Citation Excel, Citation XLS, Citation XLS+, Citation Sovereign, Citation Sovereign+, Citation X

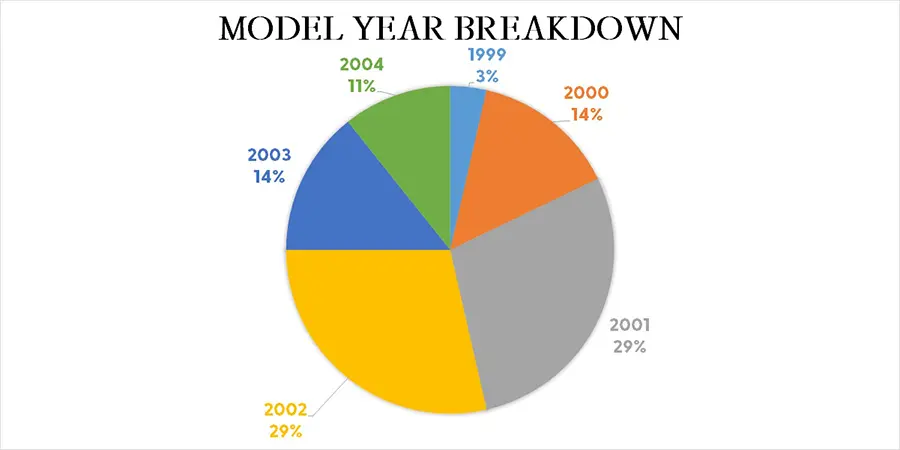

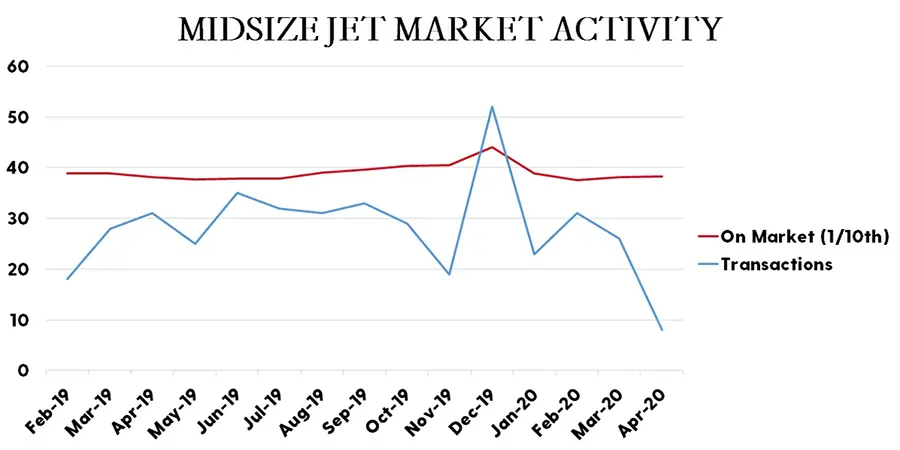

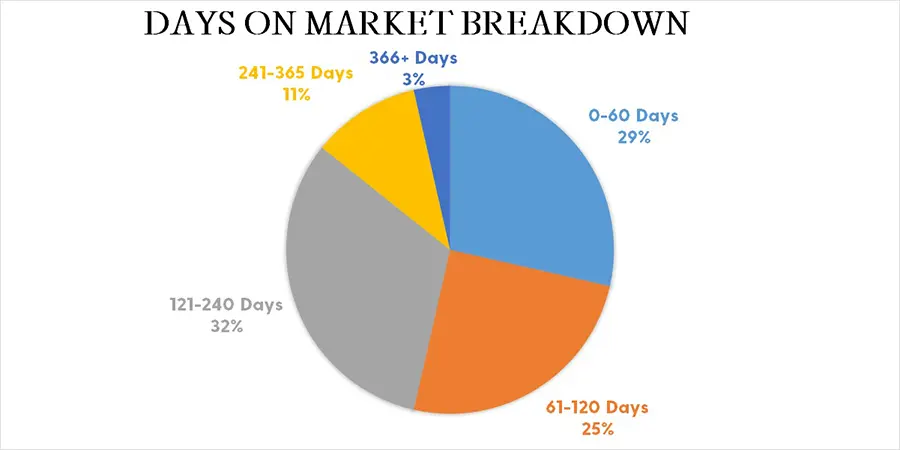

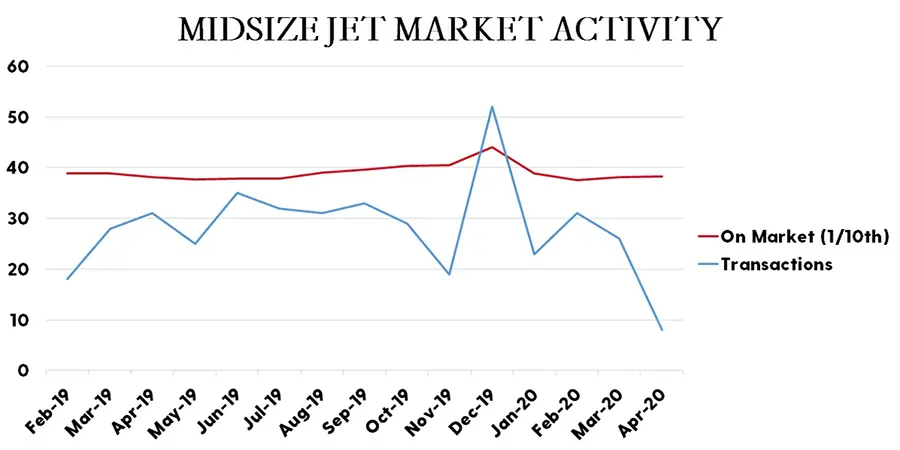

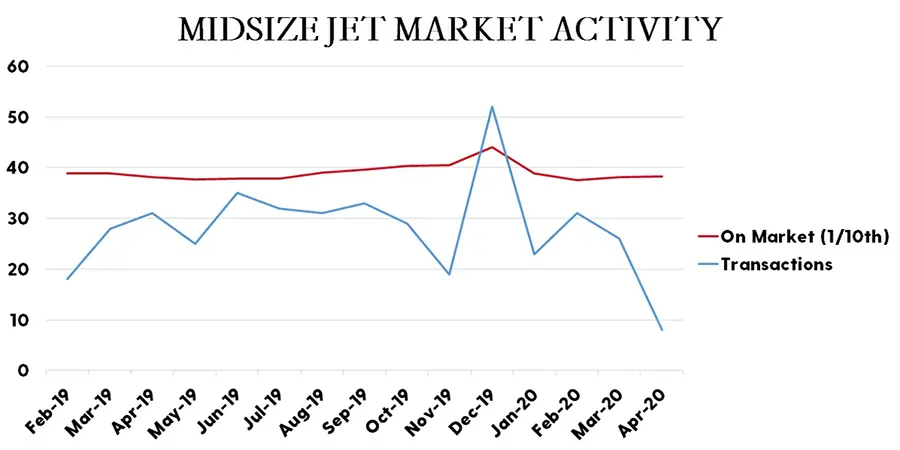

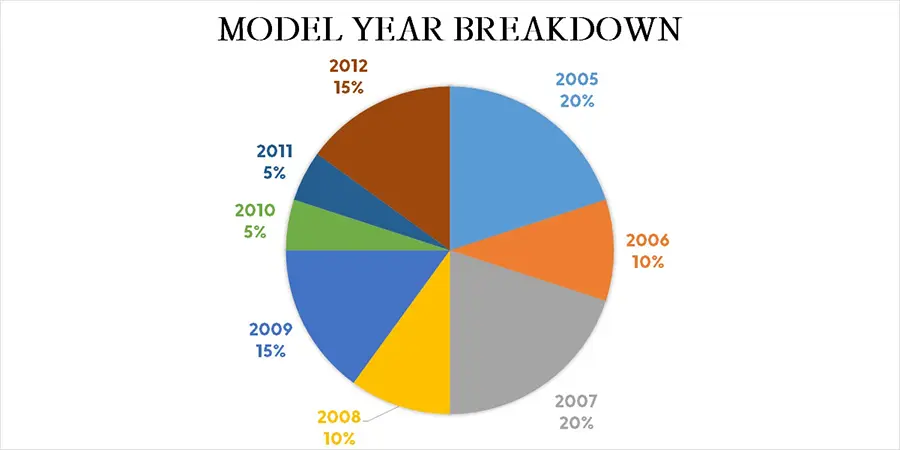

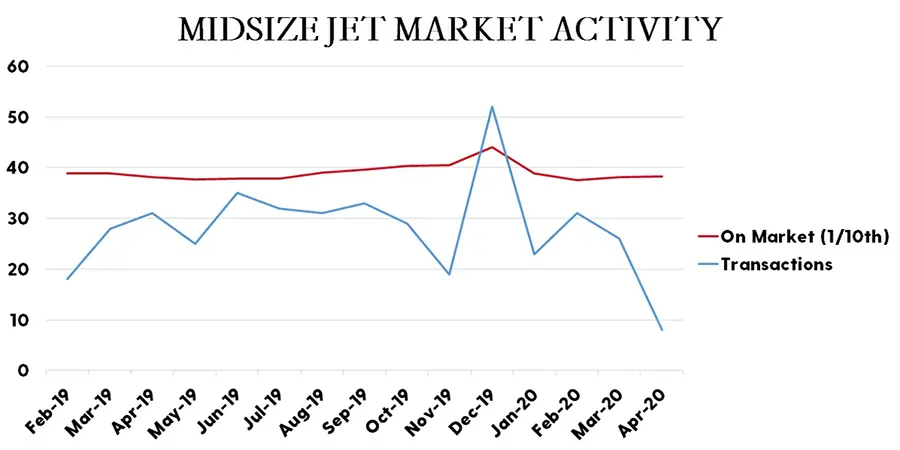

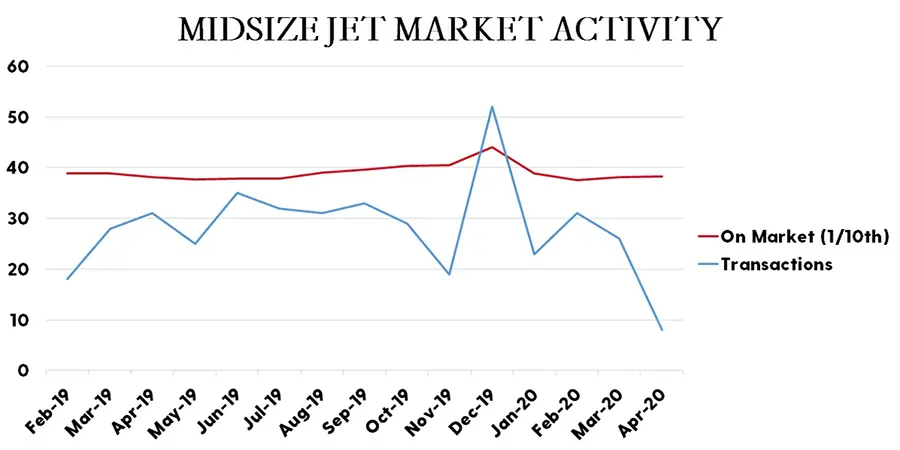

The Citation Excel inventory has been trending upward with an increase of 21% since March 2020. Further, the number of units on the market has more than doubled when compared to April, 2019. As steep as this increase of availability is, the number for sale only represents 7.8% of the current fleet. Looking at time on market, 29% of the current market was listed in the past 60 days. 2001 and 2002 models are in abundance, making up 58% of the available inventory. Midsize Jet market activity slowed to just eight combined transactions in April, down from 31 a year ago.

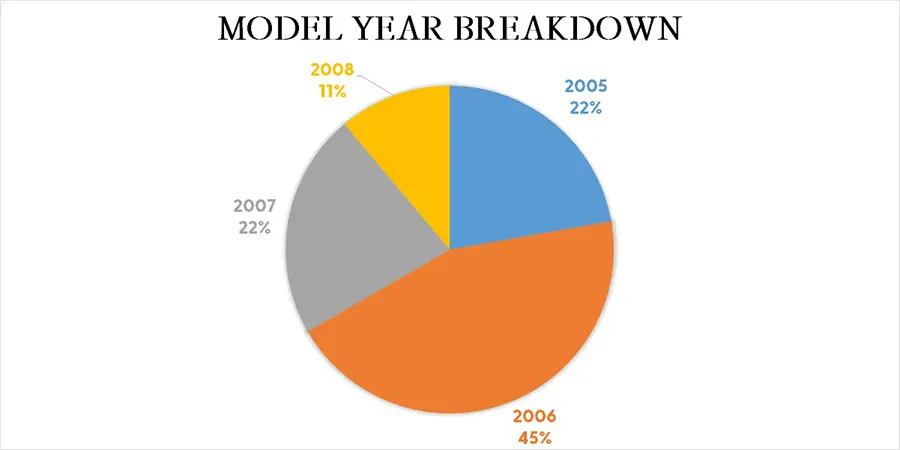

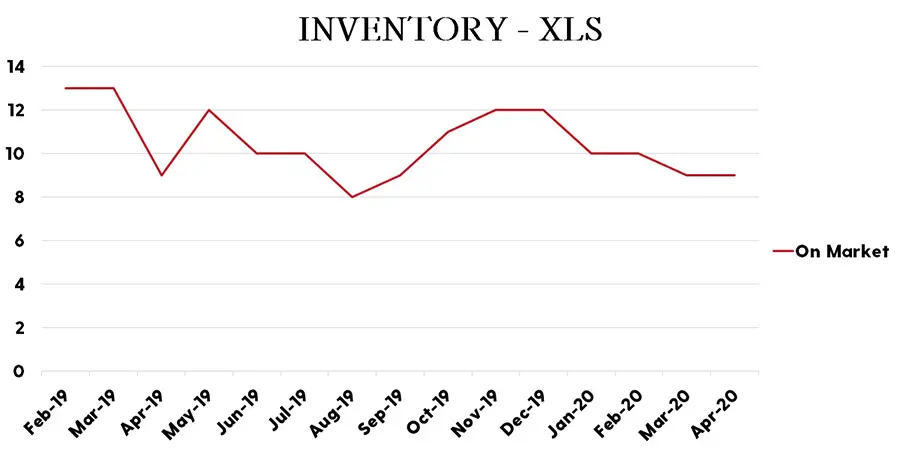

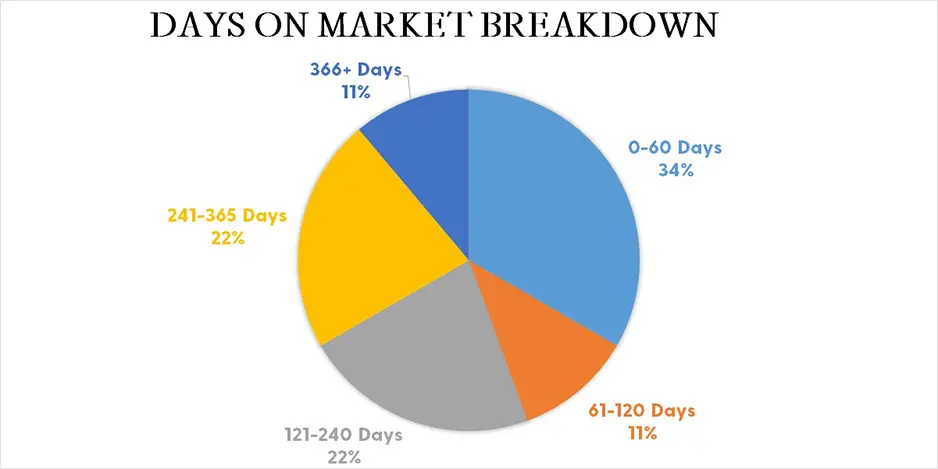

The Citation XLS inventory has been trending downward, and remains tight with only nine units on the market. A scant 2.7% of the fleet is available for sale. Looking at time on market, 34% of the current market was listed in the past 60 days. 2006 models are mostly represented, with 45% of the available inventory. This market continues to be tight, although there have been only two retail sales so far in 2020. Midsize jet market activity is down 74% compared to a year ago.

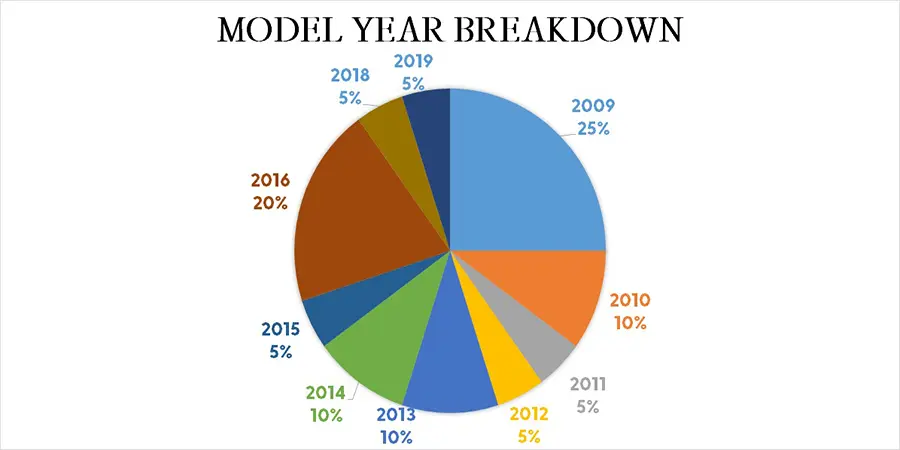

Citation XLS+ inventory has been increasing throughout 2020. The midsize jet category has remained relatively stable over this same time frame. Currently 20 XLS+’s are for sale, which is up from 14 listings in January, 2020. Just over seven percent of the active fleet is for sale. Most of the inventory has come on the market within the past 120 days. The majority of the aircraft for sale are either 2009 or 2016 models. Category transactions slowed to just eight midsize jet sales in April, down from 31 during April of 2019.

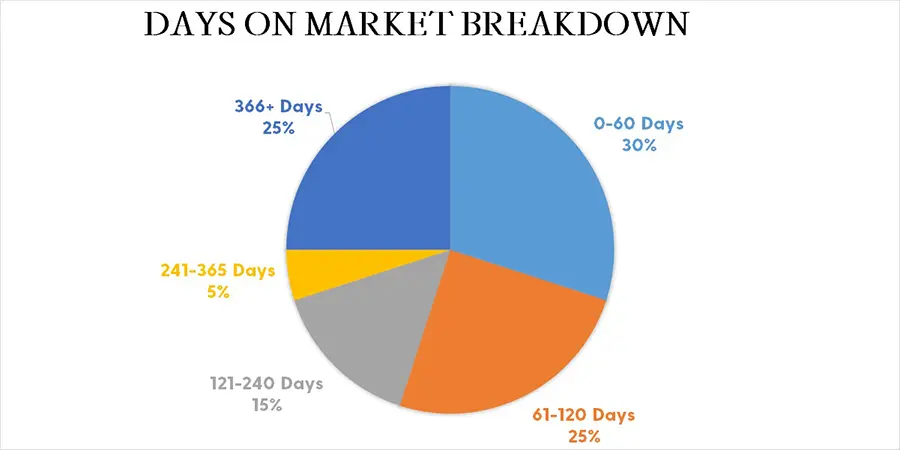

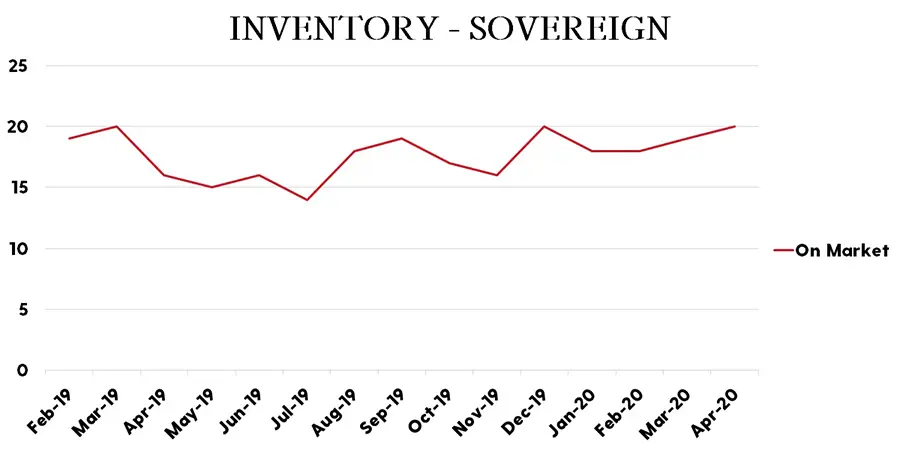

Since the first of the year, Citation Sovereign inventory has risen slightly. This is up comparatively to the collective midsize jet category, which saw its inventory slightly decrease over the same time frame. There are currently 20 Sovereigns listed for sale, which represents 5.7% of the active fleet. 25% of the current inventory was listed in the past 60 days, with 35% being on market for over a 240 days. Looking at model year, 80% of the pre-owned offerings are older than 2010 models, which is consistent with the entire active fleet’s model year distribution. Midsize jet market activity slowed to just eight combined transactions in April, down from 31 a year ago.

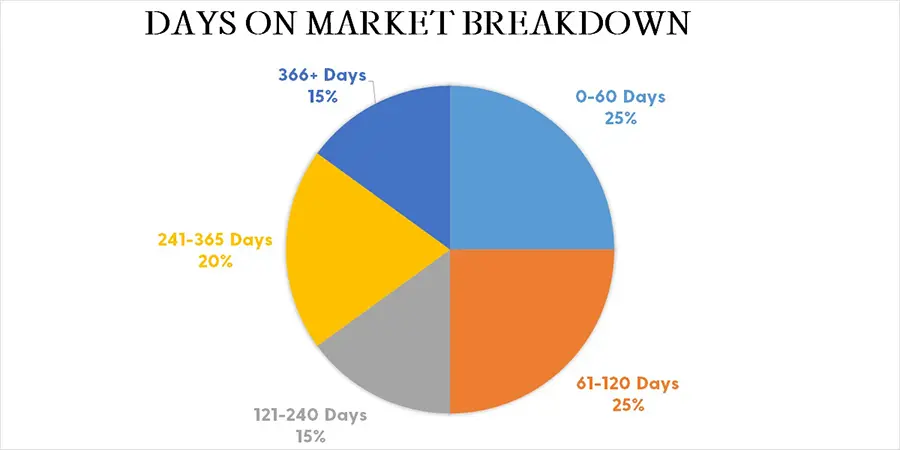

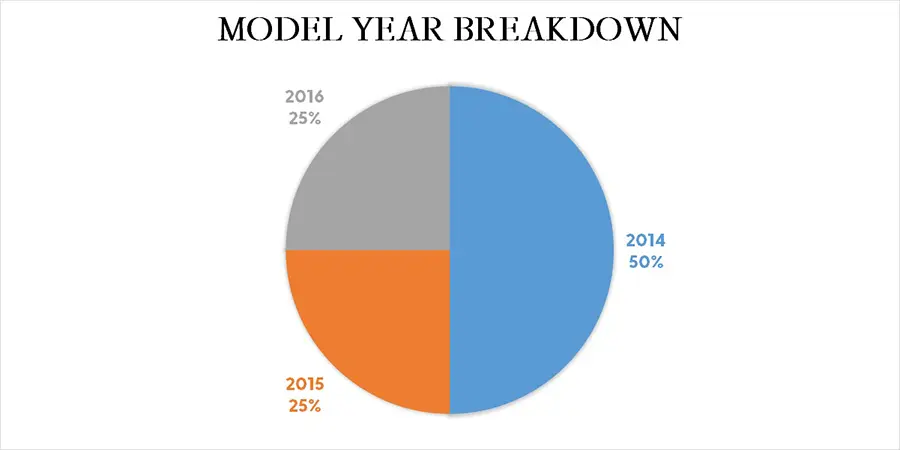

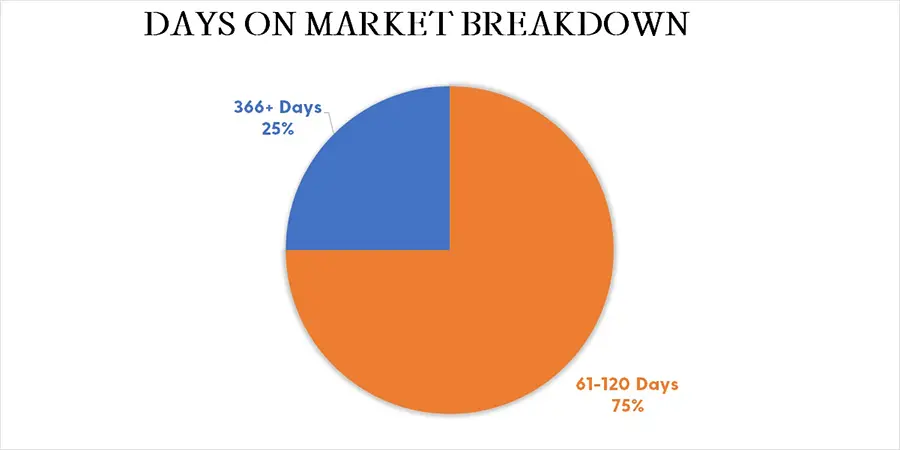

Citation Sovereign+ inventory has dropped slightly since the first of the year, and is down slightly when compared to a year ago. Going back to April of 2019, Sovereign+ listings have dropped by 20%, down comparatively to the entire midsize jet market which remained level during that same time frame. 75% of the current listings were brought to market in the past 120 days, with 25% listed over a year. 2014 models make up 75% of the pre-owned listings. April transactions in the midsize jet category were down 74% compared to a year ago.

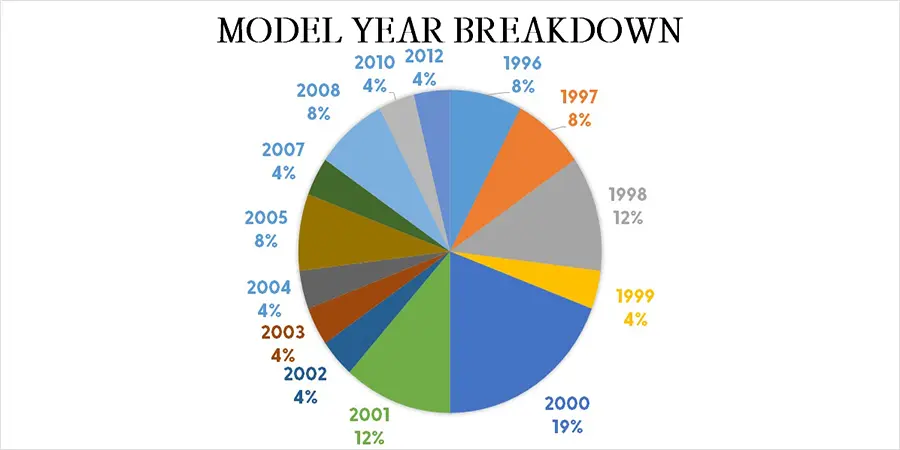

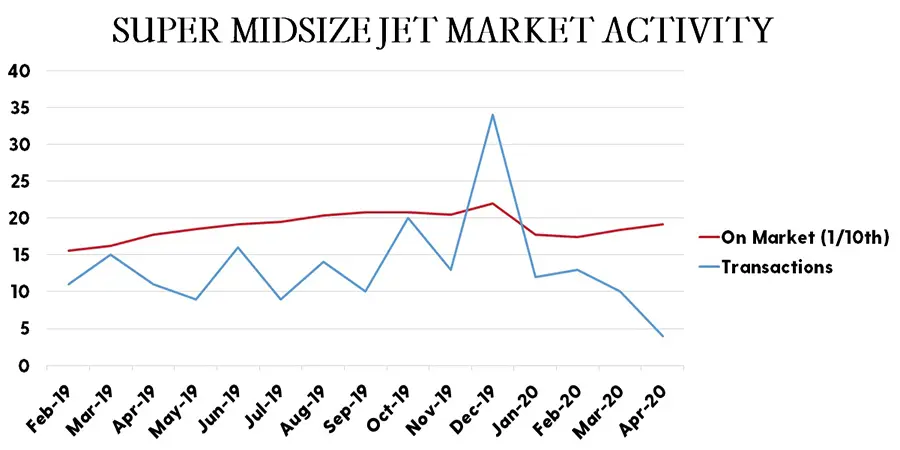

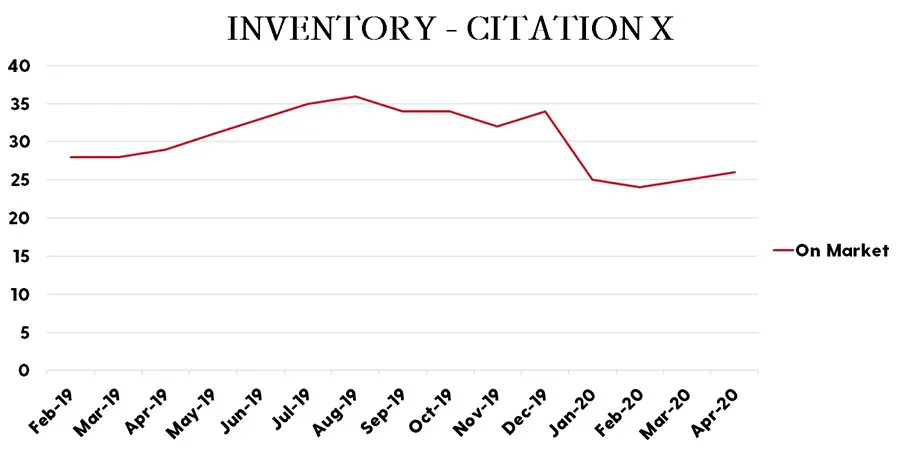

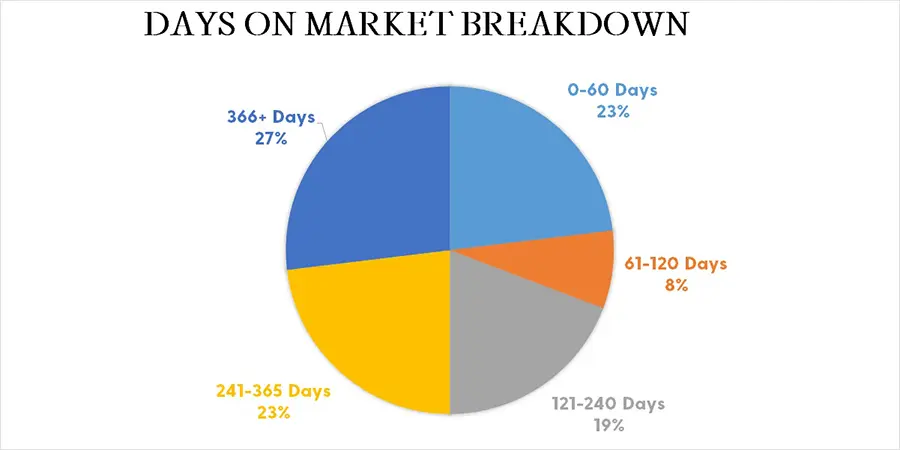

Citation X inventory has held relatively steady since the first of the year, compared to the broader super midsize category, which is up eight percent over the same time frame. The lowest inventory in the past 12 months was seen during February of 2020, where 24 Citation X’s were for sale. There are now 26 aircraft for sale, which represent 8.5% of the active fleet. Nearly 31% of current listings were brought to market in the past 120 days. Model years 2000 and newer make up 69% of pre-owned listings, and are 67% of the active fleet. Super midsize jet market activity slowed to just four sales in April, down from 11 a year ago.