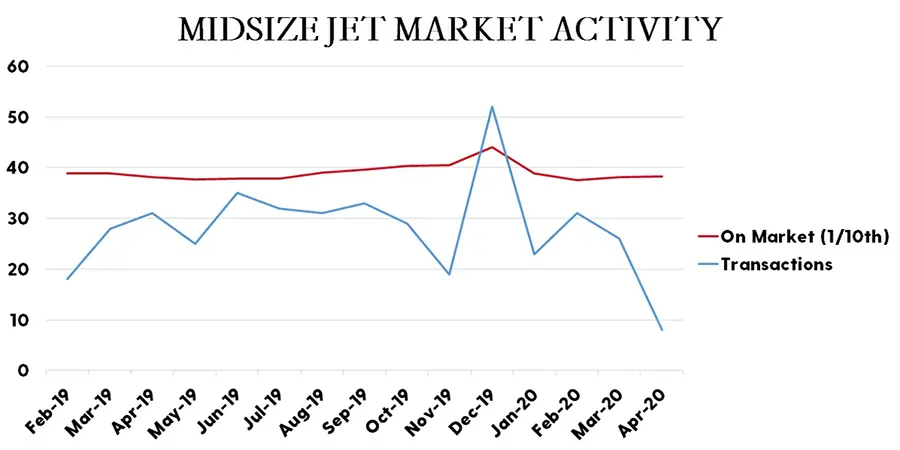

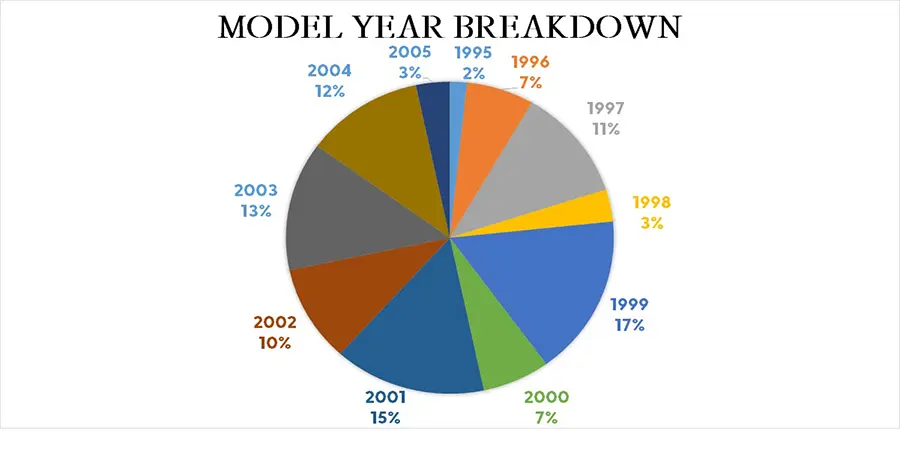

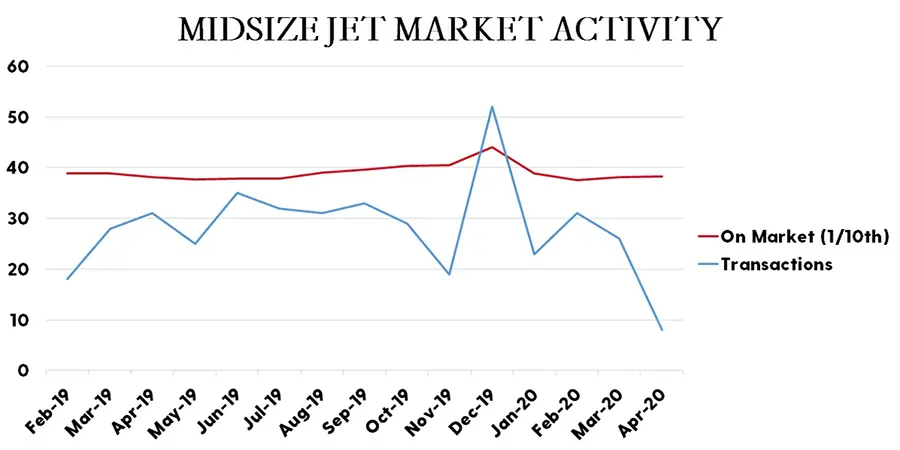

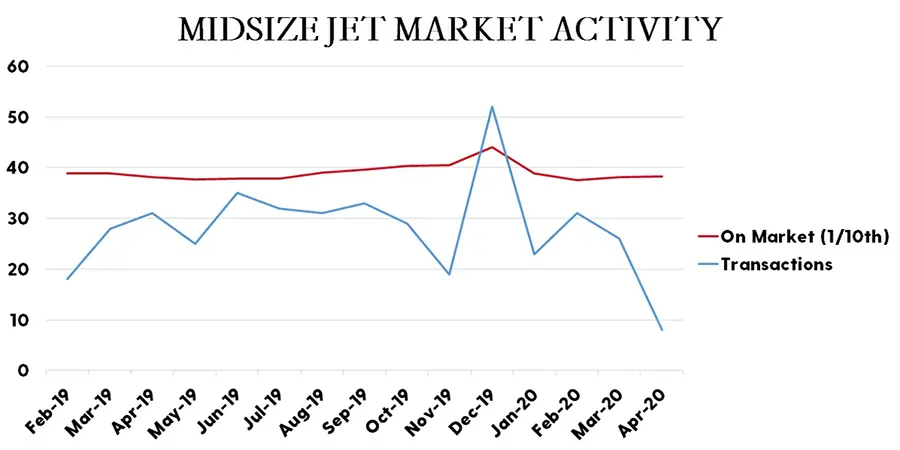

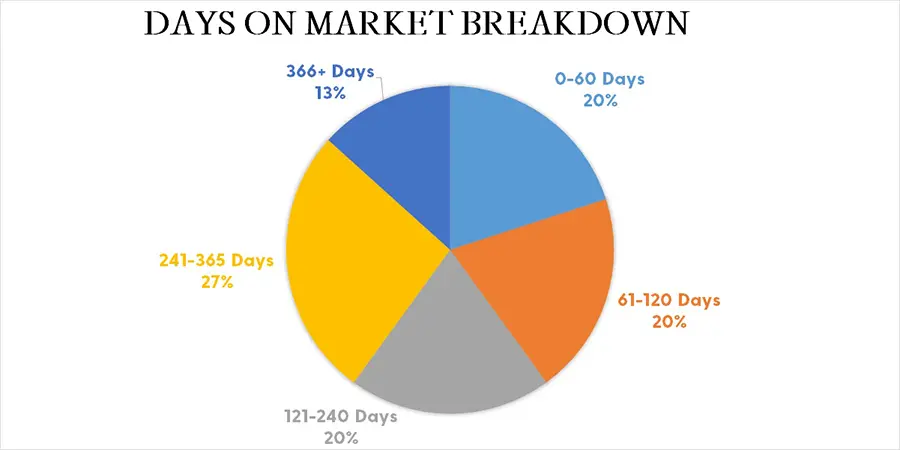

Since the first of the year, 800XP inventory has risen 11%. This is up comparatively to the collective midsize jet category, which saw its inventory slightly decrease over the same time frame. There are currently 60 800XP’s listed for sale, which represents 15% of the active fleet. 25% of the current inventory was listed in the past 60 days, with 27% being on market for over a year. Looking at model year, 62% of the pre-owned offerings are older than 2002 models, which is consistent with the entire active fleet’s model year distribution. Midsize Jet market activity slowed to just eight combined transactions in April, down from 31 a year ago.

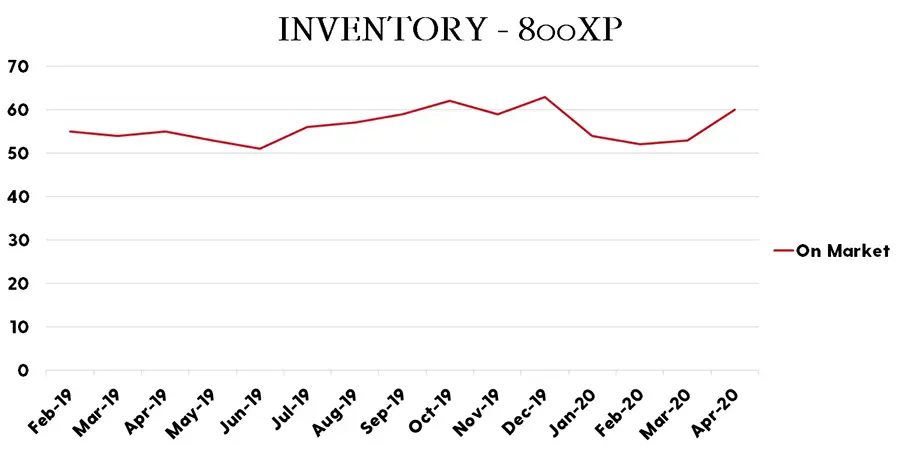

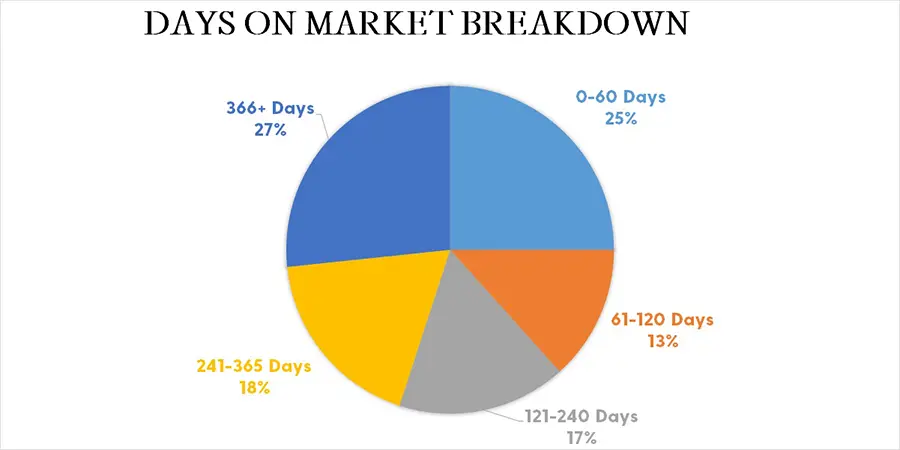

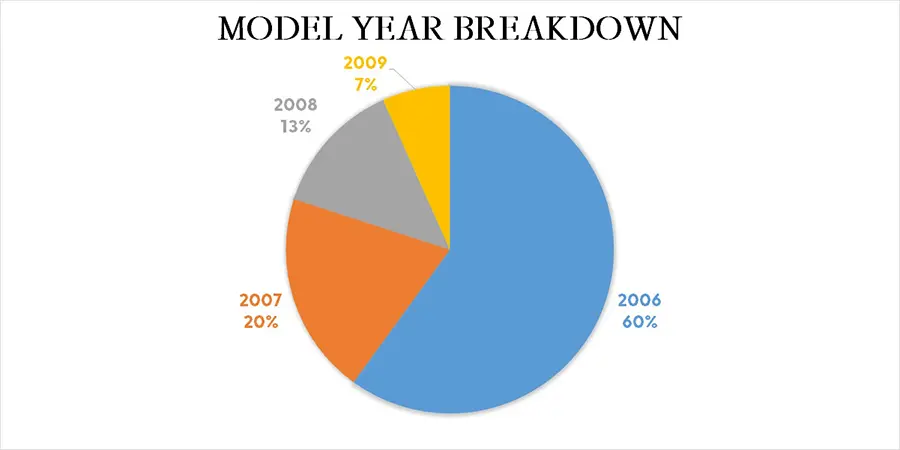

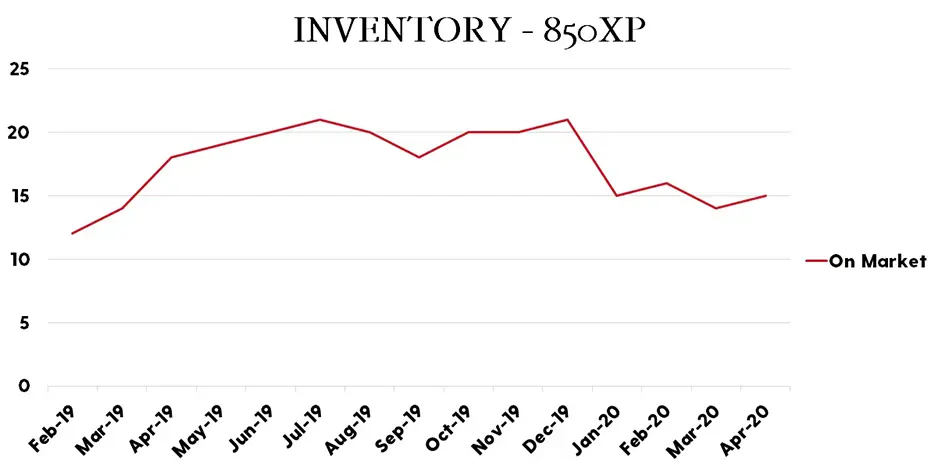

Hawker 850XP inventory has remained steady since the first of the year and is actually down when compared to a year ago. Going back to April of 2019, 850XP listings have dropped by 17%, down comparatively to the entire midsize jet market which remained level during that same time frame. 20% of the current listings were brought to market in the past 60 days, with just 13% listed over a year. 2006 models make up 60% of the pre-owned listings and represent 50% of the entire active fleet. April transactions in the midsize jet category were down 74% compared to a year ago.

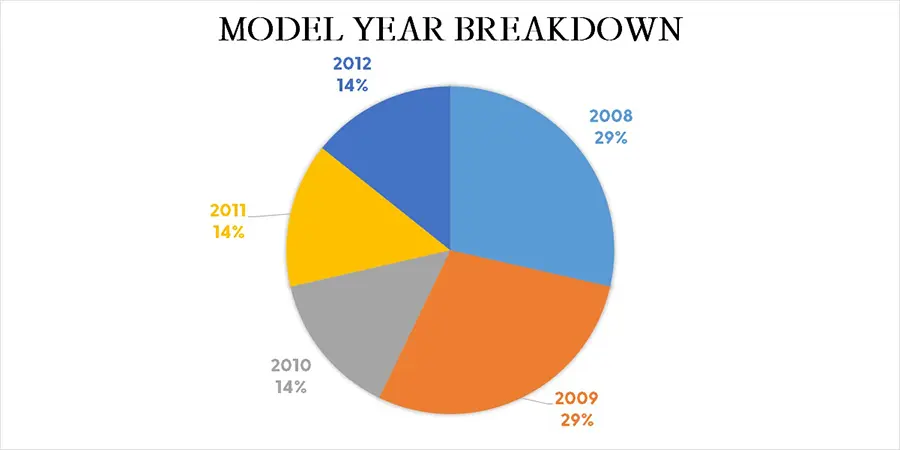

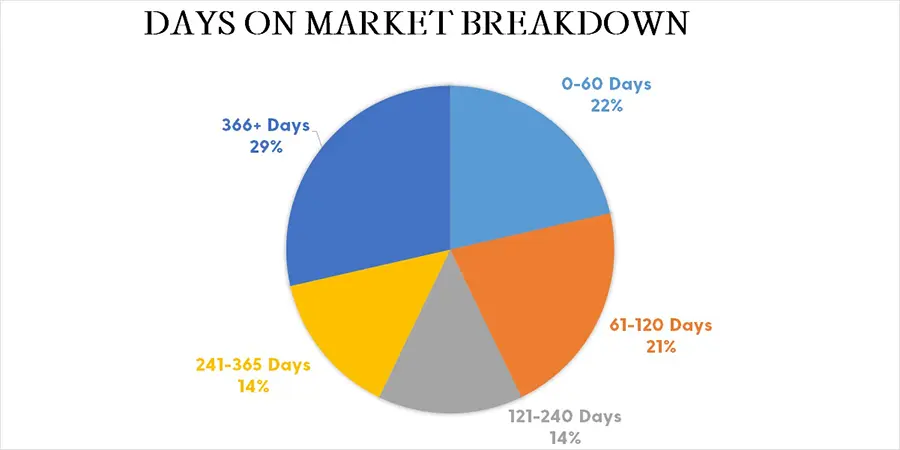

900XP inventory is down 33% since December of 2019, compared to a 13% average decrease in the midsize jet category over that same time frame. There are currently 14 900XP listings, which matches the lowest inventory levels we’ve seen in over a year. 7.7% of the active fleet is for sale. Breaking down the current inventory, 22% were listed in the past 60 days, with 29% on market for over a year. 2008 and 2009 model years make up 58% of the current inventory and represent 66% of the active fleet. Category transactions slowed to just eight midsize jet sales in April, down from 31 during April of 2019.