Hawker 800XP, Hawker 850XP, Hawker 900XP

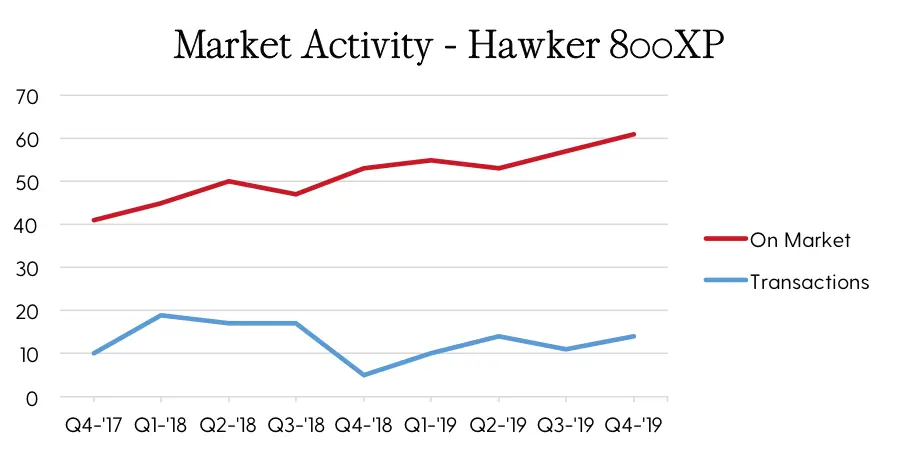

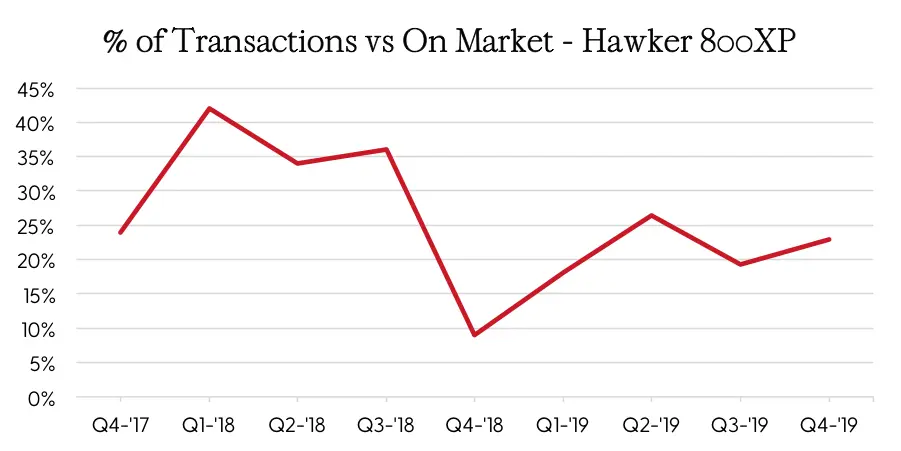

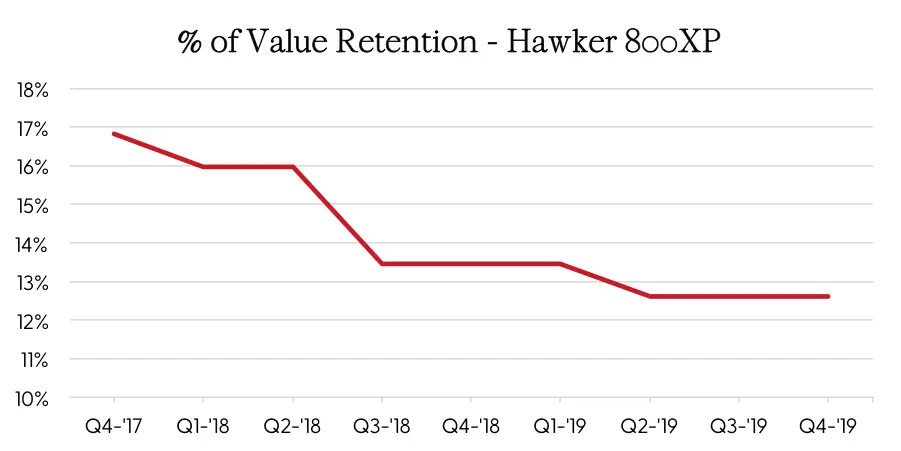

Activity, as well as inventory, has increased in the 800XP market as we head into the first quarter of 2020. 800XP inventory has reached 61 listings, the highest level we’ve seen in more than two years. This represents over 15% of the active fleet. Activity, however, did pick up in the fourth quarter of 2019, with 14 transactions taking place. Sales in 2019 totaled 49, down comparatively from 58 sold in 2018. Pricing has now held steady for three consecutive quarters. With current inventory levels providing plenty of options, this market remains favorable to buyers.

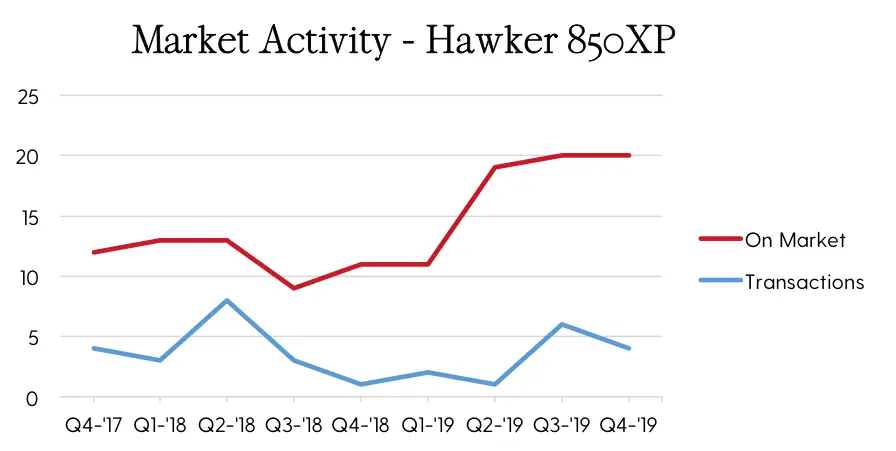

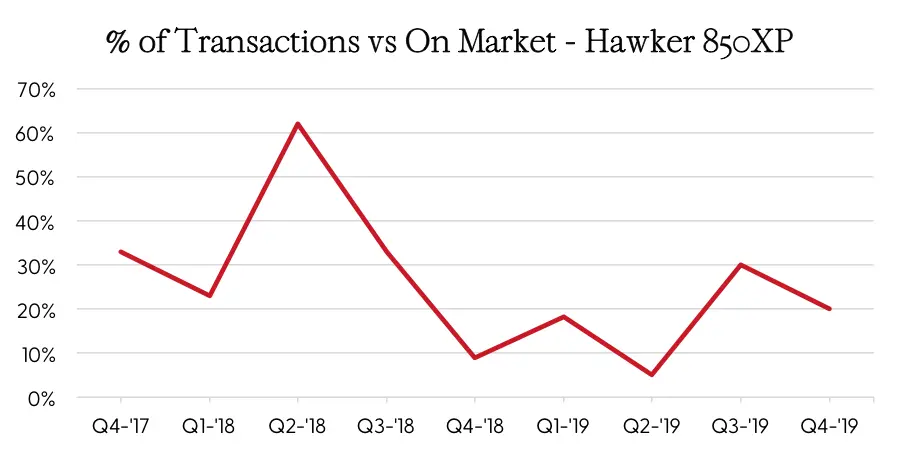

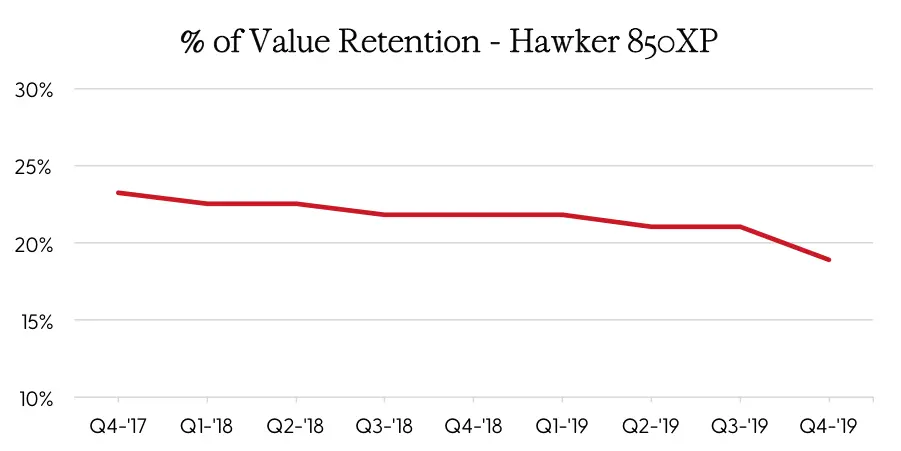

Inventory levels remain high in the 850XP market, with pricing declining sharply in the fourth quarter of 2019. Just like the previous quarter, inventory remains at 20 listings. This represents over 20% of the active fleet. After only three sales during the entire first half of 2019, ten transactions occurred in the second, with four of those taking place during Q4. 2019’s total of 13 transactions fell short of 2018’s 15 closings. Pricing dropped off sharply in the fourth quarter, after holding relatively steady the past two years. With elevated inventory and attractive pricing, this market remains favorable for buyers.

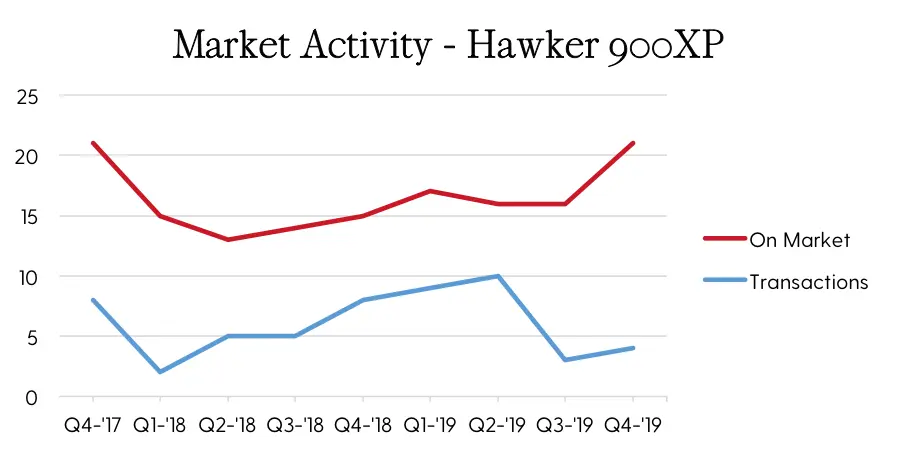

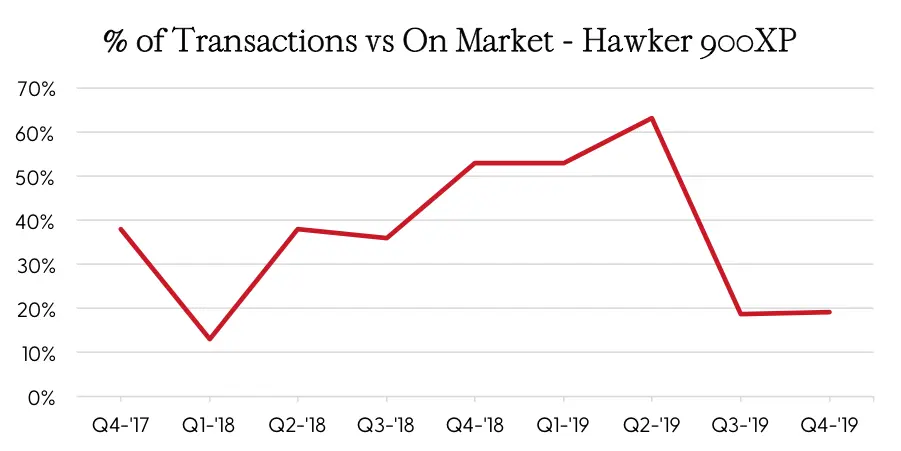

Hawker 900XP inventory rose sharply in the fourth quarter, with pricing holding steady as we head into the first quarter of 2020. Inventory jumped over 30% during the fourth quarter, now at 21 listings. This represents nearly 12% of the active fleet. After a busy first half of 2019, transactions slowed and remained that way throughout the fourth quarter. There were just four sales during Q4 2019, making only seven transactions during the second half of 2019. Thanks to the first two quarters, 2019’s total sales of 26 exceeded 2018 numbers. Even with an increase in inventory, pricing has held steady for four consecutive quarters. With inventory creeping up, yet pricing holding firm, this market remains balanced for both buyer and sellers.