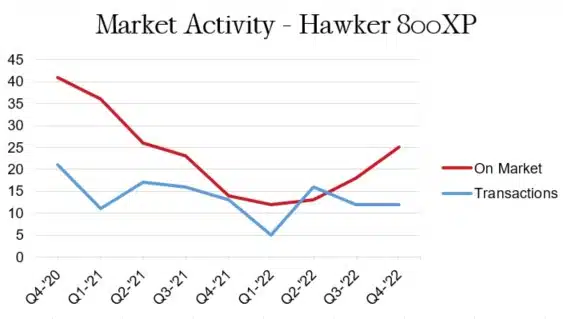

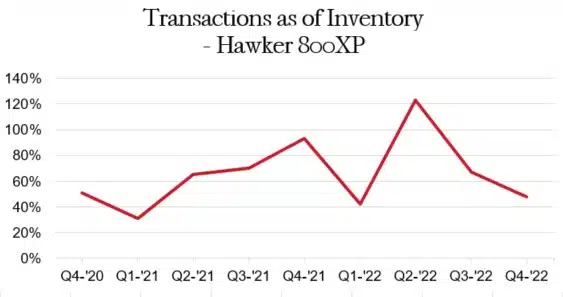

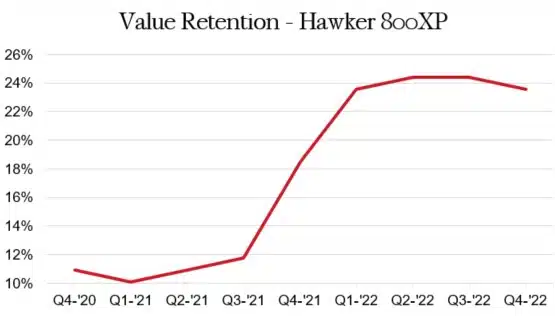

Hawker 800XP inventory is on the rise, but transactions are holding steady as we head into the first quarter of 2023. There are now 25 listings, up from 18 during the third quarter. Inventory is now more than double what it was to start 2022. One thing to consider, even with this recent up-tick in listings, current inventory remains less than half of pre-covid levels. Transactions held their own during Q4, with another 12 sales taking place, similar to Q3. The increase in inventory did affect pricing, with the first decrease in values taking place since things started climbing Q1 of 2021. With inventory on the rise, yet plenty of demand, this market remains balanced for buyers and sellers.

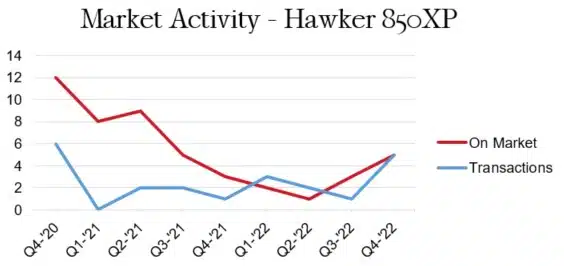

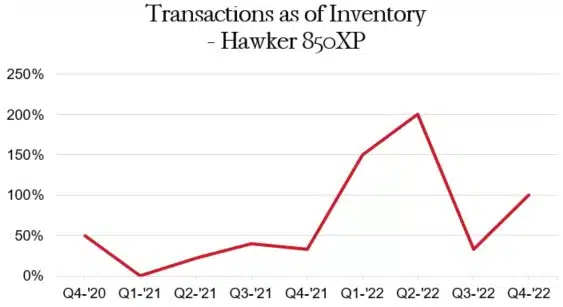

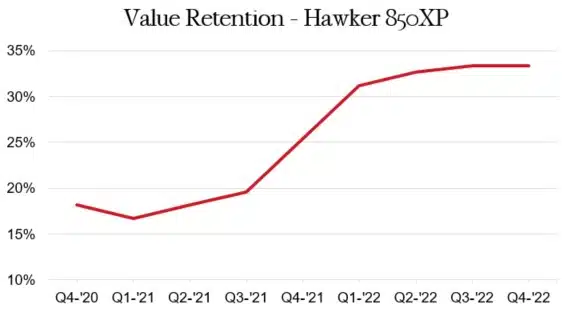

An inventory increase in the 850XP market has re-engaged buyers, with Q4 producing more sales than any quarter in the past two years. There are now five listings, up from just one six months ago. Current inventory levels represent 5% of the active fleet. After only one sale took place during Q3, things rebounded nicely and Q4 produced five transactions. This is the most active quarter we’ve seen since Q4 of 2020 when six sales occurred. Pricing has remained strong, with values still roughly double what they were during Q1 of 2021. With demand and pricing still strong, it is still a great time to sell your 850XP.

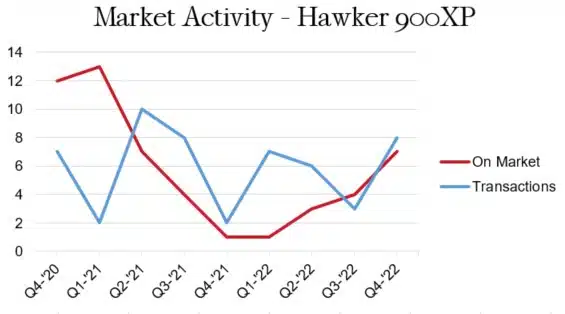

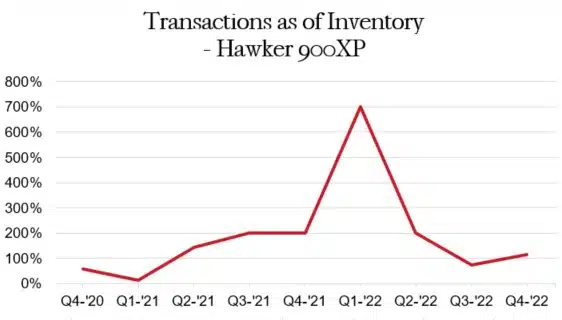

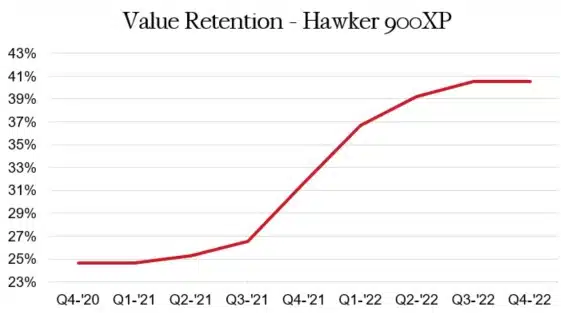

Hawker 900XP inventory saw an increase in inventory during the fourth quarter, but demand and pricing remains strong. There are now seven listings in this market, up from just four during Q3. This market found itself depleted of quality, low time airplanes which affected Q3 transactions. With a few more options hitting the market during Q4, buyers were able to find some desirable airplanes and put eight deals together, more than any quarter in the past year. Pricing has remained strong, with values holding steady at peak levels. With continued demand and strong pricing, the 900XP market remains favorable for sellers.