Citation Excel, Citation XLS, Citation XLS+, Citation Sovereign, Citation Sovereign+, Citation X

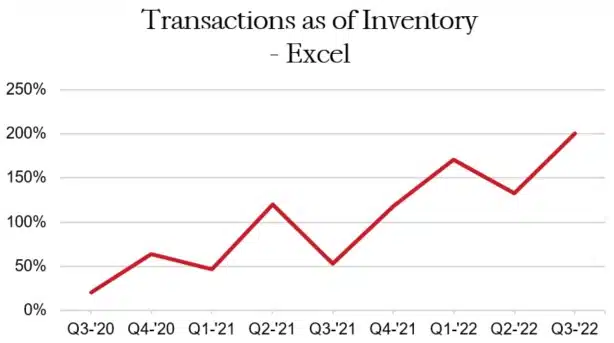

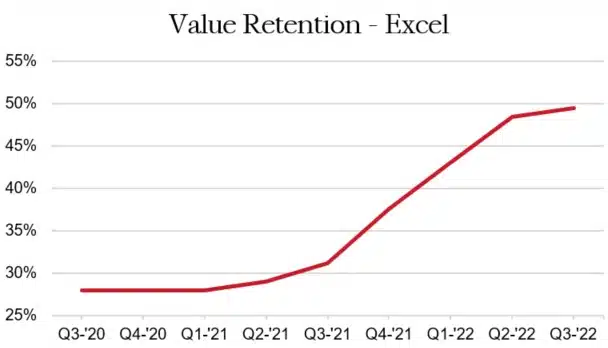

The Citation Excel retail transactions have increased significantly in Q3 when compared to the previous quarter. 16 aircraft sold in the third quarter, which is double that of the previous quarter, and eight more than a year ago. Q3 averaged only seven Excel aircraft for sale, representing just 1.9% of the active fleet, and is only one more than the lowest number offered for sale since the Excel has become a mature market over 20 years ago. Because so many aircraft sold that were not listed for sale, 229% of the available aircraft sold in the third quarter, which means that many of the aircraft sold never were advertised on the open market. Pricing has increased significantly in the past year. This presents an excellent opportunity for the seller, as inventory is scarce and prices are holding at a record rate.

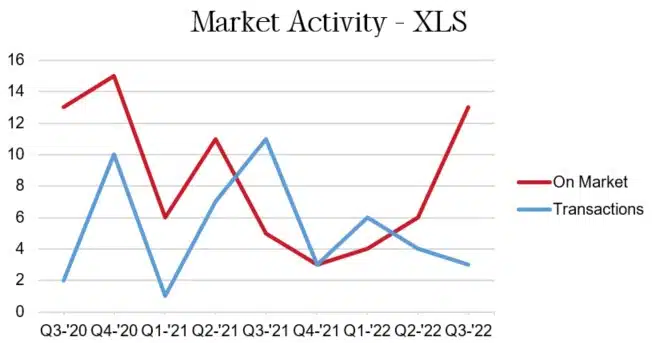

After an average second quarter, the XLS sales have dropped slightly in Q3. Three aircraft sold in the third quarter, which is one fewer than the previous quarter. Q3 averaged 13 of the Citation XLS aircraft for sale, representing 3.9% of the active fleet. The number available for sale has increased significantly when compared to the previous quarter, more than doubling the number of offerings. Just 23% of the available aircraft sold in the third quarter, which is half of that of the previous quarter. Pricing for the XLS has held steady, after having increased significantly in the past five quarters. This presents an excellent time for a buyer, as pricing is stable, and inventories are rising.

With almost no aircraft available for sale earlier this year, the Citation XLS+ market is moderately loosening. Q3 averaged six of the Citation XLS+ aircraft for sale, representing 1.9% of the fleet, and is three less than a year ago. Eight aircraft, which is 133% of those available, sold in the third quarter. Pricing has held steady in the past two quarters after increasing dramatically during the previous year. Demand continues in the XLS+ market, and supply remains tight. This is a market that represents an excellent opportunity for a seller, as demand remains strong with light inventory.

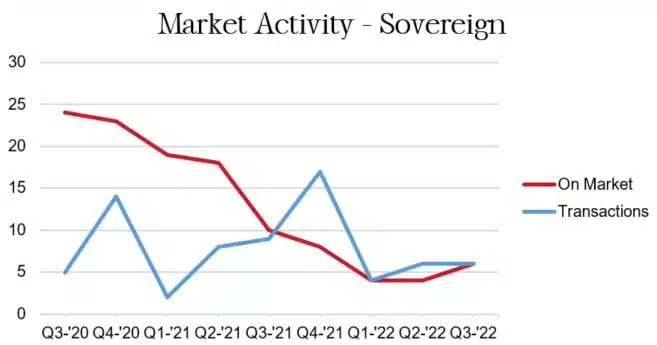

After dropping significantly before Q1, Citation Sovereign retail transactions have rebounded slightly and have held steady at six units for the past two quarters. Six aircraft transacted last quarter, which is three less than a year ago, and is 100% of the availability for the quarter. Q3 averaged six Citation Sovereign aircraft for sale, which is a mere 1.7% of the fleet, and is just above the lowest amount offered in the past fifteen years. Pricing has held steady the past two quarters after rising significantly during the previous five quarters. This presents a good opportunity for a buyer, as pricing has plateaued, and more inventory is becoming available.

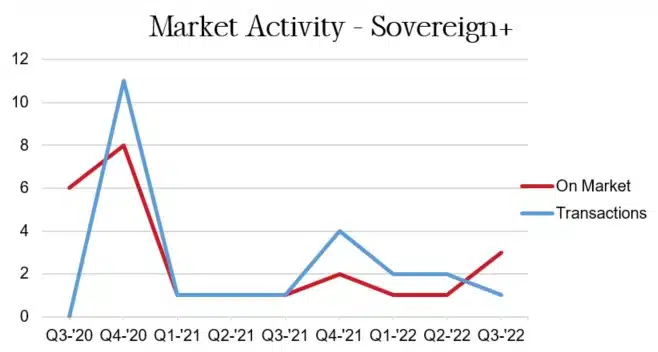

After being virtually nonexistent in 2021, the Citation Sovereign+ market has shown some signs of life. With only one or two aircraft available at any one time for over a year, Q3 averaged three aircraft listed for sale, which is 3.1% of the active fleet. After an average fourth quarter, sales have slowed thorough out 2022. Only one unit sold in Q3, which is one fewer than the previous quarter. Pricing in this market has held steady after increasing significantly in the past year. This would be a good time to sell, as there is very little supply, and record high pricing.

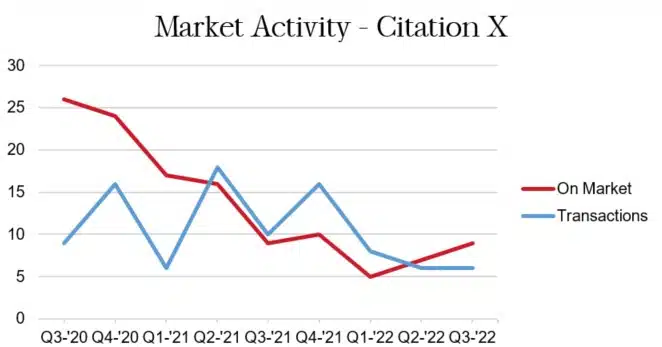

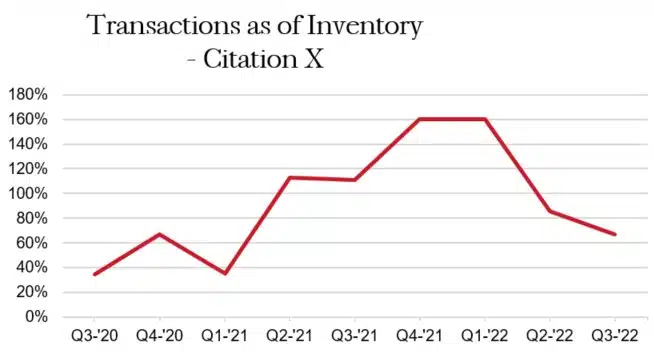

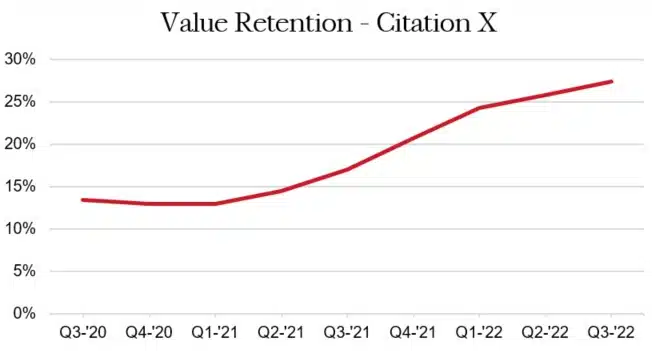

The Citation X market continues to be active. Although down from a strong second quarter, activity was steady in Q3. Inventory levels have rebounded from nearly 20 year lows, with nine available, representing 2.9% of the active fleet. Six aircraft sold in Q3, which is the same as the previous quarter, but four less than a year ago. Pricing in this market continues to rise, and has increased significantly in the past year. This presents an excellent time for a seller, as inventory is still limited and pricing continues to rise.