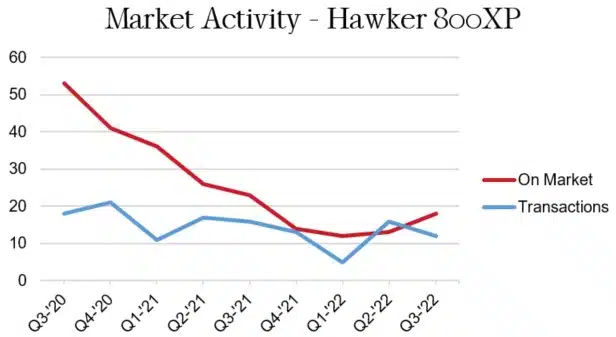

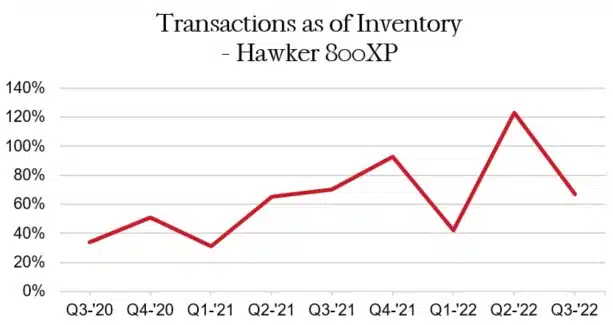

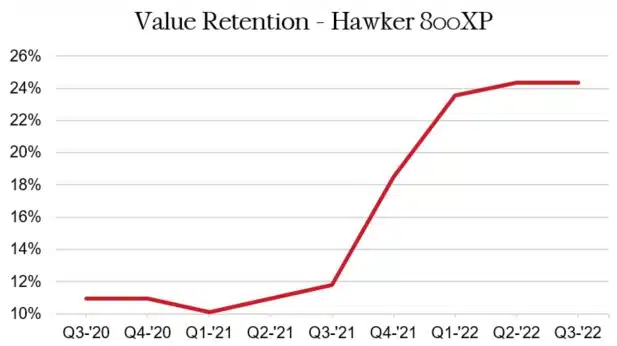

Inventory is on the rise, but pricing is still holding strong in the 800XP market. There are now 18 listings, up from 13 last quarter. Even with this increase of nearly 40%, we are still lower than Q3 2021’s 23 listings. Looking back to Q2 of 2020, there were over 60 800XP’s listed for sale, which gives perspective on how low inventory remains. Transactions cooled off a bit in Q3 with 12 listings, down from 16 last quarter. With a few more options to choose from, yet pricing holding strong, this market is considered balanced for buyers and sellers.

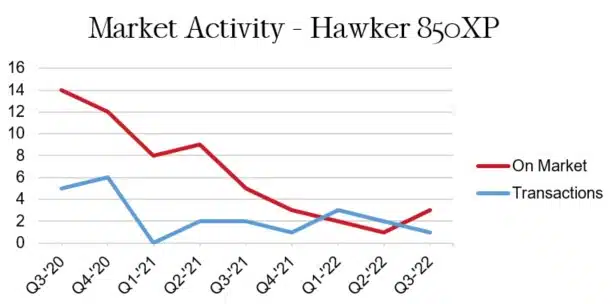

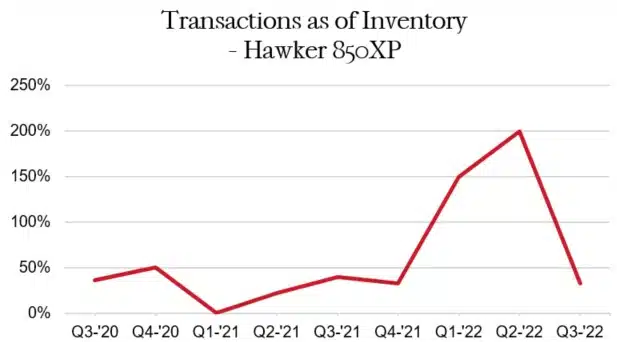

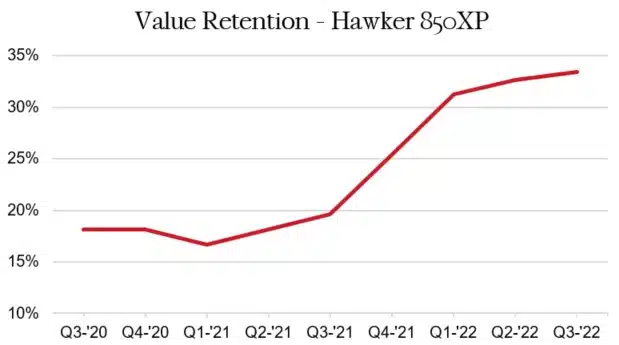

A few more options have trickled in to the 850XP market, but inventory remains historically low. There are now three aircraft for sale, up from just one listing last quarter. Inventory has remained depleted in this market for a year now, bouncing between one and three listings. Looking back to 2020, there were an average of 14 aircraft for sale. This low inventory continues to have its effect on transactions, with only one sale taking place during Q3. Pricing continues to rise, but at a slower pace than the past few quarters. With a limited amount of inventory, and prices that continue to rise, now is a great time to sell your 850XP.

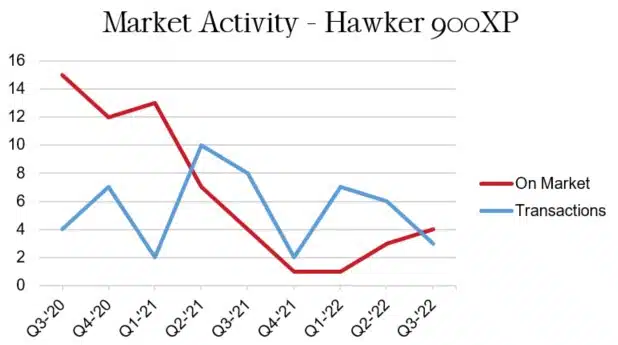

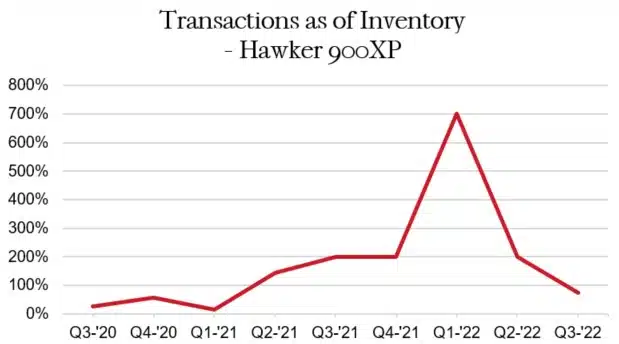

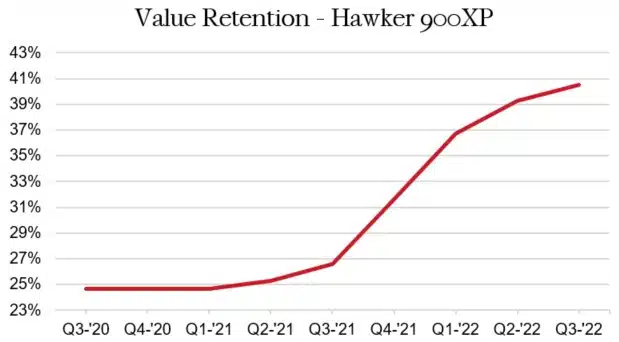

900XP inventory remains low and prices continue to climb as we head into the fourth quarter of 2022. There are now four listings, up one unit from our last report. This is the highest level this year, but we are still well below 2020 and 2021’s average of 12 listings. The lack of quality domestic options caused transactions to slow last quarter, but this market still managed to squeak out a few sales. Pricing jumped another 3% in the past three months, with values now up 64% since bottoming out in 2020. With buyers still competing for available aircraft, and prices as strong as ever, it is still a great time to sell your 900XP.