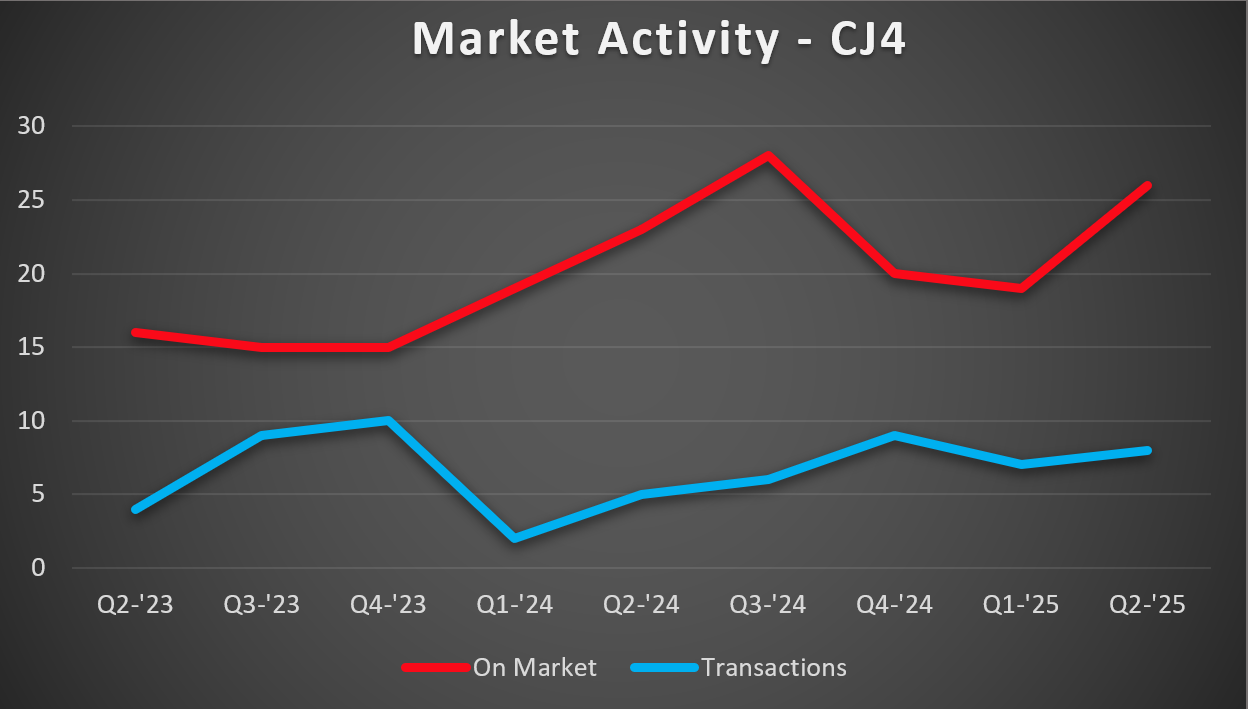

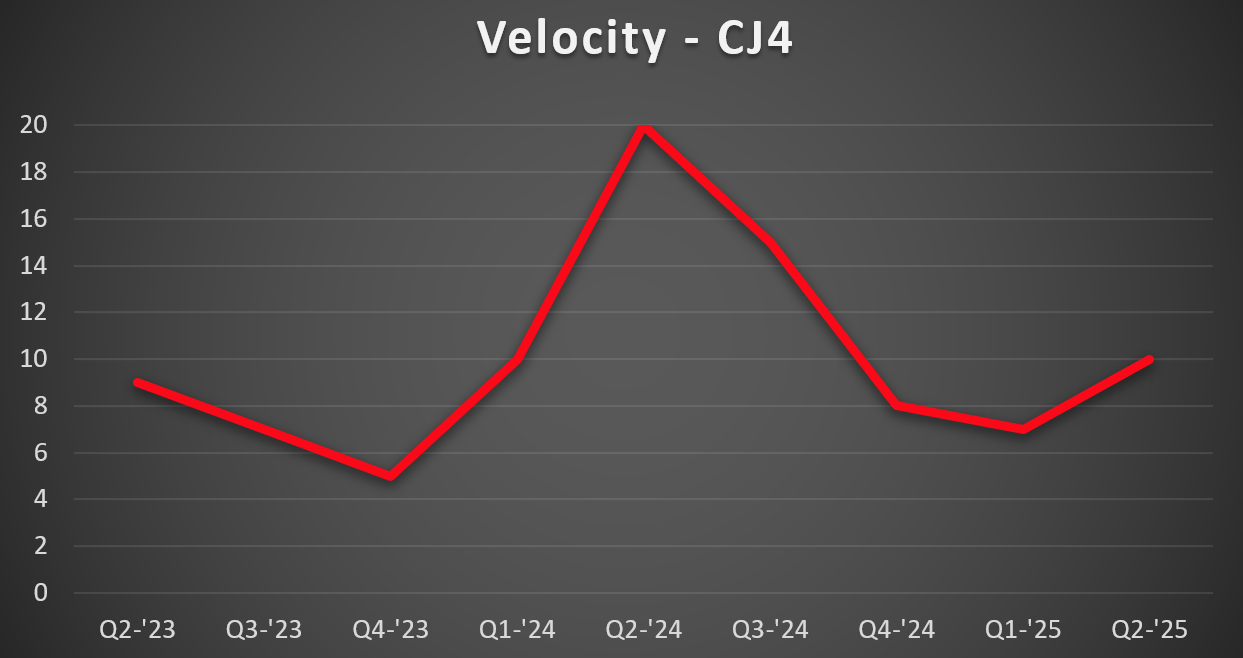

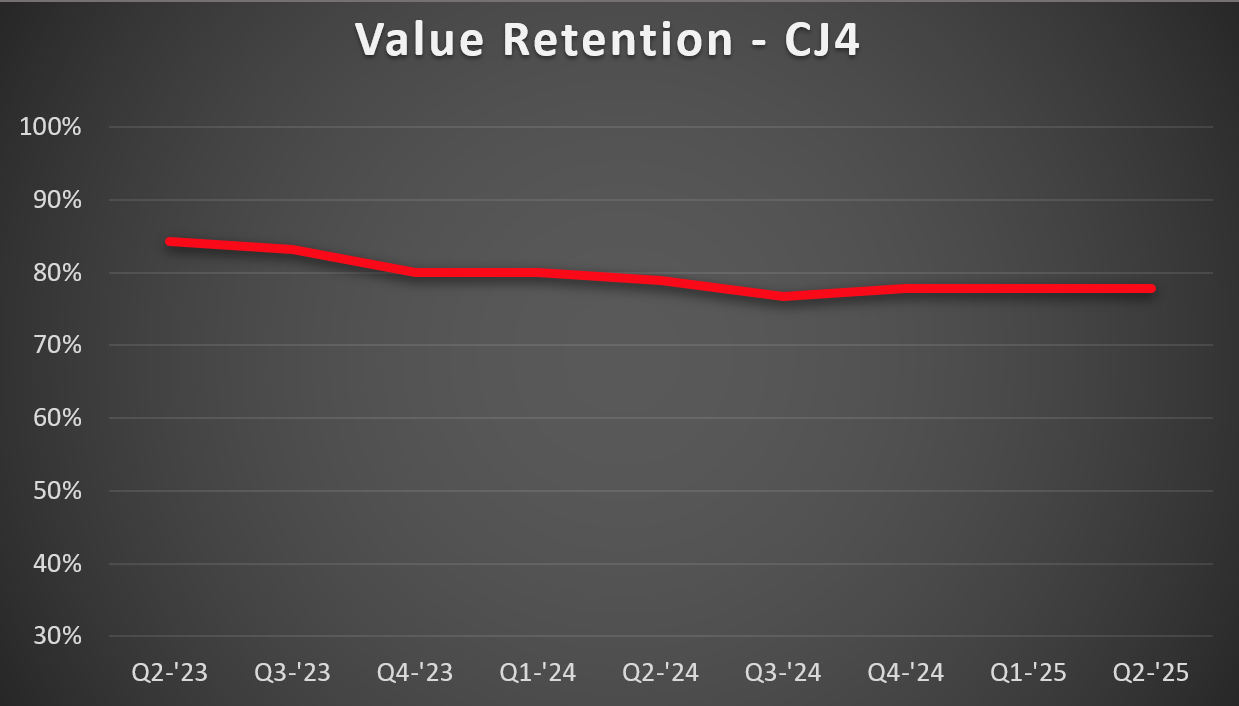

The CJ4 market values remained strong from Q1 to Q2 2025. Transactions picked up slightly, and inventory increased by about 37%. As inventory and velocity continue to rise, so do opportunities for buyers. As more CJ4s that have completed the window SB become available, the dynamics of this market will tend to shift towards buyers. However, the CJ4’s value remaining unchanged for 2 quarters also hints that it is still a good time to bring a CJ4 to market.

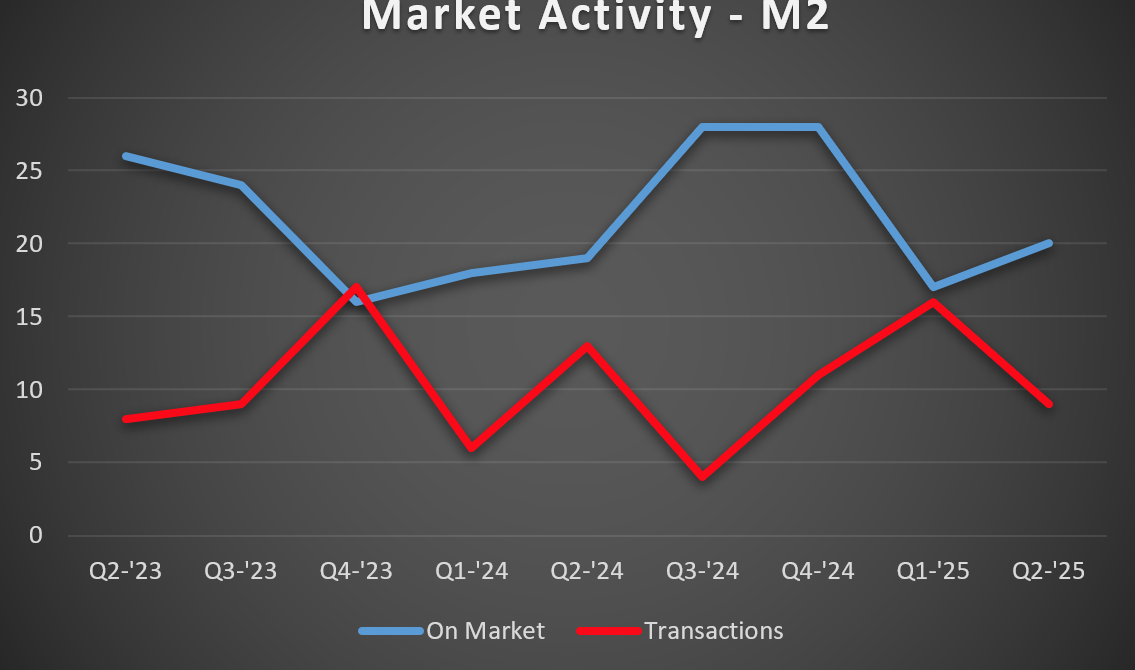

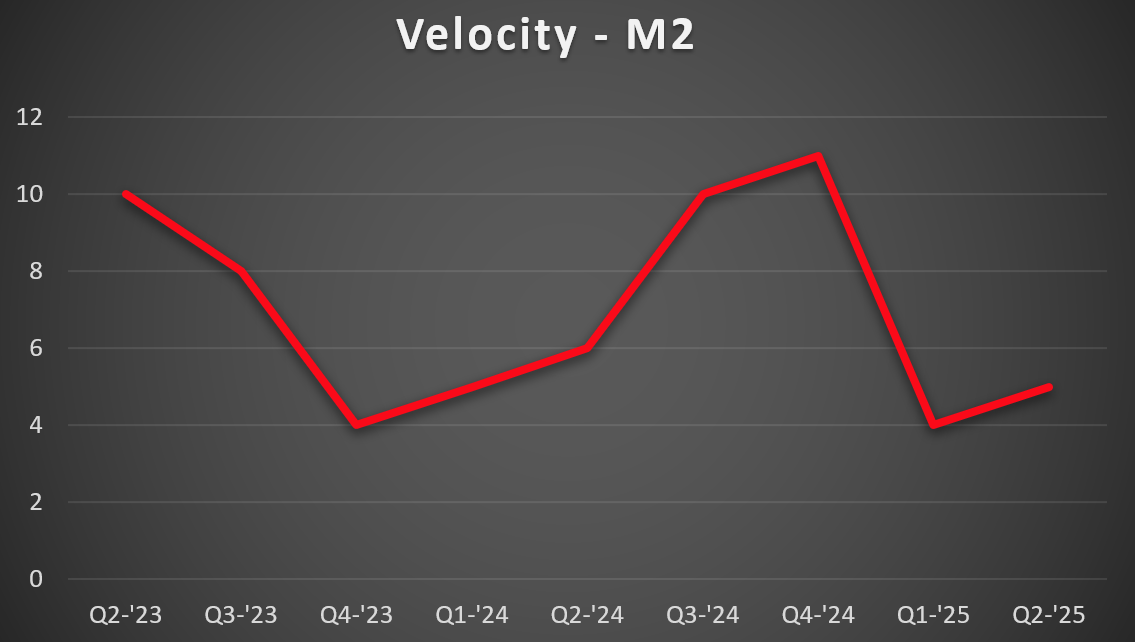

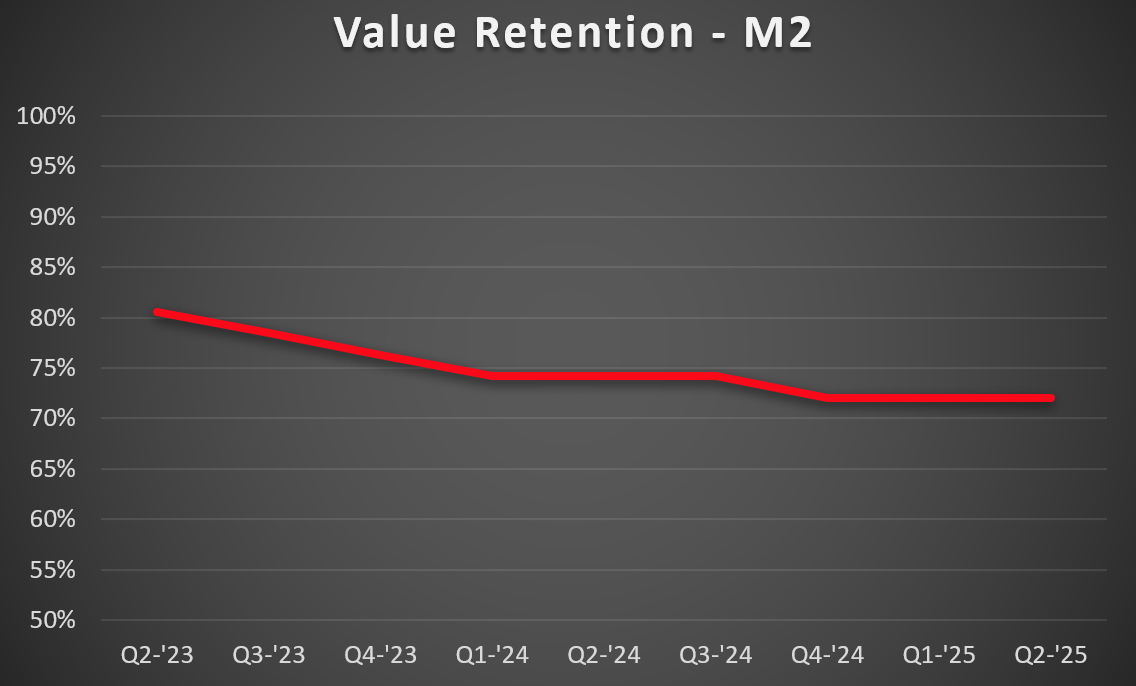

After a few quarters of increasing transactions, the M2 market has experienced a cooldown. Transactions have pulled back in Q2 by 77%. The average number of available M2’s has increased from 17 in Q1 to 20 in Q2. Despite the pullback and increased inventory, pricing remains resilient for Q2. These dynamics can quickly turn the M2 market into a buyers’ market if the current trajectory continues. For now, this still remains a balanced market and a good time to buy or sell an M2.