Citation Excel, Citation XLS, Citation XLS+, Citation Sovereign, Citation Sovereign+, Citation X

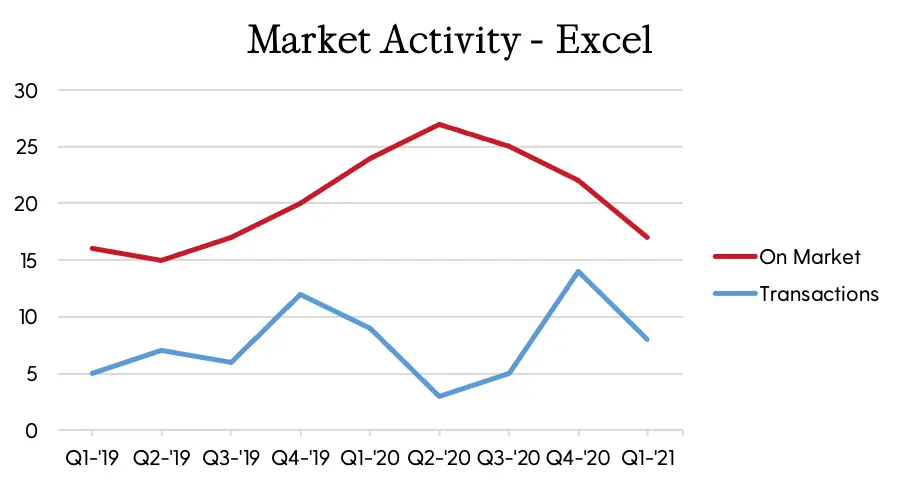

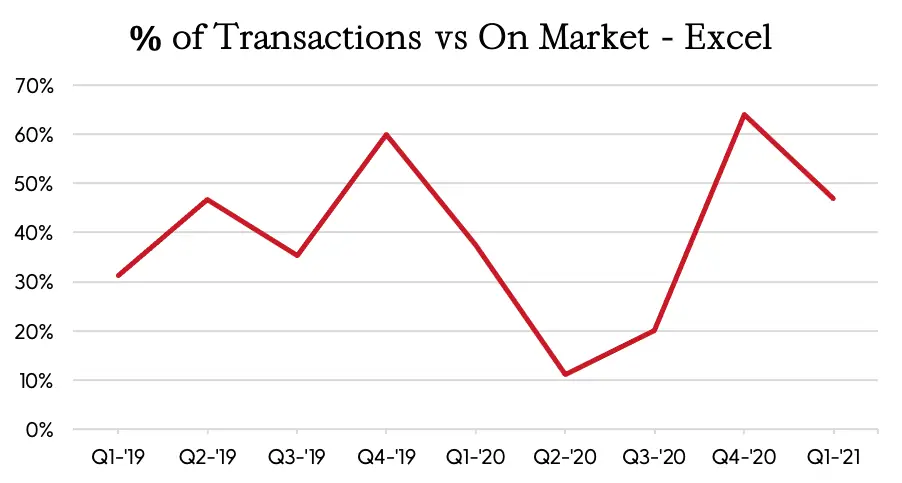

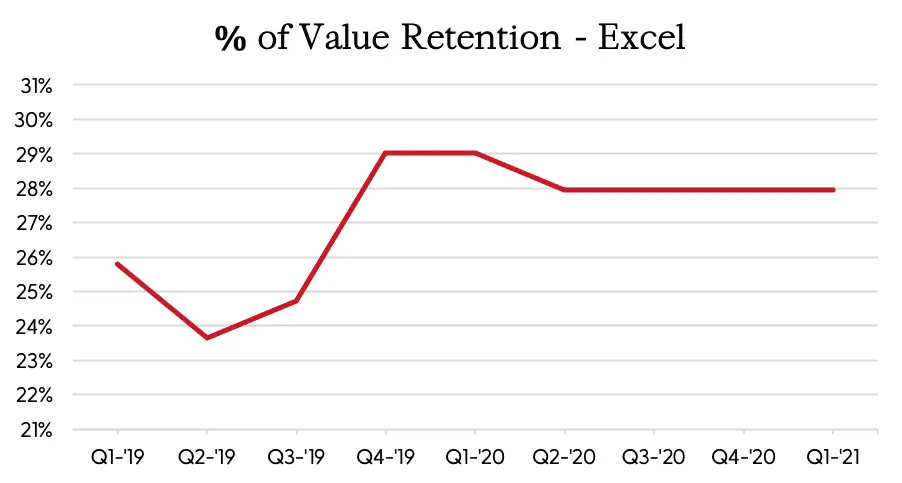

The Citation Excel retail transactions have dropped significantly in Q1 after a robust end to last year. Eight aircraft sold in the first quarter, which is six fewer than the previous quarter, and one less than a year ago. Q1 averaged 17 Excel aircraft for sale, representing 5% of the active fleet, and is the lowest number offered since Q3, 2019. 47% of the available aircraft sold in the first quarter. Pricing has remained stable for the past four quarters. With ample inventory and steady pricing, this is one of the few markets that provide both the buyer and seller opportunities.

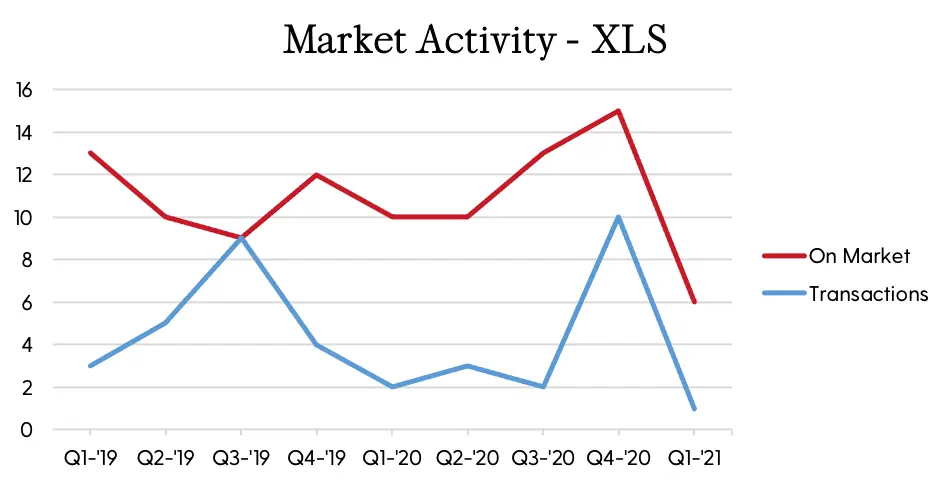

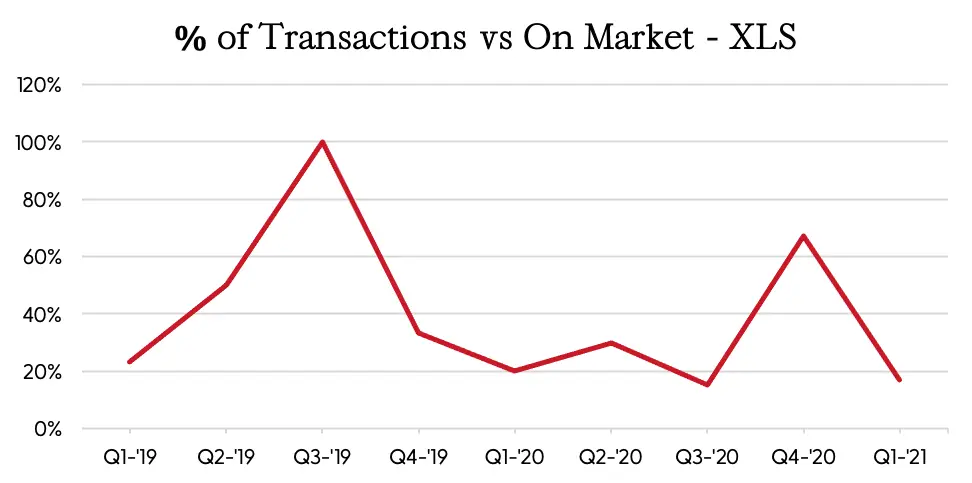

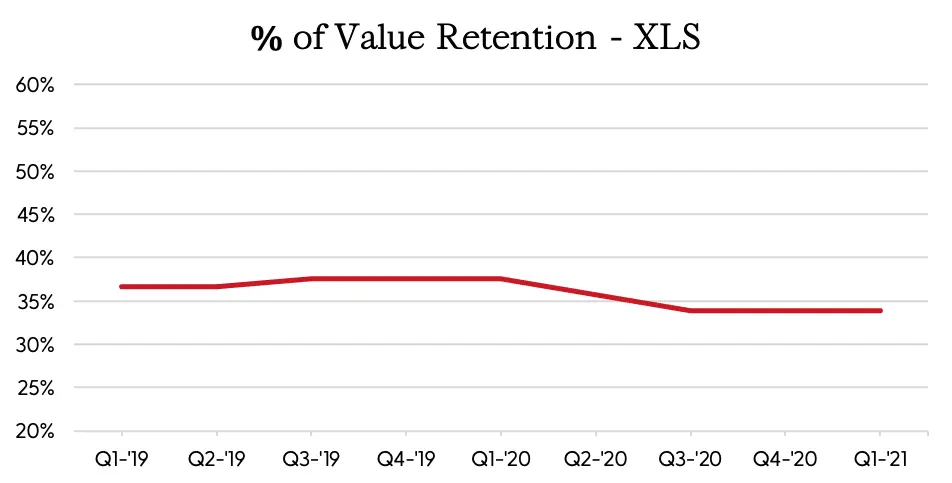

After a phenomenal fourth quarter, the XLS sales have fallen off of a cliff for Q1. Only one aircraft sold in the first quarter, which is nine fewer than the previous quarter. Q1 averaged just six of the Citation XLS aircraft for sale, representing a stunning 1.8% of the active fleet. The number available for sale has dropped well over half when compared to the previous quarter. In fact, it has been at least a decade since there were this few of the Citation XLS on the market. Just 17% of the available aircraft sold in the first quarter, largely because of the lack of supply. Pricing for the XLS held steady for the past three quarters. This presents an excellent time for a seller, as inventory is scarce and pricing is poised to rise.

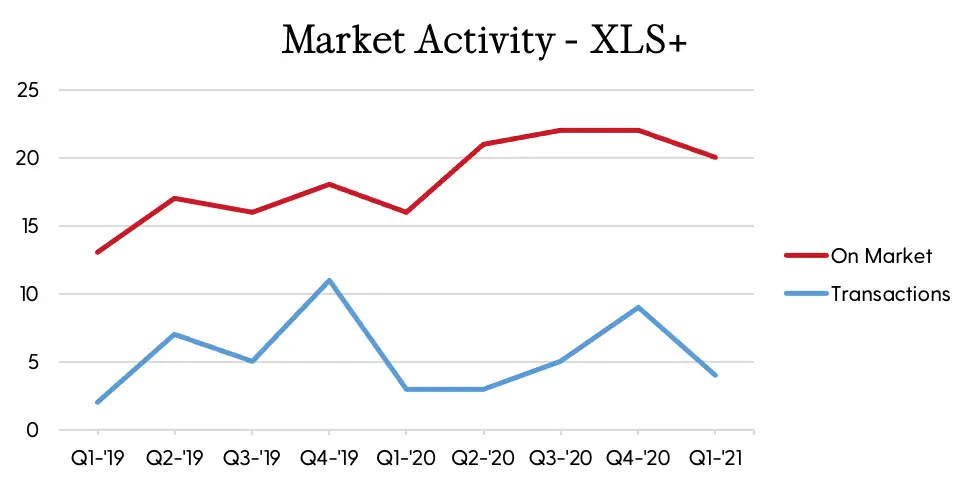

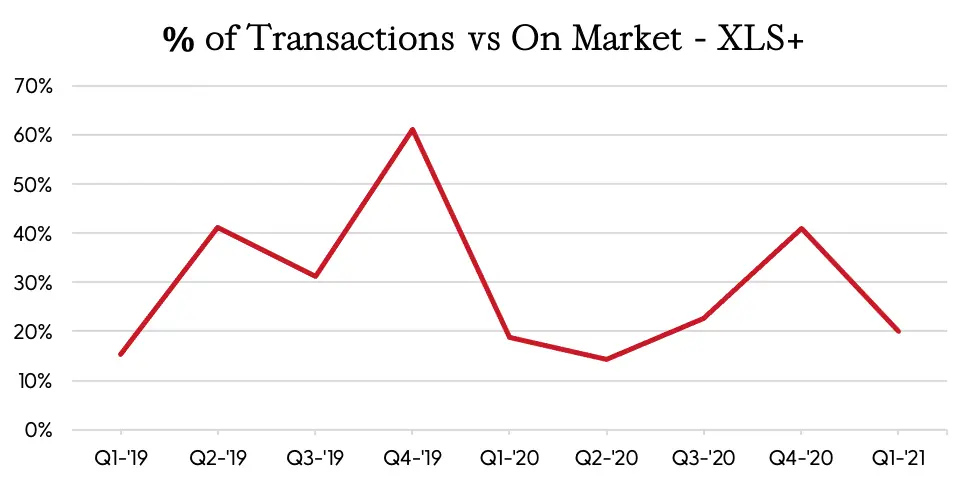

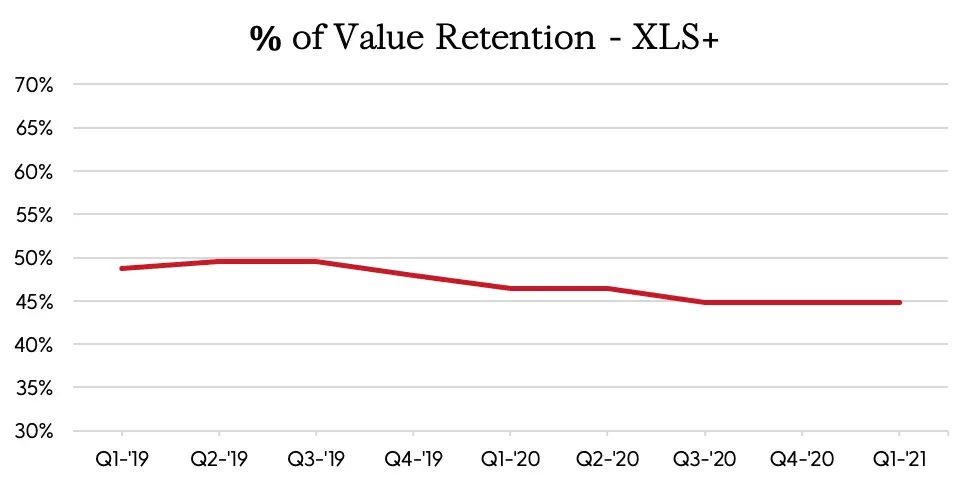

The Citation XLS+ is one of the few markets with inventory levels greater than a year ago. Q1 averaged 20 of the Citation XLS+ aircraft for sale, representing 7% of the fleet, and is four more than a year ago. However, unlike most markets, the number available for sale is only marginally lower than last quarter with two fewer aircraft available. Only four aircraft, which is 20% of those available, sold in the first quarter. Pricing has held steady for the past three quarters. Demand continues in the XLS+ market, and supply remains ample. This is a market that represents an excellent opportunity for a buyer. Pricing is steady, and there is a more than sufficient supply of aircraft.

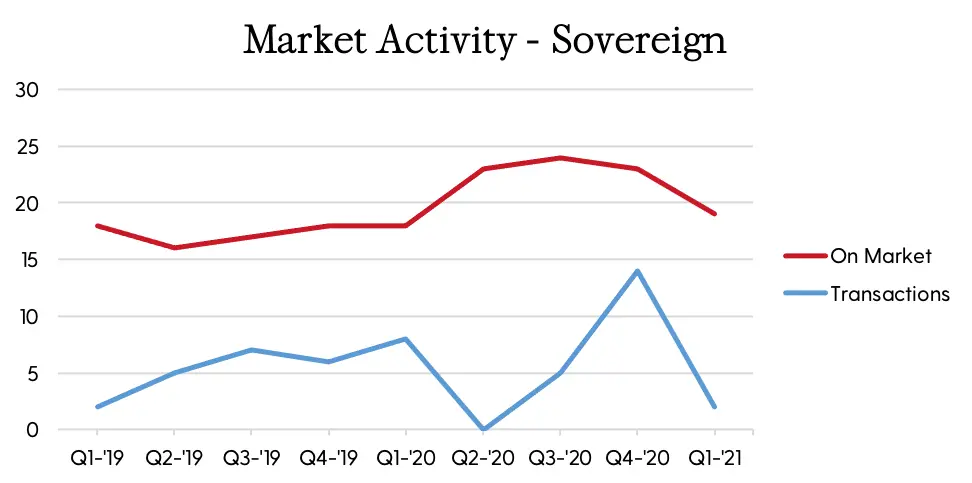

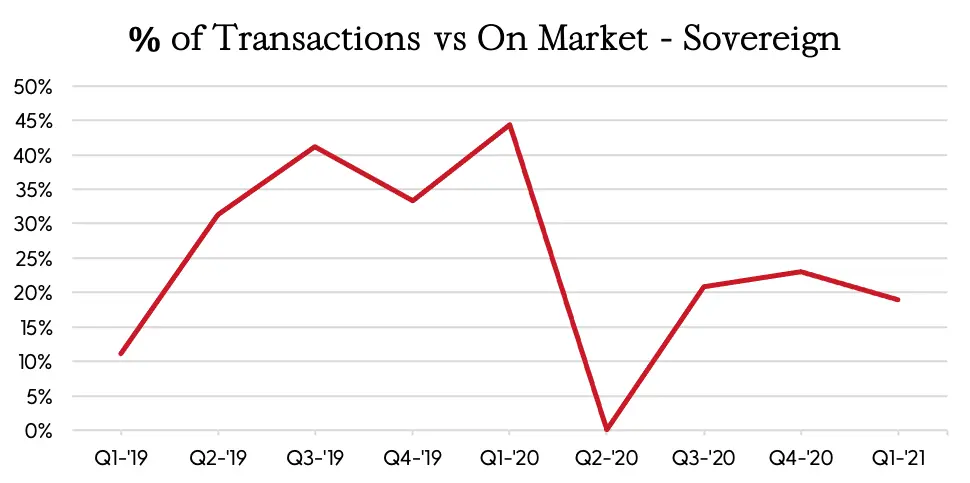

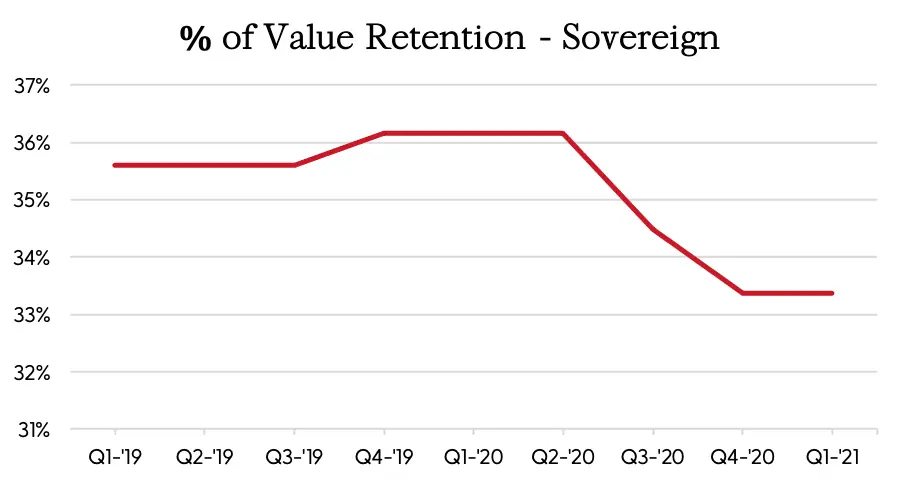

The Citation Sovereign retail transactions have slowed considerably in Q1, after a near-record number of sales in Q4. Only two aircraft transacted last quarter, which is 12 fewer than the previous quarter and is a slight 19% of the availability. Q1 averaged 19 Citation Sovereign aircraft for sale, which is 6% of the fleet, and although one more than a year ago, it is the fewest offered in the past four quarters. Pricing has remained steady for the past two quarters. This is a great time to purchase a Citation Sovereign, with excellent supply and steady pricing.

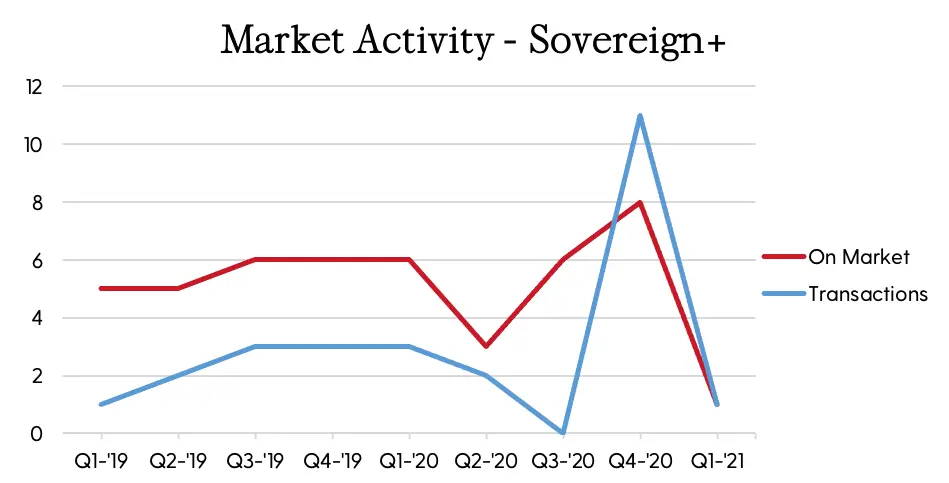

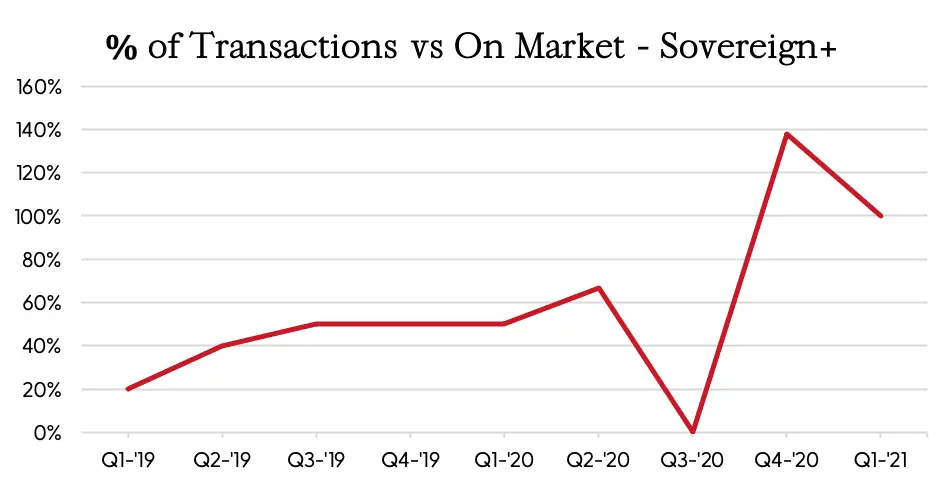

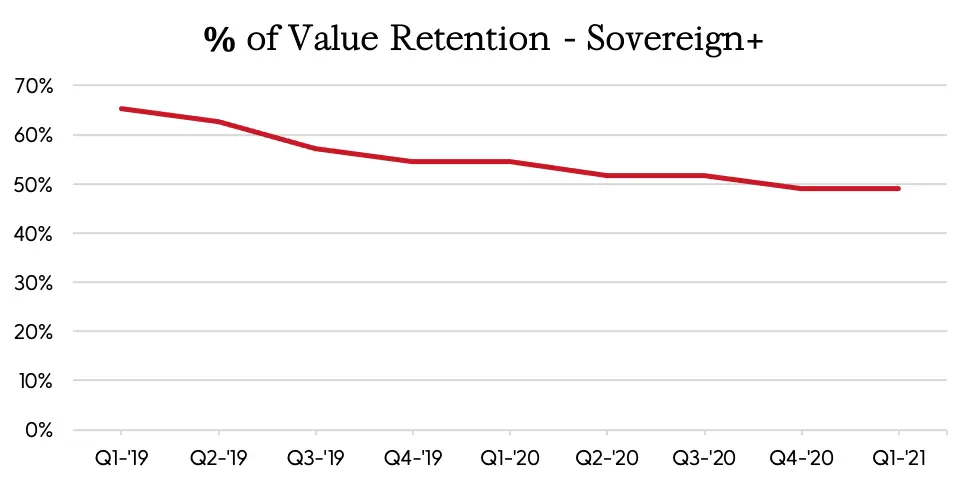

The Citation Sovereign+ market has all but ground to a halt in Q1. In fact, there is only one aircraft listed for sale. After a record Q4, which saw 11 sales and eight aircraft listed for sale, supply mostly dried up. The number available for sale decreased seven units, while demand decreased by 10 units. Pricing in this market has held steady for the past two quarters. This would be a good time to sell; with almost no supply, pricing is sure to remain firm.

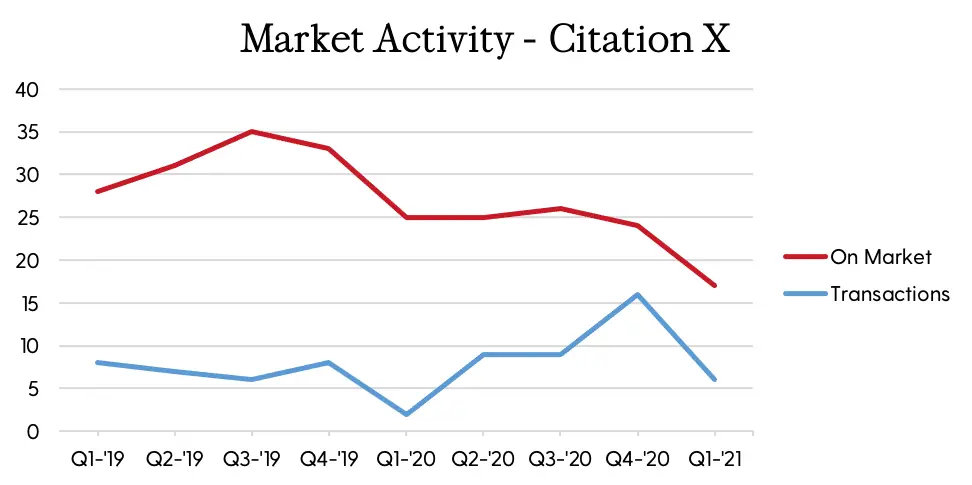

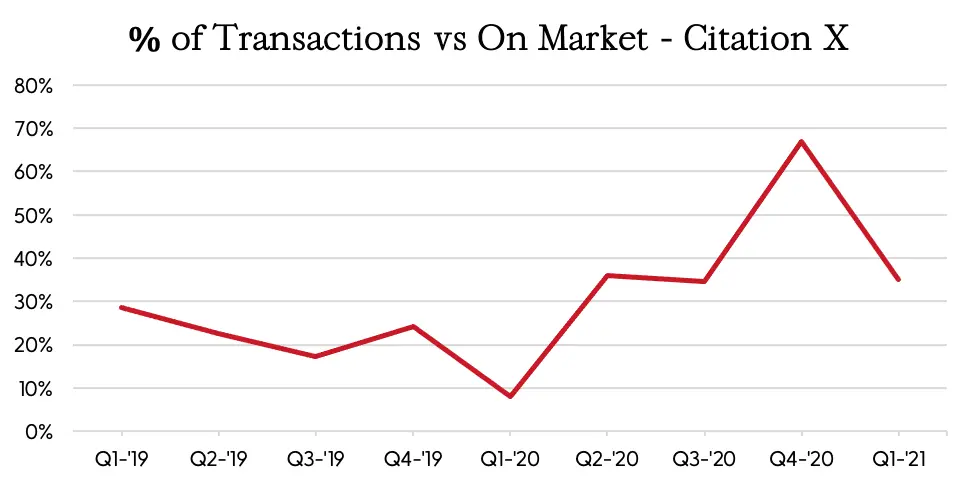

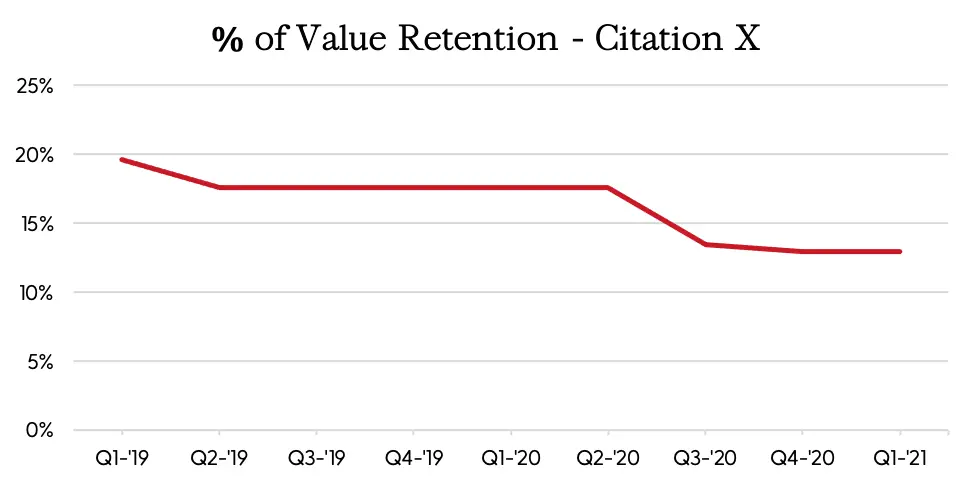

The Citation X market continues to be strong. Although down from a strong fourth quarter, activity was relatively good in Q1. Inventory levels are the lowest in many years, with 17 available, representing 6% of the active fleet. Six aircraft sold in Q1, which, although ten fewer than the previous quarter, is four more than a year ago. Pricing has held steady for the past two quarters. This is an excellent time to be in the Citation X market with both buying and selling opportunities.